Second of two parts

With municipalities in so much financial trouble, now is the time for banks to rev up lending to them. Wait a second …

Odd as it sounds, that's what banks are doing, and so far the strategy isn't getting panned.

"Fiscal positions [of municipalities] are likely to improve substantially rather than get worse," said Daniel Mullins, an associate professor at American University and director of the school's Center for Public Finance Research. "The track records of governments in the U.S. are quite good in paying off their debts."

For all the headlines about the budget woes of state and local governments, banks see them as good clients.

Most market experts say there are plenty of investment-grade municipalities to court. In addition to underwriting services, banks provide municipalities with credit products, deposit services and prepaid cards for tax refunds, benefits and payroll.

"[For] all the reasons we like this clientele, so does everybody else," said Patrice DeCorrevont, head of government, not-for-profit and health care banking within JPMorgan Chase & Co.'s commercial bank. "They need and use a lot of bank products."

DeCorrevont's unit brings in about 15%-20% of the commercial bank's revenue, she said; in the fourth quarter that revenue totaled $1.6 billion.

With billions of dollars of bank guarantees on a type of variable-rate debt that municipalities issue coming due this year, the opportunities are great for banks to renew existing relationships with local governments and make new ones — sometimes on more lucrative terms, experts said.

Richard Ciccarone, chief research officer at McDonnell Investment Management, a fixed-income asset manager in Oak Brook, Ill., said banks "that have intensified their research capabilities and understanding … and applied strict standards are going to feel empowered … not only to take advantage of fee income opportunities in this area but also to broaden their banking relationships with government entities in general."

RETURN TO SENDER

Municipalities have historically relied on the public debt markets to raise funds for schools, infrastructure improvements and other capital projects, as well as general operating expenses. In addition to selling long-term, fixed-rate bonds, many municipalities issue what are known as variable-rate demand obligations, or VRDOs.

Because the interest rates on VRDOs reset regularly, they typically track other short-term interest rates. The yields on VRDOs, like long-term municipal bonds, are tax-exempt.

As the interest rates reset, VRDOs are remarketed to new investors. To make the VRDO more salable in the short-term market, the issuer includes a "put" option, or the right for investors to sell the VRDO back to the issuer whenever they want. The municipality pays a bank a fee to agree to pay the investor in the event he wants out. This is known as a letter of credit.

The fees banks earn on letters of credit have made it a valuable business, experts say.

"For commercial banks interested in participating in the municipal bond market, extending letters of credit can be a very lucrative business," said Thomas McLoughlin, managing director and head of municipal research at UBS. "There is a lot of demand."

In recent years, the number of banks participating in this business has declined because market participants favor highly rated lenders. So the handful of big banks that are active in the market have seen their share of business grow.

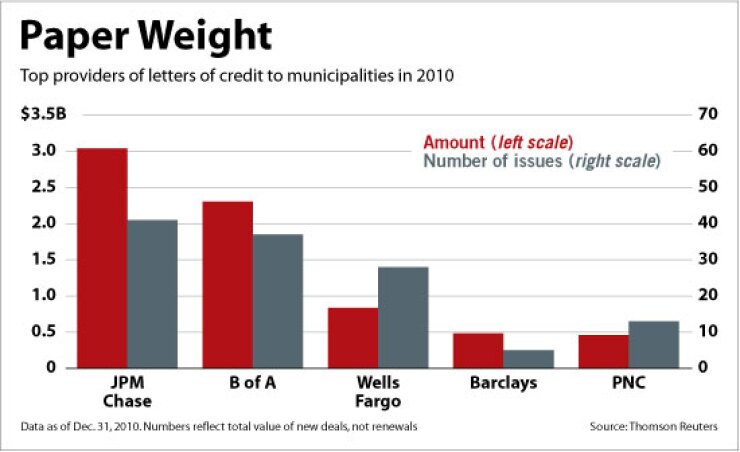

JPMorgan Chase was the biggest provider of letters of credit to municipalities last year, with 41 issues totaling $3 billion, according to Thomson Reuters. Bank of America Corp., Wells Fargo & Co., Barclays PLC and PNC Financial Services Group Inc. rounded out the top five, which issued a total of $7.1 billion.

However, the total value of the market is difficult to determine because only new deals are tallied, not renewals.

The nature of the relationship between banks and municipalities is on the verge of a transformation, with as much as $101.3 billion of letters of credit set to expire this year, according to a recent estimate from the Securities Industry and Financial Markets Association.

Competition for that business may soften because banks will have to hold more capital against those letters.

"Greater skepticism might be built into letter of credit renewals in the future," Ciccarone said. "It won't be an automatic knee-jerk rubber-stamp. … What is driving that is tougher capital standards being placed on the banks."

THE CAPITAL FACTOR

The Basel Committee on Banking Supervision plans to force banks to hold more capital behind off-balance-sheet assets, like letters of credit. While Basel III is still several years away from implementation, it no doubt has some banks reconsidering the LOC business. As a result, many experts expect banks to make more direct loans to municipalities.

"They may determine that direct loans are a more efficient way" to finance state and local governments, McLoughlin said.

Joseph Pucella, a vice president and senior analyst on Moody's Investors Service banking team, cited other reasons banks are looking at making more loans to state and local governments.

"We still think the main driver is the opportunity to increase lending when there is a lack of demand in other portfolios," he said.

EYES WIDE OPEN?

But are municipalities — many of which are facing budget constraints — ideal borrowers?

DeCorrevont says yes.

"We're very comfortable with the way we're going to get paid back in the municipal space," she said, but stressed that JPMorgan Chase doesn't "lend to every entity in every sector." The bank looks at each potential borrower in the municipal sector "completely from the bottom up," she said.

It's important to keep the fiscal problems of municipalities in perspective, analysts said.

"Credit stress in the municipal market is real," said Naomi Richman, managing director of Moody's U.S. public finance group. However, "it's primarily a budget problem, more so than a debt problem. … Debt payments make up a very small portion of these municipalities' budgets."

Richman said she believes default levels will remain low.

"Even in 2008, which was the peak year of the financial crisis, there were only five defaults among many, many thousands of issues," she said. "We do think that number could go up a little bit. It's likely to be an uptick, not a mass wave of defaults. The vast majority of municipalities are investment grade."

For municipalities, a direct loan is a simpler, and potentially cheaper, form of financing.

"Entering the bond market is expensive, so for small communities this certainly might be a reasonable alternative," said American University's Mullins.

Prepaid card services are another key part of the banking relationship with municipalities, especially in light of pending interchange fee restrictions on debit cards under the Dodd-Frank Act.

Government-issued prepaid cards are exempt from the proposed 12-cent cap on debit interchange fees. That means banks have an opportunity to earn fees on the use of prepaid cards governments issue for tax rebates, employee benefits and other uses.

Bank of America, for example, has a deal to provide Visa Inc.-branded prepaid debit cards to the state of California for the issuance of its disability and paid family-leave benefits. This spring the state will begin issuing unemployment benefits electronically.

Bill Sheedy, president of the Americas for Visa, said at a recent financial services conference that payroll and government programs are where most of the growth in prepaid card services will come from.

"The banks are heavily invested and I think you're going to continue to see a lot of strong growth there," he said. "You're going to see more and more financial institution investment in prepaid, in part because of government payroll and these other programs, and in part because … there are opportunities for financial institutions to innovate and test all kinds of new products."