BRADENTON, Fla. - Florida's auditor general renewed a request for lawmakers to rein in the issuance of dirt bonds, and order oversight of the obligations.

Despite the end of the recession in June 2009, the auditor's office found that financial difficulties have worsened for the dirt bond sector after reviewing 445 audits filed by community development districts for fiscal 2013.

Serious financial difficulties were indicated in 110 CDDs, according to a

There are 569 active CDDs, some of which failed to submit audits or were not required to file them by law.

Dirt bonds are secured by assessments on land in CDDs created by developers to finance infrastructure. Developers pay assessments until lots are sold, then homeowners assume the debt.

In the audits, 95 districts reported fund balance deficits in fiscal 2013 compared to 39 in fiscal 2008.

In their 2013 audits, 75 community development districts failed to make one or more scheduled bond payments due to lack of funds. This compares with 32 instances reported by the auditor's review in fiscal 2008.

"This is likely due to the slow economic recovery of the housing market in Florida," said the auditor general.

The housing market crisis also appears to be responsible for the fact that "many CDDs are facing a financial crisis due to a lack of sufficient funds to make debt service payments on bonds or to pay obligations within 90 days," the auditor said.

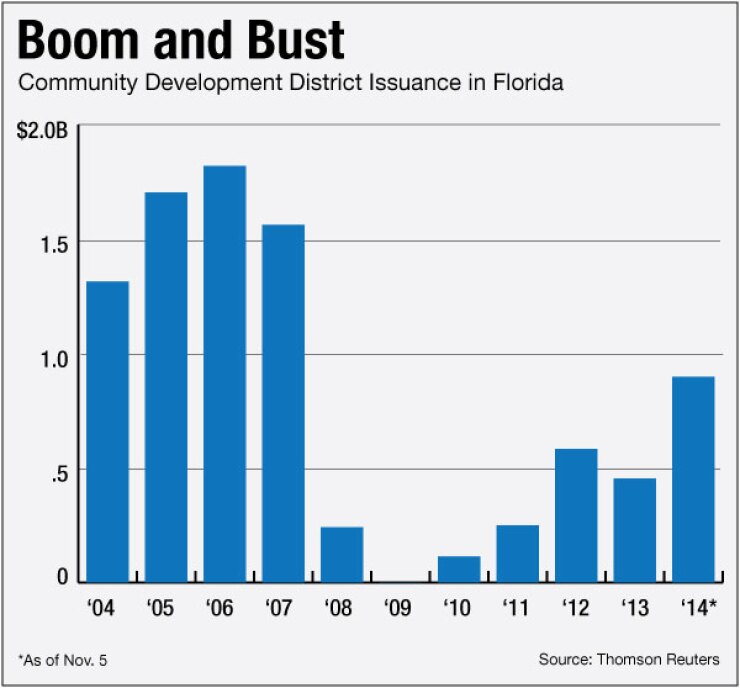

During the recession, many CDDs failed to make bond payments as underwater homeowners defaulted on mortgage payments, or developers filed for bankruptcy.

As of Sept. 30, 2013, CDDs in Florida reported more than $5 billion in outstanding debt, the report said. Most CDDs issue revenue bonds, and there is no limit on the amount of debt that can be sold.

In recommending changes to the Legislature, the auditor general said that establishing parameters on the amount of bonds a CDD can issue, and providing additional oversight for CDD bonds, "could provide additional assurance as to a CDD's ability to repay bondholders and pay creditors."

Martin made the same recommendation in a 2011 report, after reviewing a land-secured financing oversight program in Texas.

No legislation has been filed addressing the issues to date. Florida does not have a bond oversight program except for debt issued at the state level.

The number of CDDs in financial difficulty could be broader than those mentioned in the auditor's report, according to Richard Lehmann, president of the Florida-based Income Securities Advisors and publisher of Distressed Debt Securities.

Lehmann said his data base found 173 district bond issues in Florida over the last 10 years that reported difficulty or defaulted and had not resolved those problems.

"The [auditor's] report significantly understates the scope of the problem," he said Thursday. "The other thing that I find here is that it really made no recommendation about what the Legislature should look at to address the rules regarding issuance.

"This report leaves you shrugging your shoulders," he added.

Florida continues to have problems in CDD sector that have not been remedied since 2008 when the breadth of the real estate sector crisis became evident, according to Lehmann.

The Texas bond oversight program is a good model that was created to address problems with that state's land-secured debt obligations and tighten program rules, he said, adding that Texas' program requires developers to have a financial stake in their districts, while Florida does not.

In January 2012, Gov. Rick Scott, who was reelected to a second term Tuesday, ordered a review of special districts - including CDDs - to "continue bringing accountability to their powers to tax, spend, and incur debt at the expense of Florida taxpayers," he said at the time.

Scott's office did not immediately respond to requests for an update on the review.

Recent secondary market disclosures indicate that some CDDs continue to have trouble paying obligations, and have filed notices advising about draws on reserves to make bond payments, extending maturities, and payment defaults, according to the Municipal Securities Rulemaking Board's EMMA filing system.

In the most recent disclosure posted, the 736-acre Pine Ridge Plantation CDD in northeast Florida's Clay County notified bondholders Tuesday that $126,000 was withdrawn from reserves to make the Nov. 1 debt service payment. No reason was given about why the reserve draw was necessary.

Pine Ridge issued $14.09 million in bonds in 2006, and received a clean audit opinion for fiscal 2013. For CDDs, withdrawal from reserves is not typically considered a default, though some sector experts consider it a sign of fiscal distress.