Baltimore and Guilford, N.C., were among a handful of issuers to price municipal bonds Wednesday as the market waited for the Federal Open Market Committee to announce it had kept its benchmark interest rate unchanged.

“I guess you could say there was slightly more new issuance today in comparison to other Fed meeting days,” said one New York trader. The sellers may have moved ahead "because it was a foregone conclusion that no moves would be taken today," the trader said. "But I also think that small and less frequent/not so well known issuers could come in while not having to deal with being overshadowed by larger deals and bigger names.”

Bank of America Merrill Lynch priced the Mayor and City Council of Baltimore, Md.’s $226.955 million of general obligation consolidated public improvement and refunding and taxable bonds.

The $76.175 million of tax exempt series 2017A bonds were priced to yield from 1.06% with a 4% coupon in 2018 to 2.82% with a 5% coupon in 2037.

The $108.49 million of tax-exempt series 2017B bonds were priced to yield from 1.17% with a 5% coupon in 2019 to 2.57% with a 5% coupon in 2031.

The $33.675 million of taxable series 2017C bonds were priced at par to yield from 1.734% in 2018 to 3.659% in 2037. The 2018 maturity was priced about 30 basis points above the comparable Treasury and the 2037 maturity was priced about 130 basis points above the comparable Treasury.

The $8.61 million of taxable series 2017D bonds were priced at par to yield from 1.734% in 2018 to 1.958% in 2019. The 2018 maturity was priced about 30 basis points above the comparable Treasury and the 2019 maturity was priced about 35 basis points above the comparable Treasury.

The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings.

Wells Fargo priced and repriced the County of Guilford, N.C.’s $179.785 million of GO refunding bonds. The bonds were repriced to yield from 0.97% with a 4% coupon in 2018 to 2.64% with a 3% coupon in 2030. It carries top ratings of triple-A from Moody’s, S&P and Fitch Ratings.

JPMorgan priced the School Board of Hillsborough County, Fla.’s $113.99 million refunding certificates of participation for the Master Lease Program. The $98.46 million of series 2017C bonds were priced to yield from 1.21% with a 5% coupon in 2019 to 1.77% with a 5% coupon in 2023.

The $15.53 million of taxable refunding COPs were priced at par to yield from 1.80% in 2018 to 1.98% in 2019. The deal is rated Aa2 by Moody’s, AA-minus by S&P and AA by Fitch.

In the competitive arena, Massachusetts sold $142.64 million of federal highway grant anticipation notes for the Accelerated Bridge Program. Wells Fargo won the bidding with a true interest cost 2.15%. The GANs were priced to yield from 1.17% with a 5% coupon in 2021 to 1.98% with a 5% coupon in 2027. The deal is rated Aa2 by Moody’s and AAA by S&P.

Elsewhere, Williamson County, Tenn., sold a total of $125 million in two separate sales.

Morgan Stanley won $50 million of general obligation public improvement school bonds with a TIC of 2.75%.

Morgan Stanley also won the $75 million of county district school bonds with a TIC of 2.79%. Both deals are rated Aaa by Moody’s.

Also, Spokane School District No. 81, Wash., sold a total of $107.045 million of unlimited tax GO bonds in three separate sales.

JPMorgan won the $62.505 million deal with a TIC of 2.65%, PNC Capital Markets won the $27.32 million deal with a TIC of 3.36% and Bank of America Merrill Lynch won the $17.22 million deal with a TIC of 1.12%. The deals are backed by the Washington State School District Credit Enhancement Program and are rated Aa1 by Moody’s and AA-plus by S&P.

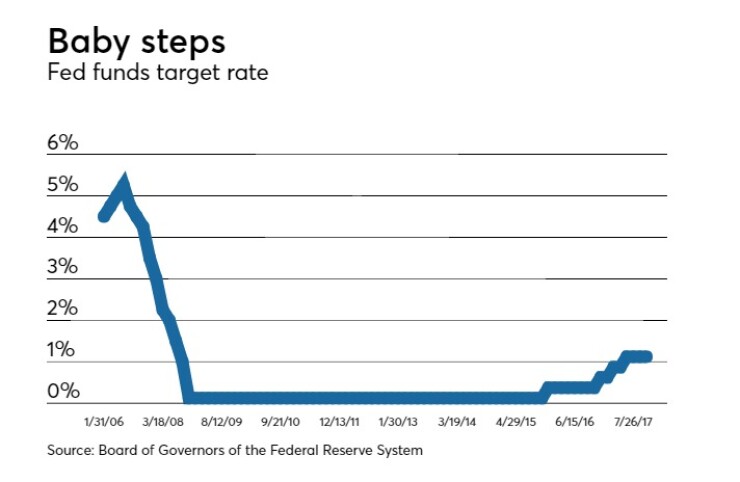

The FOMC decision came as no surprise. The committee voted unanimously to keep the fed funds rate in the 1.0% to 1.25% range. Most market participants now expect an increase the next time the FOMC meets on Dec. 13.

President Trump is expected to make his nomination for Federal Reserve chair Thursday, in a move that may have wider consequences.

That choice “could have broad implications for domestic monetary policy,” said Bill Merz, director of fixed income at U.S. Bank Wealth Management. “Jerome Powell is viewed as the strong favorite and would be seen as a status quo nomination given his past board experience and close policy alignment with current Chair Janet Yellen.”

Merz also said that John Taylor or Kevin Warsh, who have seen their odds drop in recent days, would represent a more hawkish pivot at the Fed, which could potentially push bond yields higher on the expectation they may favor more rapid rate increases and asset sales from the Fed’s balance sheet.

Secondary market

Top-shelf municipal bonds were mixed at the market close on Wednesday. The yield on the 10-year benchmark muni general obligation was one basis point higher to 2.02% from 2.01% on Tuesday, while the 30-year GO yield was one basis point lower to 2.82% from 2.83%, according to a final read of Municipal Market Data`s triple-A scale.

U.S. Treasuries were mixed at the market close on Wednesday. The yield on the two-year Treasury nudged up to 1.62% from 1.59%, the 10-year Treasury yield was flat at 2.37% and yield on the 30-year Treasury bond was down to 2.86% from 2.87%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 83.2% compared with 84.6% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 9.6% versus 98.4%, according to MMD.

AP-MBIS 10-year muni at 2.326%, 30-year at 2.886%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was stronger on trading around the market close on Wednesday.

The 10-year muni benchmark yield dropped to 2.326% from the final read of 2.335% on Tuesday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.