Municipal bond traders were hit with a huge wave of new issuance on Wednesday, as yields on some maturities rose as much as seven basis points.

Primary Market

On Wednesday, Goldman Sachs priced the biggest deal of the week for the Massachusetts Development Finance Agency.

Goldman priced and then repriced the DFA's $1.55 billion of Series 2016A revenue bonds for Harvard University. The bonds were repriced to yield from 0.90% with a 4% coupon and 5% coupon in a split 2019 maturity to 2.07% with a 5% coupon in 2031. The bonds were also repriced to yield from 2.18% with a 5% coupon in 2033 to 2.23% with a 5% coupon in 2034. A term bond in 2036 was priced to yield 2.58% with a 4% coupon and 2.63% with a 5% coupon in a split maturity and a term bond in 2040 was priced to yield 2.73% with a 5% coupon. The deal is rated triple-A by Moody's Investors Service and S&P Global Ratings.

Citi priced the Dormitory Authority of the State of New York's $1.1 billion of personal income tax revenue bonds for retail investors, prior to institutional pricing on Thursday. The bonds were priced for retail to yield from 0.99% with a 3% coupon and 5% coupon in a split 2019 maturity to 3.07% with a 3% coupon in 2038. No retail orders were taken in the 2028 through 2030 maturities, 2032 through 2035 or 2037. The deal is rated Aa1 by Moody's and triple-A by S&P.

Loop Capital Markets priced the California State Public Works Board's $527.54 million of Series 2016 C&D various projects lease revenue refunding bonds for institutions, after a one-day retail order period.

For institutions, the $313.2 million of Series 2016C bonds were priced to yield from 1.11% with a 5% coupon in 2020 to 2.56% with a 5% coupon in 2034. The $214.3 million of Series 2016D bonds were priced to yield from 0.83% with a 3% coupon in 2017 to 2.81% with a 4% coupon and at par with a 3% coupon in a split 2034 maturity.

For retail, the $313.2 million of Series 2016C bonds had been priced as 5s to yield from 1.09% in 2020 to 2.49% in 2034. The $214.34 million of Series 2016D bonds had been priced to yield from 0.86% with a 3% coupon in 2017 to 2.74% with a 4% coupon and at par with a 3% coupon in a split 2034 maturity.

The bonds are rated A1 by Moody's and A-plus by S&P and Fitch Ratings; the issue carries stable outlooks from all three agencies.

Morgan Stanley priced the Tarrant County Cultural Education Facilities Finance Corp., Texas' $636.72 million of Series 2016A revenue bonds for the Texas Health Resources System. The bonds were priced to yield from 1.70% with a 5% coupon in 2024 to 1.98% with a 5% coupon in 2026. The bonds were also priced to yield from 2.66% with a 5% coupon in 2034 to 3.10% with a 4% coupon and at par with a 2.25% coupon in a split 2036 maturity. A term bond in 2041 was priced to yield 2.86% with a 5% coupon and a term bond in 2047 was priced to yield 3.51% with a 3.25% coupon, 3.31% with a 4% coupon and 2.91% with a 5% coupon in a triple-split maturity.

Bank of America Merrill Lynch priced the city and county of Honolulu's $222.05 million of GOs. The $86.835 million of Series 2016A bonds were priced to yield from 0.97% with a 3% coupon in 2018 to 3.16% with a 3% coupon in 2041. The $37.24 million of Series 2016B bonds were priced to yield from 0.97% with 4% coupon in 2017 to 1.56% with a 4% coupon in 2024. The 2017 maturity was offered as a sealed bid. The $97.975 million of Series 2016C bonds were priced to yield from 1.22% with a 5% coupon in 2021 to 2.66% with a 4% coupon in 2034. The deal is rated Aa1 by Moody's and AA-plus by Fitch.

BAML also priced the city of Syracuse, N.Y., Industrial Development Agency's $200.13 million of tax-exempt refunding pilot revenue bonds for the Carousel Center Project. The bonds were priced to yield from 1.41% with a 3% coupon in 2018 to 2.44% with a 3% coupon in 2024. The bonds were also priced to yield 2.87% with a 3% coupon in 2024 and from 2.87% with a 5% coupon in 2028 to 3.30% with a 5% coupon in 2036. The deal is rated Baa1 by Moody's and A-minus by Fitch.

Raymond James priced the Garland Independent School District, Texas's $150.25 million of unlimited tax school building bonds, to yield from 0.85% with a 2% coupon in 2017 to 2.68% with a 4% coupon in 2036. The deal is backed by the Permanent School Fund Guarantee Program and is rated triple-A by Moody's and Fitch.

