WASHINGTON — The Federal Reserve is making a number of last-minute changes to a middle-market loan program in an apparent bid to boost its appeal among prospective participants.

The Fed on Monday announced new flexibility on loan amounts for qualifying businesses, and that the central bank increase its stake to 95% on all loans made through the Main Street Lending Program.

The program, aimed to help midsize business affected by the coronavirus crisis, is expected to be open for business shortly. It will be available to companies with up to 15,000 employees or $5 billion in annual revenue. But whereas the Fed had previously established a minimum loan amount of $500,000, that threshold has been halved to $250,000.

The Fed also increased the maximum loan size for each of the three Main Street Lending Program facilities. In the Main Street New Loan Facility, borrowers will be able to get loans of up to $35 million (up from $25 million); for the Main Street Priority Loan Facility, the maximum is $50 million (up from $25 million); and for the Main Street Expanded Loan Facility, it is $300 million (up from $200 million).

The Fed also made changes to offer borrowers greater flexibility in repaying Main Street loans, extending the loan terms from four to five years. The prepayment periods for all of the loans will also be extended, and the Fed will now allow borrowers to delay principal payments for two years instead of one.

Additionally, the Fed said the Main Street Lending Program would now purchase 95% of each eligible loan. That amount is unchanged for the New Loan Facility and the Expanded Loan Facility, but is up from 85% for the Priority Loan Facility.

The changes appear to be in response to concerns that the program as originally conceived

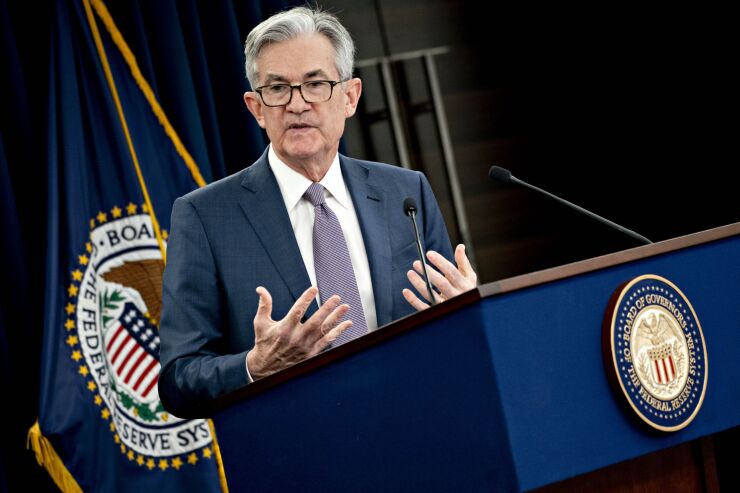

“Supporting small and mid-sized businesses so they are ready to reopen and rehire workers will help foster a broad-based economic recovery,” Fed Chair Jerome Powell said in a press release. “I am confident the changes we are making will improve the ability of the Main Street Lending Program to support employment during this difficult period.”

The Fed board voted unanimously to approve the slate of changes after reviewing feedback and considering that the needs of small and medium-sized businesses “vary widely,” the agency said.

The program will still accept loans that were made under the old terms if they were funded before June 10 and will be open for lender registration “soon,” the Fed said. The Main Street Lending Program will then begin actively purchasing loans shortly afterward.