DALLAS — Taking advantage of high credit ratings, the Denver Board of Water Commissioners will refund $122 million of debt for savings while seeking new ways of serving a growing metro area.

The negotiated deal is expected to price June 26.

JPMorgan is senior manager. Stifel Nicolaus & Co., George K. Baum & Co. and First Southwest Co. are co-managers.

Piper Jaffray & Co. is financial advisor, Peck, Shaffer & Williams is bond counsel and Kutak Rock is disclosure counsel.

The refunding bonds come a month after Denver Water issued $36.6 million of new-money bonds for a variety of projects. Bank of America Merrill Lynch won the competitive bid for the bonds maturing through 2041 at a true interest cost of 3.49%.

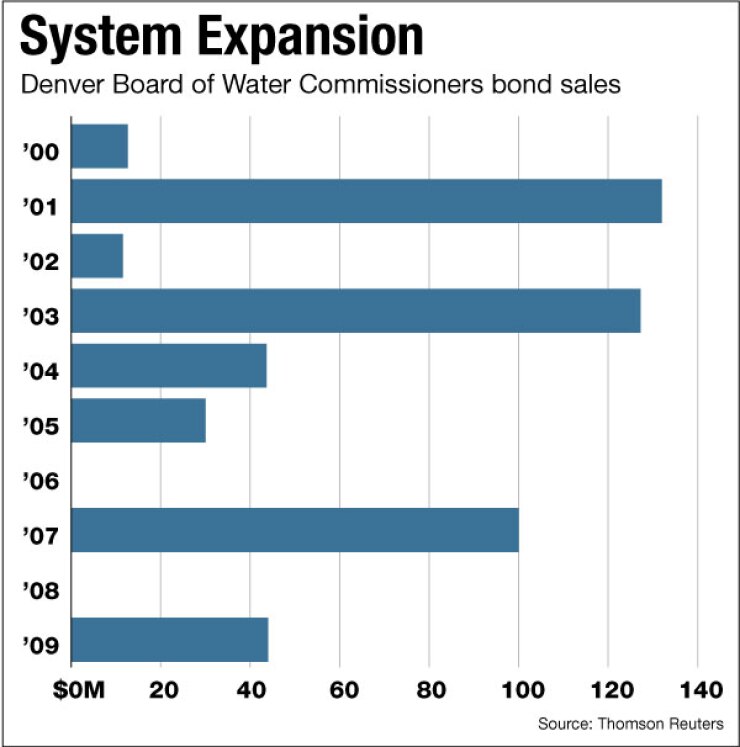

“Our last issue went really, really well,” said Usha Sharma, head of treasury for Denver Water. “So, I don’t expect any diminished interest in our upcoming bonds either.” Sharma said she expects net present-value savings of about $21 million in total on some maturities of bonds issued in 1999, 2002, 2003, 2004 and 2005.

This month’s refunding has AAA ratings from Standard & Poor’s and Fitch Ratings. Moody’s Investors Service rates the credit a notch lower, at Aa1.

All three agencies assign a stable outlook, reflecting the expectation that sound coverage will continue, supported by regular rate increases and manageable future borrowing plans.

“Moody’s believes the utility’s long-term capital plan and borrowing needs will remain manageable given its current favorable debt ratio and the expectation that management will continue to fund its capital needs through a diverse mix of resources,” wrote Moody’s analysts Bryan Quevedo and Matthew Jones.

Denver Water’s 10-year, $1.63 billion capital plan provides $1.1 billion for system expansion. Most projects will be financed with bond proceeds, officials indicated. The majority of the raw water projects are aimed at expanding the north end supply, known as the Moffat Collection System.

The remainder of the capital plan includes general system repair and replacement and equipment purchases.

Officials anticipate issuing additional parity debt in annual amounts of $56 million in 2013, $92 million in 2014 and $96 million in 2015, according to Moody’s.

Established in 1918, Denver Water now serves 1.3 million people in the city and county of Denver and surrounding suburbs. Colorado’s oldest and largest water utility, Denver Water harvests about a third of the state’s treated water and competes with the city of Aurora on its eastern boundary for new water sources.

After building a chain of reservoirs to supply the growing city, Denver Water in recent decades has shifted its focus to environmental and political concerns with a new strategy emphasizing conservation and recycling while expanding an existing reservoir.

In May, leaders from Grand and Summit counties, Denver Water, and the Clinton Ditch & Reservoir Co. signed the Colorado River Cooperative Agreement, changing the way water will be managed in Colorado after years of court battles. Gov. John Hickenlooper, the former mayor of Denver, presided over the ceremony.

“From farmers and families to businesses and wildlife, this agreement will help protect Colorado’s water and is a testament to how collaboration can overcome even long-standing differences in managing this vital resource,” Hickenlooper said.

In exchange for environmental improvements that include financial support for municipal water projects, additional water supply and service-area restrictions, the agreement, with the required mitigation, should eliminate opposition to Denver Water’s Moffat Collection System Agreement.

“This agreement honors the recognition that protecting water resources and tourism in our headwaters counties also protects the entire state of Colorado’s economy,” said Summit County Commissioner Karn Stiegelmeier.

The Moffat Collection System project would add 18,000 acre-feet of water by raising the height of the Gross Reservoir Dam to 465 feet from its current 340 feet, nearly tripling its capacity.

“Enlarging Gross Reservoir will deliver the most benefits at the least cost and with similar environmental impacts compared with the other practicable alternatives,” Denver Water officials said in announcing the agreement.

Expanding the dam will still require permits and approvals, but the agreement with the key participants in the lawsuit clears a path.

Water use from the Denver system has declined due to water conservation measures following a record 2002-2004 drought, according to analysts. Peak one-day water consumption for the system occurred in 1997 at 517 million gallons a day, and peak average daily consumption for a year totaled 228 mgd in 2000. By comparison, for 2011, peak one-day consumption was 366 mgd and average daily consumption was 187 mgd.

“Current water treatment capacity of 715 mgd can easily meet this demand,” according to Standard & Poor’s analyst Corey Friedman. “Because the system is older, the city secured most of its needed water rights and paid for initial system infrastructure long ago.”

The city forecasts a potential production shortfall in water supply beginning in 2016 that could grow to 34,000 acre-feet by 2030. While the utility has sufficient water rights, a bottleneck exists for storage and supply for future growth, Friedman noted. Denver plans to meet half this projected 2030 shortfall through conservation and half by increasing the size of water storage facilities.

The board has annually raised rates over the past two decades. Most recently, it raised them by 9.5% in 2011 and 5.5% in 2012. Rate increases have been at least 5% annually in the past five years.

Compared with those of other cities in Colorado, the system’s in-city rates are among the lowest and out-of-city rates are moderate, Friedman said. The board plans future rate increases of at least 5.5% annually through 2016.

“Historically, the board has maintained coverage in excess of two times on its revenue and non-revenue bonds,” Friedman wrote. “However, coverage was down slightly in fiscal 2010, but improved in fiscal 2011.”