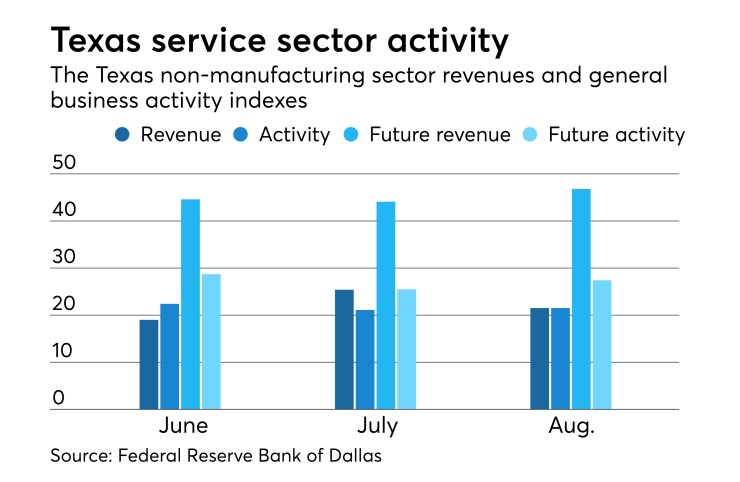

Texas service sector activity “continued to increase in August, albeit at a slower pace than last month,” according to business executives responding to the Federal Reserve Bank of Dallas' Texas Service Sector Outlook Survey, as the revenue index dropped to 21.5, from 25.4, a three-year high.

The employment index slipped to 11.5 from 11.9, the part-time employment index increased to 6.8 from 5.7, the hours worked index grew to 11.8 from 9.1, the wages and benefits index climbed to 25.5 from 24.5, the input prices index gained to 32.1 from 31.4, the selling prices index increased to 14.2 from 13.2, the capital expenditures index rose to 23.4 from 17.4, the general business activity index rose to 21.5 from 21.1.

The future revenue index rose to 46.8 from 44.1, the employment index climbed to 31.2 from 28.9, the part-time employment index decreased to 4.7 from 9.4, the hours worked index fell to 7.9 from 9.1, the wages and benefits index fell to 48.6 from 51.1, the input prices index gained to 50.0 from 48.7, the selling prices index increased to 37.6 from 35.0, the capital expenditures index grew to 32.1 from 28.7, the general business activity index gained to 27.4 from 25.5.