Retail investors, setting aside concerns over interest rates, tax reform, and tight yield and credit spreads, are poised to pump money into the municipal market as 2017 winds down.

“Typically, all municipal investors want to make sure net cash is invested by year end,” said Jonathan Law, portfolio manager with Advisors Asset Management. “With the broader indexes up and yield and credit spreads at their lows, demand for paper is very much alive.”

Fund managers said retail investors are eyeing defensive strategies to curtail some of their concerns and guard against the market’s volatility.

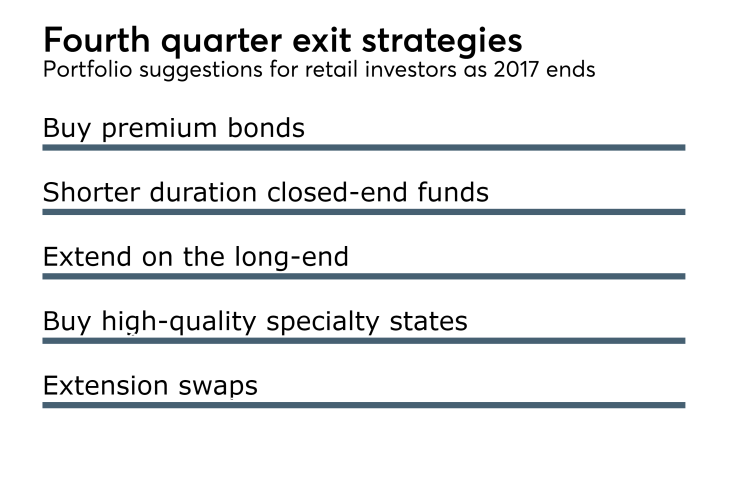

Law suggested conservative investors swap out of discount and zero-coupon paper and buy premium bonds to remain defensive ahead of the Fed’s final 2017 meeting on Dec. 13, when economists see an 83% probability of a rate increase.

The Federal Open Market Committee left rates unchanged at its two-day policy meeting Oct. 31 and Nov. 1.

Law said the premium coupon strategy appeals to retail investors who are more preoccupied with higher rates than they are with maximizing yields and returns.

Jim Robinson, founder and chief investment officer of Gross Pointe Farms, Mich.-based Robinson Capital Management, said while concerns over tax reform are compounding retail investors’ interest rate fears, many will remain active as the calendar year ends.

He recommends retail investors move toward shorter duration closed-end funds, as they are trading at a premium and allow investors to hedge interest rate risk.

His firm offers the Robinson Tax-Advantaged Fund, which hedges duration risk with short positions in U.S. Treasury futures contracts to avoid making interest rate bets.

Others, he said, should dabble on the long-end of the municipal curve where yields can potentially be attractive; or seek out high-quality paper in specialty states like New York, New Jersey, and California with exemption from high state and local taxes.

“We think tax reform will eventually take shape and become law, however, we expect the ultimate package to be manageable, without having a materially adverse impact upon the muni market,” Jeffrey Lipton, head of municipal research and strategy and fixed income research at Oppenheimer & Co. wrote in an Oct. 30 weekly municipal report.

“New purchases should largely focus on quality, and portfolio diversification remains essential as a way to absorb potential market shocks,” he added.

Other strategies for retail include moderate extension swaps by participating in existing new deals.

For instance, Law said some investors used a $189.04 million California State Public Works Board deal that was priced by Raymond James & Associates on Oct. 26 to swap from shorter to longer paper within the same credit.

The single-A-rated lease revenue refunding bonds in Series H for the Department of Education with a 5% coupon extended out to 2034 with a final yield of 2.81%, Law said.

The bonds were 28 basis points higher in yield than the generic triple-A general obligation benchmark in 2034 on the day of the pricing, according to Municipal Market Data.

Law said this deal allowed investors to replace shorter Cal Public Works paper for longer bonds of the same quality from the new deal at slightly higher yields – especially if they were overweight in short Cal paper and are concerned about a potential rate hike.

“Usually bonds five years and in are a little more vulnerable during a rate increase versus intermediate and longer paper,” Law said. “Treasury ratios are still tight and yields on the short end are very compressed.”

The five-year triple-A municipal benchmark recently yielded 1.37% -- 67% of the 2.03% comparable Treasury bond – down from 1.79% at the start of 2017, Law said.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.8% compared with 83.2% on Oct. 27, while the 30-year muni-to-Treasury ratio stood at 98.2% versus 96.7%, according to MMD.

Lipton of Oppenheimer said there is value in extending out to 20-year maturities, where over 90% of the yield curve can be captured.

“Investment quality portfolios derive little benefit from moving down the credit curve as the ability to capture sufficient offsetting yield is quite thin in such a compressed market,” Lipton wrote.

John Mousseau, executive vice president and director of fixed income at Cumberland Advisors, said municipals are likely to remain attractive to mom and pop investors through year end.

“We think retail will continue to be involved in the longer end of the market as munis are still very cheap to Treasuries there,” he said.

While some retail investors may opt for a wait-and-see approach toward year end, the strategists said they may miss a chance for value as they contemplate potential uncertainty.

Law and Robinson said those who are slower to plunk down available cash as they weigh interest rate concerns – or await the announcement of a new Federal Reserve Board chairman – may lose out on opportunities when supply swells as it typically does in November.

“There should be some attractive opportunities for muni bond investors probably beginning at the end of November and middle of December” leading up to the last Fed meeting, Robinson said.

“There are some issuers who are going to try and squeeze in before year end to beat anything in a tax bill that might be retroactive to Jan 1,” Cumberland said. “To that end I think you will see a supply bulge between now and year end.”

Law said retail investors should be prepared to take advantage of new supply at potentially higher yields available in November – when municipalities typically rush to issue their last deals of the year – so they can avoid facing seasonal supply shortages in the new year.

“Regardless of where rates are headed there is a higher demand and low supply pattern that takes place in January,” typically known as the January Effect, he said.

This period follows the holiday season when investors' portfolios are flush with cash from heavy Jan. 1 coupon and maturity payments, yet municipalities are slow to issue new debt in the first few weeks of the year.

“Now might be a good time to sell out of weaker paper and swap into higher-quality paper” to take advantage of value and opportunities ahead of this annual phenomenon, Law advised.

Law’s advice to retail investors? Since rates were lower rather than higher for much of the year, some sophisticated retail investors may have compromised on credit quality and duration earlier in the year to meet their yield targets, Law said. “The fourth quarter might be a good time for them to come to their senses,” he said.

Additionally, he said those that have been prepared for higher interest rates and volatility should stay the course. “The reality is a lot of things we have been preparing for have not really happened yet,” Law said.

Investors should be flexible and vigilant concerning interest rates, Fed actions, as well as inflation and political concerns.

“We all thought at the beginning of the year rates were finally going to go higher with a new administration and new initiatives; we have yet to see that take place,” Law said, adding that there could be more political gridlock at the start of 2018.

He suggested geopolitical risks, such as threats from North Korea, for instance, could create a flight to quality. “Municipal bonds are positioned to benefit from something like that,” he said.

Lipton recommended investors keep some powder dry, remain selective and be in a position to identify and take advantage of market opportunities.

“Investors should identify appropriate credits having the most suitable coupon and maturity structures that will align with interest-rate expectations and maximize flexibility to take action,” Lipton said. “The bottom line is: prepare your bond portfolio for the long-term and collect your coupons – that is something you can’t say for other asset classes.”