Texas and Florida municipal bonds should weather the aftermath of Hurricanes Harvey and Irma without any credit weakness in the short term, according to buy-side analysts, who continue to recommend the paper.

Claims-paying insurance coverage, federal aid packages, and post-storm infrastructure renovation, are expected to curtail any potential weakening of credit quality and eventually serve as an economic boon after the pair of Category 4 hurricanes blitzed the two southern states, along with parts of Louisiana, Georgia and South Carolina, among others.

“We think at a minimum, investors should not knee-jerk react to anything,” Dan Heckman of U.S. Bank said on Monday, a day after Hurricane Irma walloped into Florida, packing winds of 130 miles per hour, killing at least a dozen Floridians, displacing 7,000 evacuees, and leaving more than six million without power.

The natural pair of natural disasters wreaked havoc on the two large municipal bond-issuing states and could cost the U.S. economy a combined $290 billion, and Florida’s insurance industry could potentially handle claims for damages estimated at $40 billion.

Still, investors should remain patient and unwavering when it comes to holding existing paper from Florida and Texas issuers, as well as new debt, buyside analysts said.

“Short-term there is no impact to credit quality; longer term it’s harder to ascertain,” Heckman said. “We think if you have a solid credit, you should maintain that holding and assess that situation as time goes on.”

Buyside experts say the potential for investing in Texas and Florida paper remains strong as cities, states, and municipalities must adhere to debt service covenants, pledges, liens, and other repayment terms, while bond holders are typically paid via trustees with national headquarters typically located outside of the hurricane-battered states.

“We think many of these municipalities will make good on their bond payments and we would not be a seller in here,” Heckman said. “We continue to suggest to clients to maintain the positions we have bought for them, and we are not advocating to do any selling at this stage.”

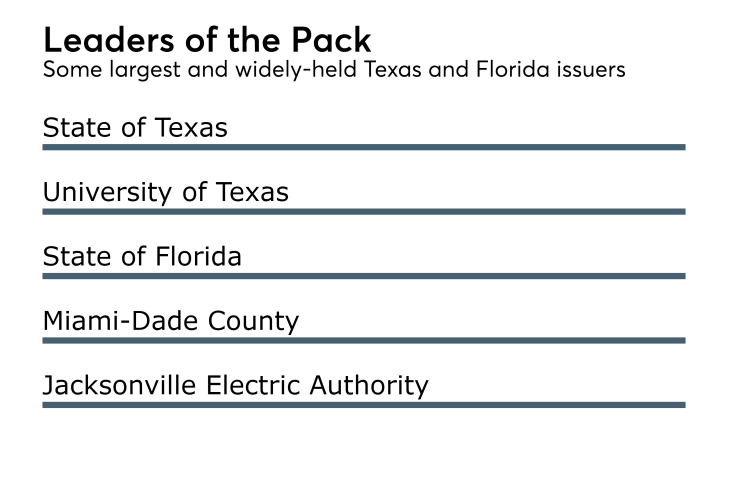

Texas has about $361 billion of total bonds outstanding. The most widely-held issuers include the state of Texas, University of Texas, and various school districts, many of which are guaranteed by the Texas Permanent School Fund, which is triple-A-rated.

Florida’s total debt outstanding is estimated at $146 billion. Its largest issuers include the state of Florida, large counties and their school districts, such as Miami-Dade County; the Greater Orlando Airport, and Jacksonville Electric Authority.

Buyside analysts and managers said they have not witnessed any widespread selling to date on these or any other credits and that the market has become accustomed to such events and their potential impact on municipal credits.

Natural disasters, like hurricanes, are typically followed by substantial infrastructure rebuilding that gives the affected municipalities an economic boost, according to Patricia Healy, senior vice president of research and portfolio manager at Cumberland Advisors.

She said this is likely to be the case with issuers, such as the Port of Houston, in Texas, where Hurricane Harvey made landfall on Aug. 25 and later caused at least 70 deaths and billions in damage.

“In both cases we don’t think investors should overly react to the unfortunate weather instances,” Heckman said. “Could they have temporary negative implications to the economy in the short-term? Yes, but there will be a resurgence due to the economic recovery process.

“Eventually many of these municipalities will recover and come back in better form and shape, and provide the same level of service -- but for some that will take multiple years when you consider the widespread number of municipalities impacted,” Heckman continued.

Cumberland continued to hold highly-rated, double-A Texas bonds in clients’ separately-managed accounts and its exchange traded funds four days after Harvey reached land. “We are invested in highly-rated entities we already think will be OK,” Healy said.

She, too, said it was business as usual for the municipal market following Harvey. She reported a lack of trading on Aug. 29 of Texas school bond paper that was out for the bid a few days after Harvey – and said stronger pricing was evident compared with the previous month on double-A bonds that were not pre-refunded and not backed by the Texas Permanent School Fund.

Healy attributed that to the overall credit strength of Texas paper, and the resiliency of municipal bonds during a natural disaster.

“The Texas economy has been strong post-recession, although growth stalled in the past two years as the energy space and related employment contracted,” Alan Schankel, managing director of municipal strategy and research at Janney Capital Markets said in the days after Hurricane Harvey’s arrival.

Schankel said he expects stability and further growth to continue on a statewide basis in Texas in the months ahead following one of the state’s most devastating hurricanes.

The Texas Department of Public Safety said localities have estimated that more than 200,000 homes have been damaged, more than 13,500 destroyed, estimates that are expected to rise.

President Trump ordered additional emergency aid from the Federal Emergency Management Agency for public assistance for 67 Florida counties and individual assistance for nine counties, on the heels of the House of Representatives’ approval last week of a $7.85 billion aid package for victims of Hurricane Harvey in Texas and Louisiana. The earlier package includes $7.4 billion for FEMA and $450 million for the Small Business Administration.

Peter Block, managing director at Ramirez & Co., said even though there are many Texas municipal utility districts rated in the triple-B category due to concentrated tax bases that could be vulnerable to liquidity issues, most credits will remain steady.

“Although there may be some localized challenges with municipal utility districts or smaller communities located in storm impacted counties, most credits -- including Houston -- should be able to manage through coming months,” Schankel said.

Others said state safeguards and programs should contribute to the recovery. For instance, the Florida Hurricane Catastrophe Fund, the state’s reinsurance fund established after Category 5 Hurricane Andrew hit in 1992 causing $27 billion in damages, could expedite the recovery process, according to Heckman. The fund, which has accumulated $17 billion since then for repairs, recovery, and relief, is double-A-rated by all three major rating agencies.

Heckman said the presence of the fund provides confidence for Florida bond holders.

“Time has really helped Florida from the standpoint of the severity of hurricanes,” Heckman said. “That lag in time in between Andrew and Irma has allowed them to build up strong cash reserves in this fund” to coincide with much-needed relief after Irma’s devastation.

Overall, municipals have been a strong asset class recently, according to Heckman, who said he doesn’t foresee these recent or other upcoming weather-related incidents changing that dynamic.

“Generally following natural disasters, aid for rebuilding begins to flow from insurance companies as well as federal and state government sources, which is economically stimulative,” Schankel agreed.

“There will certainly be gaps, unforeseen circumstances, and problems, but credit quality of most Texas municipal bond issuers -- even many of those located in storm damaged areas -- should hold steady, and eventually benefit from new infrastructure investment,” Schankel added.