The municipal bond market is gearing up to see two cities and a school authority price into a firm market that is seeing yields holding at recent lows. Demand for the bonds is expected to be robust as some say the size of the market may be declining.

Primary Market

About $5 billion of bonds will sell this week in a calendar composed of $2.8 billion of negotiated and $2.2 billion of competitive deals.

On Tuesday, Barclays Capital is expected to price Philadelphia’s (A2/A/A-) $190.16 million of Series 2019A GO refunding bonds.

The city last sold GOs in July 2017, when Citigroup priced the $331.615 million of Series 2017A GOs (A2/A+/A- with he 2035 maturity at A2/AA/A- insured by Assured Guaranty Municipal) to yield from 1.14% in 2018 to 3.53% in 2037; the 10-year 2027 maturity was priced as 5s to yield 2.85%. On July 11, 2017, the Refinitiv MMD 10-year muni stood at 2.05%.

This will be the city’s first GO sale since it was downgraded in March 2018 when S&P Global Ratings lowered the rating to A from A+ based on its view of the city’s ability to manage its pension costs.

This February, the city filed a federal class-action suit against Bank of America, Barclays, Citigroup, Goldman Sachs, JPMorgan Chase, RBC, and Wells Fargo alleging they violated remarketing agreements by conspiring not to compete against one another and working to keep variable-rate demand obligation interest rates artificially high.

Also Tuesday, Dallas (NR/AA-/AA) is selling $398.46 million of GOs in two competitive deals. Slated for sale are $241.045 million of Series 2019A refunding and improvement GOs and $157.415 million of Series 2019B refunding GOs.

PFM Financial Advisors and KG & Associates are the financial advisors. Bracewell, West & Associates and the State Attorney General are the bond counsel.

The city last competitively sold GOs on July 17, 2018 when Robert W. Baird won $58.715 million of Series 2018 refunding GOs with a true interest cost of 3.2647%. The bonds were priced to yield from 1.55% in 2020 to 3.55% in 2038. On July 16, 2018, the Refinitiv MMD 10-year muni stood at 2.41%.

The previous year, Dallas sold $301.96 million of Series 2017 refunding and improvement GOs (with 2033, 2035 and 2037 maturities insured by AGM) to RBC Capital Markets with a TIC of 2.885% on Nov. 16, 2017. The bonds were priced to yield from 1.23% in 2018 to 3.36% in 2037; the 10-year 2027 maturity was priced as 5s to yield 2.32%. On Nov. 15, 2017, the Refinitiv MMD 10-year muni stood at 1.99%.

And the Virginia Public School Authority (Aa1/AA+/AA+) will competitively sell $244.23 million of GOs in two issues on Tuesday. Slated for sale are $157.325 million of Series 2019B 1997 Resolution school financing refunding bonds and $86.905 million of Series 2019A 1997 Resolution school financing refunding bonds.

The Series 2019B proceeds will be used to current refund some outstanding debt; Series 2019A proceeds will be used for localities to finance capital projects for their public schools. Davenport & Co is the financial advisor; McGuire Woods is the bond counsel.

On Wednesday, the biggest deal of the week is hitting the screens as Metro (Aaa/AAA/NR), Ore., is competitively selling $652.8 million of taxable Series 2019 GOs.

Piper Jaffray is the financial advisor while Orrick Herrington is the bond counsel.

Bond Buyer 30-day visible supply at $9.79B

The supply calendar was calculated at $9.79 billion for Tuesday and is composed of $4.67 billion of competitive sales and $5.12 billion of negotiated deals.

Is the muni market shrinking?

There are $342.1 billion of bonds are already scheduled to mature or be called in 2019 and new-issue supply is annualizing around $320 billion, suggesting that unless there is a meaningful pickup in municipal borrowing, total market size could decline this year, according to Patrick Luby, senior municipal strategist at CreditSights.

"Municipal bond demand has remained very strong, especially through mutual funds, which have now pulled in over $30 billion in net new assets so far this year — that's more than the total flows in any of the last six years," Luby said. "Demand this week will get bolstered by $19.4 billion in redemptions scheduled for Wednesday."

Redemptions will be led by $4.5 billion in New York, $3.4 billion in California, $2.3 billion in Wisconsin and $1.9 billion in Michigan, he said, while May 15 redemptions will total $11.0 billion and be heaviest in California ($4.3 billion), New York ($1.8 billion) and Texas ($1.4 billion).

