The municipal market was hit with a ton and a half of new issuance with bond-hungry investors waiting with open arms and cash in hand.

"Today was all about new issues," a New York trader said. "With the 10-year Treasury having backed off from 1.45% to 1.87% now and with wider spreads from the high-grade scale, deals are definitely getting done. Different names also help."

One portfolio manager noted the ease in which the deals were getting done.

"It seems like things are selling fairly easily," he said. "I’ve been focusing on higher-yielding credits today, and they’ve been blowouts."

The biggest deal of the week got even bigger as it was upsized from its original par amount of $944.825 million to $1.3 billion — a record size for the District of Columbia's income tax-secured bonds.

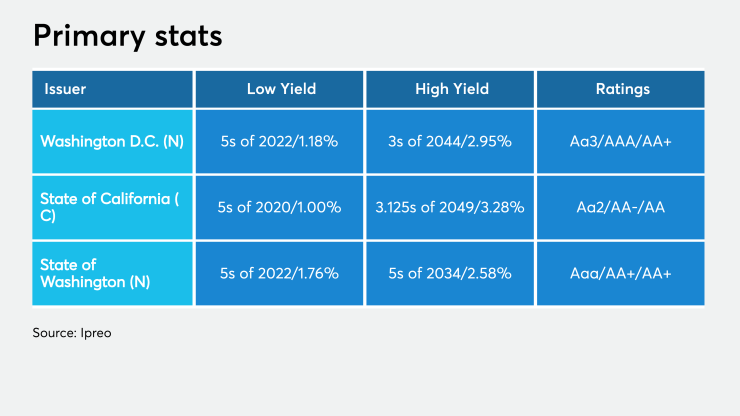

Morgan Stanley priced D.C.’s (Aa1/AAA/AA+) $1.321 billion of income tax secured revenue and revenue refunding bonds.

"The deal grew in size due to robust demand," said another New York trader. "Pristine market conditions and the fact that D.C. isn't that frequent of a market participant also factored in."

The 2029 maturity was priced as 5s to yield 1.72%, 12 basis points above the MMD scale. The 2044 maturity was triple split as 3s to yield 2.95%, 4s to yield 2.63% and 5s to yield 2.37%. Those yields are 78 basis points, 46 and 20 BPs above MMD’s 2.17%.

District of Columbia 5s of 2029 traded 1.63% on November 5. The high was 1.87% in recent trading and the low was 1.40%.

Meanwhile, California (Aa2/AA-/AA) sold $682.435 million of various purpose GO and refunding bonds, which were won by Citi with a true interest cost of 2.70495.

The 2029 maturity was priced as 5s to yield 1.70%, which is 10 basis points above the MMD spread. The long bond, which in this case is a 2039 maturity was priced as 5s to yield 2.16%, resulting in a spread to MMD of plus 12.

The long California bond, 5s of 2049, traded at 2.12% on October 30, with the original September yield at 2.07%, in line with how the market has moved since then.

Bank of America Securities priced Pennsylvania Higher Educational Facilities Authority’s (Aa3/AA/ ) $537.225 million of revenue bonds for the University of Pennsylvania Health System.

Bank of America Securities priced Washington State's (Aaa/AA+/AA+) $400.710 million of motor vehicle fuel tax general obligation refunding forward delivery bonds.

Citi ran the books on Clark County, Nevada's (Aa3/ / ) $370.90 million of airport system subordinate lien refunding revenue non-alternative tax bonds.

BofAS priced Lower Colorado River Authority's ( / A/AA-) $139.350 million of refunding revenue bonds.

BofAS also priced Lower Colorado River Authority’s ( /A/AA-) $139.350 million of refunding revenue bonds.

Loop Capital Markets priced Parish of East Baton Rouge, Louisiana's (Aa3/AA+/AA) $130.180 million of capital improvement sales tax revenue bonds.

"We saw solid demand and firm pricing beginning to creep into the market as the correction to higher yields seems to have run its course in the short run," Michael Pietronico, CEO, Miller Tabak Asset Management said. "Paper on the shorter end of the market is getting harder to find and that should not be a surprise as the year-end 'roll' is coming more into focus by money managers."

ICI: Muni funds see $2.1B inflow

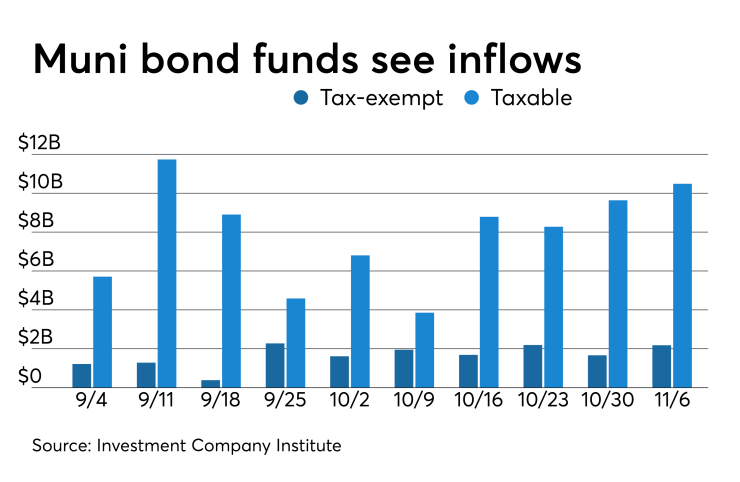

Long-term municipal bond funds and exchange-traded funds saw a combined inflow of $2.182 billion in the week ended Nov. 6, the Investment Company Institute reported on Wednesday.

