Despite the Federal Reserve’s changes to its Municipal Liquidity Facility, the short-term borrowing program is still insufficient for struggling agencies such as New York’s Metropolitan Transportation Authority during the COVID-19 economic crisis, a watchdog group said.

“The program has not been the infusion of cash that state and local governments struggling from a COVID-caused revenue collapse need,” said New York-based Reinvent Albany. “It remains to be seen if the revisions will result in greater use.”

The Fed on Tuesday

“We continue to suggest that the Fed provide no- or very low-interest financing for five or more years, and not penalize localities with poor credit by charging higher interest rates,” said Rachael Fauss, Reinvent Albany’s research director.

New York State has designated the MTA as eligible for the program, an emergency financing measure that could support MTA access to long-term bonds and refinancing from the Fed.

MTA officials declined comment.

The MTA, which operates New York City’s subways and buses, two commuter rail lines and several interborough bridges and tunnels, is one of the largest municipal issuers with roughly $46 billion in debt.

It has received multiple bond-rating downgrades and warnings since the pandemic escalated in March. Ridership plummeted as much as 90% as workers stayed at home, while the authority also lost billions in toll revenue and dedicated taxes.

MTA officials are exploring whether dedicated taxes count as “general revenue” under the Fed’s program. The facility is a short-term loan from the Fed that involves up to 20% of general revenue.

According to Reinvent Albany, the facility could also benefit the MTA by reducing the short-term incentive for the state to divert or “raid” MTA dedicated taxes and funds such as the Metropolitan Mass Transportation Operating Assistance program, which provides general operating subsidies and funds for the MTA and downstate transportation systems.

Without $3.9 billion from the federal government to match what it received in later March under the CARES Act, the authority faces an operating deficit of up to $12 billion through next year. Transit agencies nationwide are seeking $36 billion.

Only triple-B-minus rated Illinois has tapped the Fed’s facility, for $1.2 billion.

“This program adjustment may have appeared necessary because Congress failed to come to an agreement on a fifth phase of COVID-19 [aid] last week,” said Tom Kozlik, head of municipal strategy and credit for Hilltop Securities. “It also may have seemed necessary so the Fed can appear as though it is not out of touch with what has been happening in the municipal market since the beginning of March.”

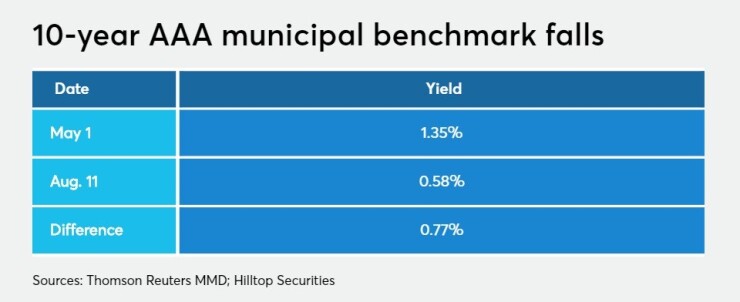

The 10 year AAA municipal benchmark has dropped 77 basis points since the beginning of May, Kozlik noted. “This number is even larger if you go back to the beginning of April or middle of March.”