CHICAGO — Bank of America Corp. won approval from the Federal Reserve to acquire Chicago-based LaSalle Bank Corp. from ABN Amro Holdings NV, paving the way for the $21 billion deal to close next month. The Fed’s approval of the transaction on Friday came after the Federal Trade Commission’s clearance of the deal in August. It marked the final regulatory approval needed, said Charlotte-based Bank of America spokesman Scott Silvestri. The approval came despite the efforts of local community and labor groups that have formed the Save Chicago Jobs and Community Investment Coalition, which called on the Fed in Chicago to hold a public hearing on the deal. The group staged its own hearing on Saturday attended by employees, congressional members, and elected state officials. “We are extremely disappointed in the decision by the Federal Reserve to forgo a public hearing and approve the acquisition of LaSalle Bank by Bank of America,” the group said in a statement. “We already know this merger could devastate Chicago — likely costing the area more than 10,500 jobs, draining more than three-quarters of a billion dollars from our economy, and ultimately raising banking costs for all of us.” A Fed spokeswoman would say only that the agency decides on a case-by-case basis whether to hold public hearings on bank acquisitions. Although the deal now has regulatory approval, Democratic U.S. Sens. Dick Durbin and Barack Obama have sent letters seeking a meeting with top Bank of America officials to discuss the deal and its impact on the bank’s longstanding community and philanthropic role in Chicago. Silvestri said yesterday: “We’ve been in touch with the offices of Sen. Durbin and Sen. Obama and we anticipate having ongoing dialogue with them as the transition progresses. We will certainly be working with the senators’ staffs to make sure we respond to their concerns and questions.” Bank of America officials have said they have made no decisions yet on job cuts on either the commercial banking or investment banking side of LaSalle’s business. LaSalle’s municipal bond practice employs roughly 35 employees. LaSalle’s municipal bond practice was ranked 23d among underwriters last year, according to Thomson Financial, while Bank of America was ninth. The deal was announced in April as part of a larger $85 billion transaction that called for Dutch-based ABN to be acquired by British-based Barclays PLC. A consortium led by the Royal Bank of Scotland has since emerged as a suitor for ABN. A legal battle ensued over the LaSalle side transaction as ABN shareholders challenged the legality of the transaction without their approval, but Dutch courts cleared the deal.

-

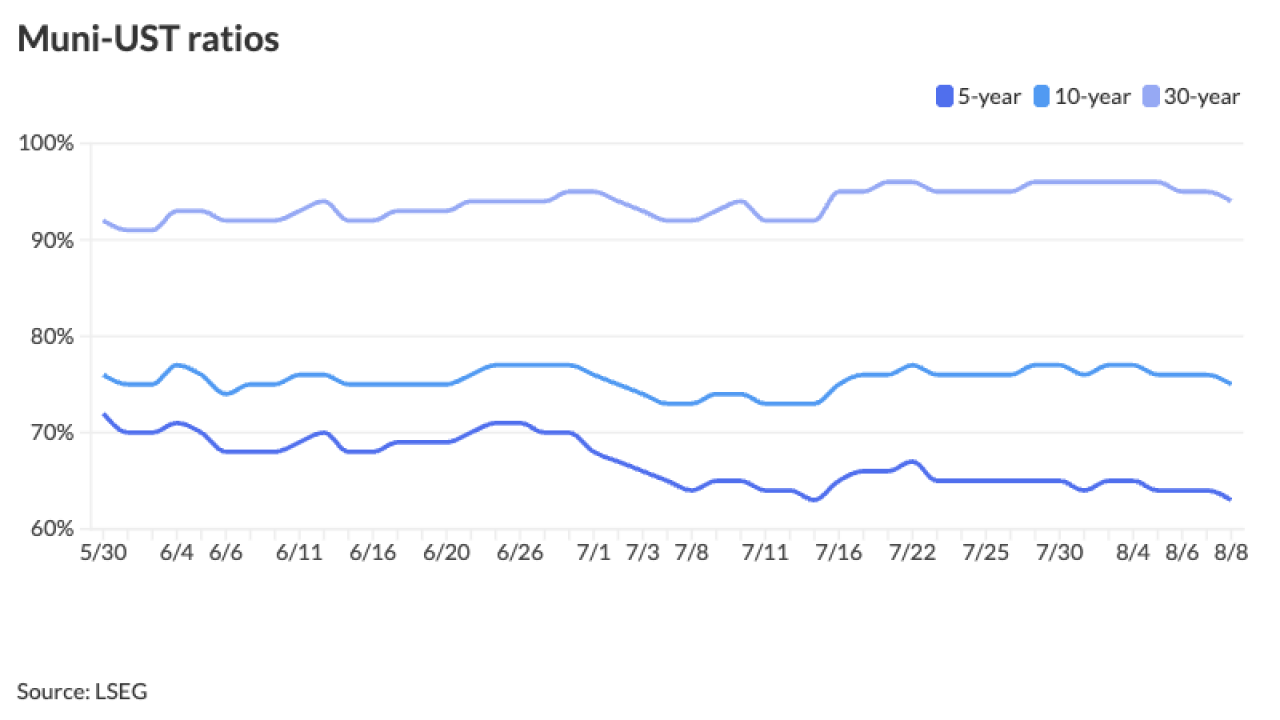

Issuance for the week of Aug. 11 remains elevated at an estimated at $10.713 billion, with $8.857 billion of negotiated deals and $1.857 billion of competitive deals on tap, according to LSEG.

10h ago -

"Nothing could delay a restructuring or a consensual deal [more] than the existing board was doing," said Assured Guaranty CEO Dominic Frederico of the Trump administration's removal of Puerto Rico oversight board members.

August 8 -

An Emerson College poll showed Lt. Gov. Eleni Kounalakis in seventh place in the crowded governor's race as she made the announcement Friday.

August 8 -

Generous federal support is offset by a small and volatile economy, the agency said.

August 8 -

Hospital acquisitions, expansions and the anticipation of federal policy changes has increased bond issuance from the California Health Facilities Financing Authority.

August 8 -

Ninety percent of FINRA's operating expenses are driven by compensation and technology costs.

August 7