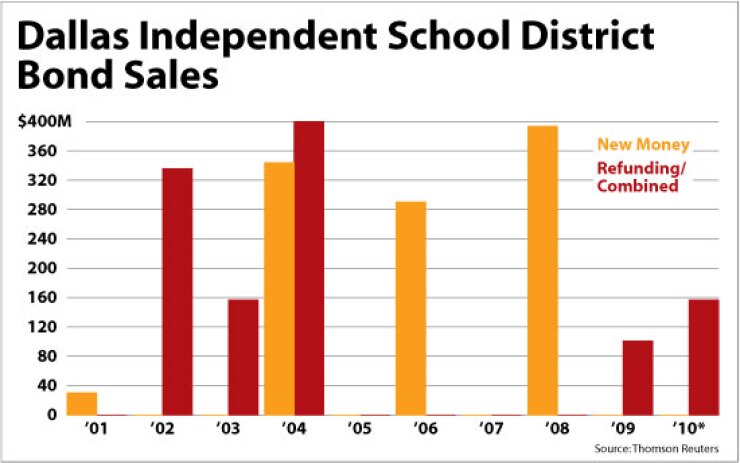

DALLAS — The Dallas Independent School District will take $1.03 billion of bonds to market the week before Thanksgiving in a competitive sale that will exhaust more than $2.7 billion of total debt approved by voters in 2008 and 2002.

The sale includes $872.4 million of taxable Build America Bonds, $78.8 million of general obligation refunding bonds, and $75.5 million of new-money GOs.

DISD trustees approved the sale on Thursday.

Steve Korby, executive director for financial services with DISD, said the bonds are tentatively set to be issued over three days.

“These are three separate issues, and we anticipate we’ll sell them on consecutive days,” Korby said. “We’ll sell the BABs first, the conventional tax-exempt GO bonds on the second day, and then the refunding bonds will be sold.”

Korby said the schedule should allow the district to gauge the market before the refunding bonds are issued.

“We need to understand how to best structure the refunding bonds,” he said. “We could be refunding more or less, depending on the market, but we don’t expect the total to vary much.”

The November sale is an effort to avoid the December deluge, according to Korby. Issuers are rushing deals to market ahead of the BAB program’s expiration at the end of the year.

“There are a number of Texas school districts with bond elections next week, and we anticipate a fair amount of that debt will be issued as BABs in December,” Korby said.

“We think we will have one of the best credits available in the market at the time,” he added.

The district’s outstanding debt is rated A-plus by Standard & Poor’s, Aa2 by Moody’s Investors Service, and AA by Fitch Ratings.

The debt is enhanced to triple-A with coverage from the Texas Permanent School Fund.

DISD currently has $1.7 billion of outstanding debt, but officials expect the outstanding debt to total $2.7 billion at the end of fiscal 2011.

The district’s co-bond counsel are Vinson & Elkins LLP and West & Associates LLP.

Co-financial advisers are First Southwest Co. and Estrada Hinojosa & Co.

The issue will draw down the final $950 million remaining from the $1.35 billion of GO bonds Dallas voters authorized in May 2008.

It will include $302,000 of bonds from the $1.37 billion of debt voters approved in January 2002, leaving only 38 cents of authorized but unissued debt from that election.

Korby said the proceeds from the sale will finance the district’s capital program through 2014.

He said the district accelerated its sale schedule because of the impending end of the BAB program.

“We wouldn’t have issued so much debt at this time if not for the opportunity afforded by BABs,” Korby said. “There will continue to be refunding opportunities if interest rates stay this low, but we won’t have any new-money authorization remaining until we go back to the voters at some point.”

Korby said he expects it will be three to four years before the district asks voters to approve additional debt.

The district expects to save $170 million to $180 million in debt-service costs with the BABs as compared to conventional tax-exempt GO bonds, he said, with another $4 million in net present-value savings realized through the refunding.

Projects financed with proceeds from the 2008 bond authorization include 15 new schools, the addition of 177 new classrooms, and renovations to 200 existing facilities.

The district posted a surplus of $54 million at the end of last school year. The surplus, which was the largest one ever posted by DISD, increased the fund balance to $91 million, up from $37 million in 2009.