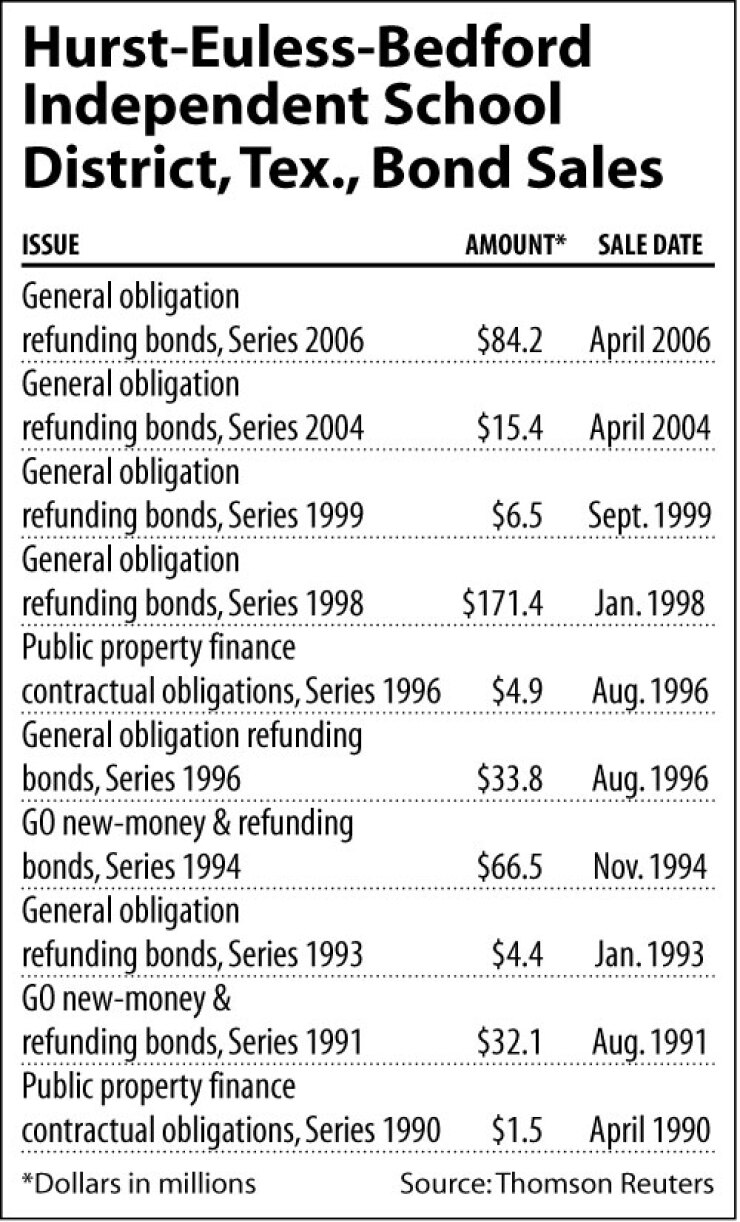

DALLAS — The Hurst-Euless-Bedford Independent School District between Dallas and Fort Worth is preparing to issue $102 million of refunding bonds without waiting for a triple-A guarantee from the Texas Permanent School Fund.

The PSF will again accept applications for bond guarantees in January after the Internal Revenue Service doubled the fund’s debt capacity this month. The fund had reached capacity limits and was sidelined this year.

The HEB district, one of the state’s largest, had already prepared to go to market after winning a Standard & Poor’s upgrade to AA-plus from AA-minus, based on the growing wealth of the district.

“The raised rating reflects our view of the district’s continued tax base growth and diversification, as well as consistently strong financial performance,” said Standard & Poor’s analyst Kate Choban. “The rating is further supported by strong wealth and income levels, moderate debt burden, and a stable and largely developed economy.”

Fitch Ratings affirmed its AA rating on the district, citing its high reserve levels, ample liquidity, and limited demands for new debt.

“Existing school capacity should mitigate any growth constraints for the next several years,” analysts Jose Acosta and Steve Murray wrote. “However, the district’s facility needs, which are centered on major maintenance of existing schools, are sizeable at $164 million, according to a recent facility assessment.”

Moody’s Investors Service has not rated the debt.

The district expects to seek its next bond authorization of up to $200 million in 18 months to finance maintenance, adding a new elementary school and a career-technical center.

The district’s 44-square-mile boundary includes the Tarrant County suburbs of Hurst, Euless, and Bedford, often referred to as H-E-B. With the maturity of its population centers, the district’s enrollment growth has been modest, although ongoing and planned residential development in the southern portion of the district may moderately increase the pace of student enrollment, according to analysts.

Viridian, a 2,000-acre mixed-use community in nearby Arlington, is the largest of currently planned developments, with a total of 3,000 future single-family homes. Lot sales are expected to begin in 2011.

Aviation is a major element in the district’s tax base, and provides its two largest taxpayers, helicopter manufacturer Textron Inc. and American Airlines. A portion of DFW International Airport lies within the district’s boundaries.

The new $1 billion Dallas Cowboys stadium in Arlington has also spurred hotel and restaurant development.

The North Tarrant Express project is a major planned expansion of Highway 121 that bisects the district, a key route connecting the greater Fort Worth area with the city of Dallas and the DFW Airport.