In the competitive arena on Wednesday, Wisconsin sold about $325 million of Series 2016D general obligation bonds, which were won by BAML with a true interest cost of 2.99%. The bonds were priced to yield from 0.88% with a 5% coupon in 2018 to 2.32% with a 5% coupon in 2037. The deal is rated Aa2 by Moody's and AA by both S&P and Fitch.

Prior to Wednesday, the last time the state competitively sold comparable bonds was on July 12 when Morgan Stanley won $83.98 million of Series 2016B GOs with a true interest cost of 0.99%.

Also in the Midwest, Minneapolis, Minn., competitively sold $120 million of Series 2016 GO improvement and various purpose bonds, which were won by Morgan Stanley with a TIC of 1.46%. No other pricing information was immediately available.

The deal is rated Aa1 by Moody's and triple-A by S&P and Fitch. The last time the city competitively sold comparable bonds was on Nov. 18, 2014, when Citigroup won $37.4 million of Series 2014 GOs with a TIC of 0.52%.

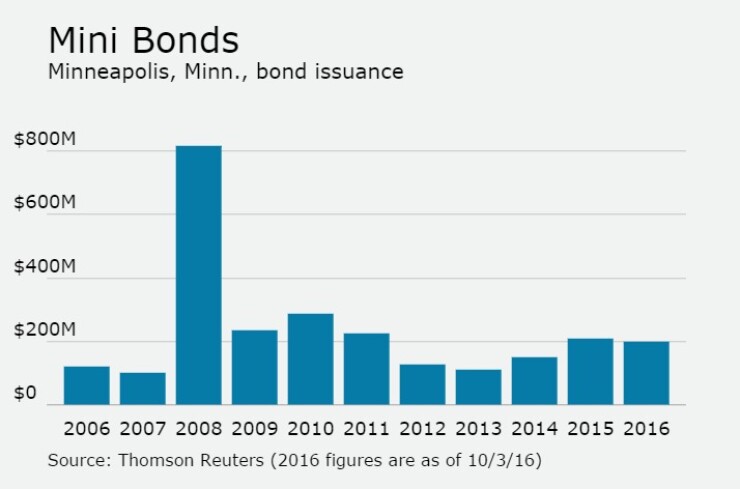

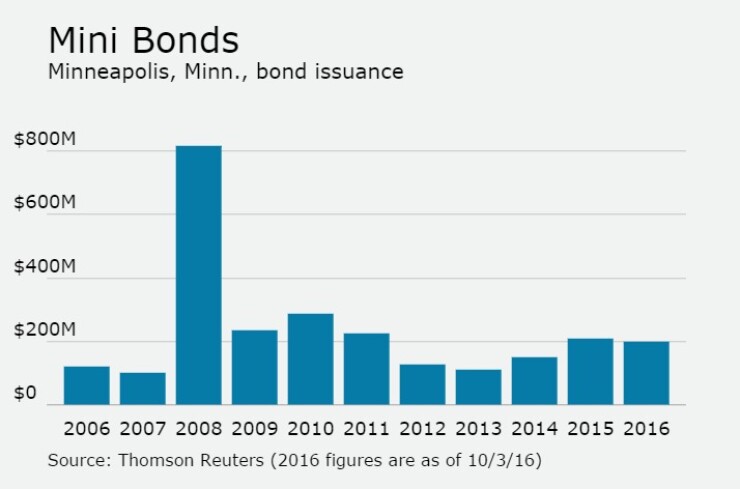

Since 2006, Minneapolis has issued roughly $2.6 billion of bonds with the largest issuance occurring in 2008 when it sold $818 million of debt. During the same period, the City of Lakes sold the least amount of debt in 2007, when it issued $100.4 million of bonds.

Secondary Market

Top-quality municipal bonds were weaker on Wednesday around midday. The yield on the 10-year benchmark muni general obligation was up anywhere from three to five basis points from 1.55% on Tuesday, while the yield on the 30-year gained between five and seven basis points from 2.36%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were also weaker around noon on Wednesday. The yield on the two-year Treasury rose to 0.85% from 0.82% on Tuesday, the 10-year Treasury yield gained to 1.72% from 1.69% and the yield on the 30-year Treasury bond increased to 2.44% from 2.42%.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 92.2% compared to 93.7% on Monday, while the 30-year muni to Treasury ratio stood at 98.2% versus 98.9%, according to MMD.