Luby added that data released last week by the U.S. Census bureau show total state revenues hit a new record last year, while local government revenues have grown but remain below the 2009 peak.

"Total state government revenues totaled $1.03 trillion last year, an increase of 5% from 2017. However, fourth quarter 2018 collections were down 3.5% from fourth quarter 2017," he said. "Total local government revenues in 2018 were $448 billion which is 22% lower than the 2009 peak of $576 billion."

Secondary market

Munis were stronger on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year and 30-year munis remained unchanged at 1.87% and 2.55% respectively. On March 29, the 10-year muni was at 1.78% while the 30-year muni stood at 2.60%.

Treasuries were a bit weaker as stocks traded slightly higher.

The 10-year muni-to-Treasury ratio was calculated at 73.7% while the 30-year muni-to-Treasury ratio stood at 85.9%, according to MMD.

“As Treasury yields back up today, the ICE Muni Yield Curve is within one basis point of Friday’s end of day levels,” ICE Data Services said in a Monday afternoon comment.

“Municipals are supported by capital inflows in response to the 2017 tax law’s restriction on federal deductibility of state and local taxes. Muni bond funds attracted a reported $1.1 billion net new cash last week, lifting the year-to-date tally to $30 billion,” ICE said. “The rotation of cash by investors is negatively impacting bonds issued in Florida, whose yields are up slightly today. Because Florida has no state income tax, its residents can buy municipals issued in other states without losing any tax advantage. Bonds of other states with no or low state income taxes likewise are facing heightened competition for investors’ dollars.”

Previous session's activity

The MSRB reported 33,456 trades on Friday on volume of $11.26 billion. The 30-day average trade summary showed on a par amount basis of $11.98 million that customers bought $5.74 million, customers sold $4.04 million and inter-dealer trades totaled $2.21 million.

California, Texas and New York were most traded, with the Golden State taking 17.818% of the market, the Lone Star State taking 11.68% and the Empire State taking 10.898%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured Series A-1 5s of 2058 which traded 60 times on volume of $49.21 million.

Last week's actively traded issues

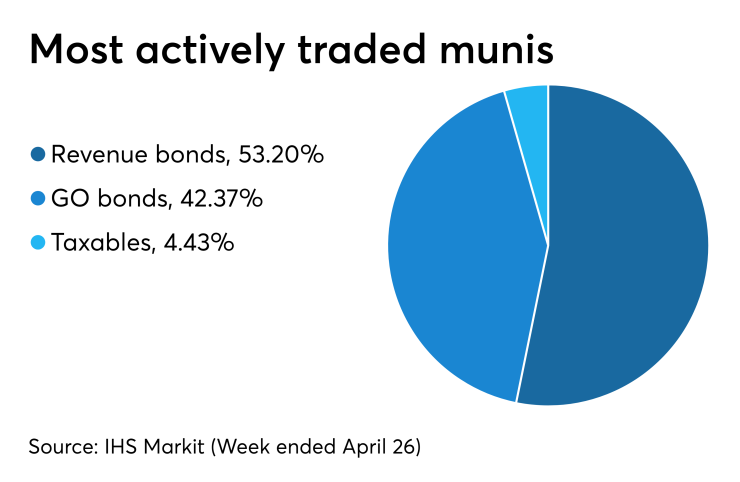

Revenue bonds made up 53.20% of total new issuance in the week ended April 26, down from 53.71% in the prior week, according to

Some of the most actively traded munis by type in the week were from Texas, Alabama and Puerto Rico issuers.

In the GO bond sector, the Frisco ISD, Texas, 4s of 2049 traded 38 times. In the revenue bond sector, the Tuscaloosa IDA, Ala., 5.25s of 2044 traded 81 times. In the taxable bond sector, the Puerto Rico GDB Debt Recovery Authority 7.5s of 2040 traded 32 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were lower, as the $39 billion of three-months incurred a 2.385% high rate, down from 2.400% the prior week, and the $36 billion of six-months incurred a 2.395% high rate, off from 2.400% the week before.

Coupon equivalents were 2.439% and 2.465%, respectively. The price for the 91s was 99.397125 and that for the 182s was 98.789194.

The median bid on the 91s was 2.360%. The low bid was 2.330%. Tenders at the high rate were allotted 91.60%. The bid-to-cover ratio was 3.08.

The median bid for the 182s was 2.370%. The low bid was 2.335%. Tenders at the high rate were allotted 3.90%. The bid-to-cover ratio was 3.01.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.