It was the 45th straight week of inflows into the tax-exempt mutual funds and followed an inflow of $1.665 billion in the previous week.

Long-term muni funds alone saw an inflow of $1.792 billion after an inflow of $1.343 billion in the previous week; ETF muni funds alone saw an inflow of $389 million after an inflow of $322 million in the prior week.

Taxable bond funds saw combined inflows of $10.484 billion in the latest reporting week after inflows of $9.613 billion in the previous week.

ICI said the total combined estimated inflows from all long-term mutual funds and ETFs were $8.217 billion after revised inflows of $3.281 billion in the prior week.

Secondary market

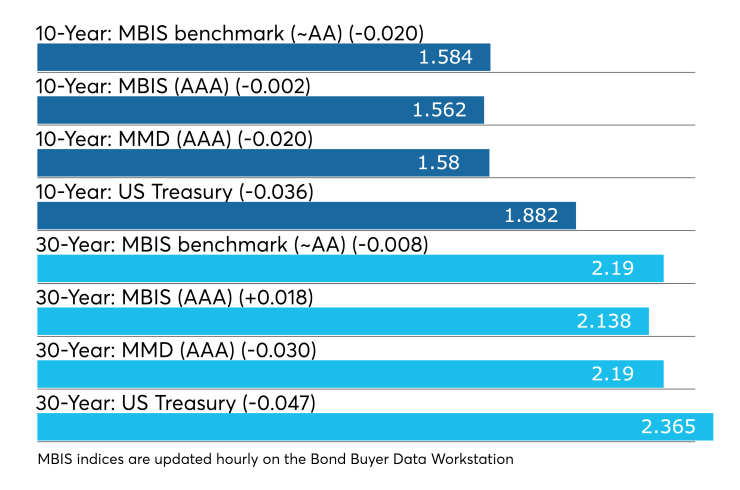

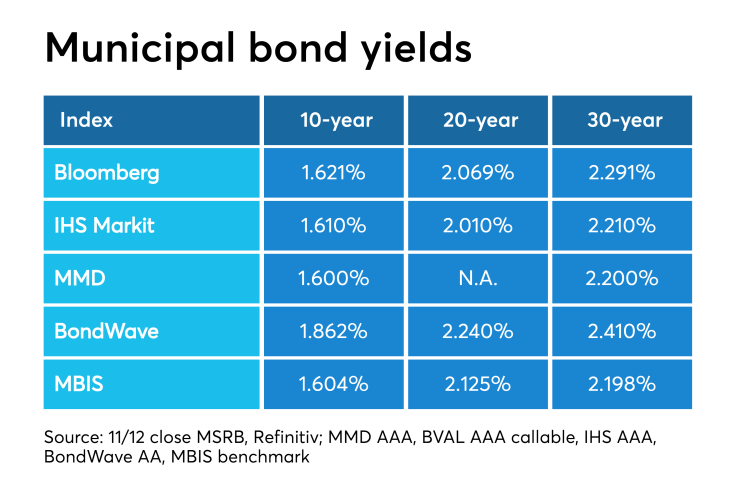

Munis were stronger on the MBIS benchmark scale, with yields falling by two basis points in the 10-year and by less than a basis point in the 30-year maturity. High-grades were mixed, with yields on MBIS AAA scale decreasing by less than a basis point in the 10-year and increasing by no more than two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on 10- year was lower by two basis points to 1.58% and the 30-year GO was down three basis points to 2.19%.

The 10-year muni-to-Treasury ratio was calculated at 84.4% while the 30-year muni-to-Treasury ratio stood at 93.1%, according to MMD.

Treasuries were lower and stocks were mixed, with the Dow and the S&P 500 in the green. The Treasury three-month was up and yielding 1.574%, the two-year was down and yielding 1.634%, the five-year was down and yielding 1.688%, the 10-year was down and yielding 1.882% and the 30-year was down and yielding 2.365%.

Previous session's activity

The MSRB reported 38,279 trades Monday on volume of $9.33 billion. The 30-day average trade summary showed on a par amount basis of $10.43 million that customers bought $5.82 million, customers sold $2.77 million and interdealer trades totaled $1.84 million.

California, New York and Texas were most traded, with the Golden State taking 16.165% of the market, the Empire State taking 13.927% and the Lone Star State taking 9.485%.

The most actively traded securities were Michigan State Housing Development Authority revenue, 3.1s of 2044 traded 14 times on volume of $35.125 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.