Central Florida stands to be among the state's hardest-hit areas economically as the coronavirus pandemic continues to shutter the theme park capital of the world, resulting in layoffs and furloughs for thousands of workers in the tourist-dependent region.

"Walt Disney World will remain closed until further notice," the park

At the same time, thousands of the region's 281,000 leisure and hospitality industry workers, many of whom live in Orange, Seminole, Lake and Osceola counties, have lost their jobs. At the Orange County Convention Center — the second-largest facility of its kind in the U.S. — events have been postponed, rescheduled, or canceled.

Gov. Ron DeSantis, a Republican who took office in January 2019, issued an order April 4 telling senior citizens and people with compromised immune systems to stay at home, while closing non-essential businesses. The order is due to expire Thursday.

DeSantis flew to Washington, D.C. on Tuesday to consult with President Trump on his reopening plans. Trump is a close ally who endorsed the governor while he was campaigning for office.

At Orlando International Airport, where a $4.12 billion largely bond-financed capital program is underway, passenger counts and flights have plummeted.

The theme parks, retailers and restaurants, airlines and airports will “face some challenges” convincing the public that it’s safe to use their facilities, Phillip Brown, the Greater Orlando Aviation Authority’s chief executive officer, told his board April 15. “We’re in uncharted territory.”

What fundamentally has attracted visitors to Orlando over the past 30 years is the tourism and leisure business, Brown said. “It is slated, I believe, to take a hard hit and it’s going to be difficult to recover.”

Brown said he expects OIA to see a 50% drop in the number of passengers this year, to 25 million compared to 50 million last year.

In Orange County, where Orlando is the county seat, tourist development taxes collected on hotel stays and other short-term accommodations are projected to see the largest decline as a result of the outbreak, followed by state sales tax revenue sharing and gas tax collections.

The county has a balanced $4.8 billion budget, Randy Singh, deputy county administrator for administration and fiscal services, told county commissioners April 22. For the first six months of the fiscal year, revenues were up, the economy was strong and unemployment was low.

The measures taken to stem COVID-19 will affect central Florida's economy for months to come, Singh said, because of the region's heavy reliance on tourism. Hotel occupancy is expected to be at an all-time low and unemployment may reach a record high.

"The good news is this crisis will have limited impact on only certain areas of our organization," Singh told commissioners, adding, "We're not fully insulated. There will be some pain."

Property taxes, the largest funding component of the county budget at $795 million, have already been collected for this fiscal year.

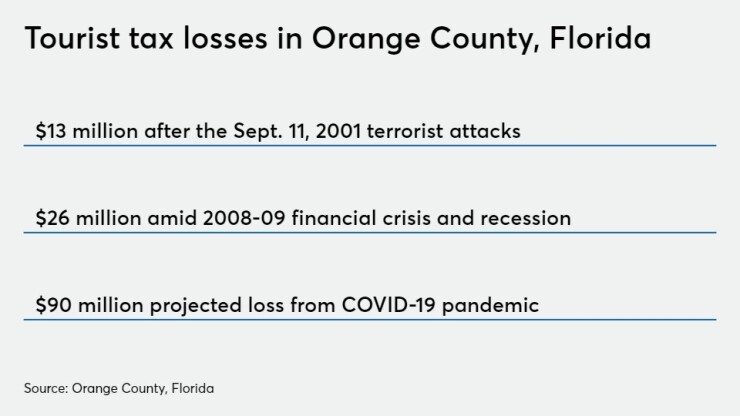

The impact of the pandemic on tourist development tax collections is expected to be greater than it was following either the 9/11 terrorist attacks and the recent recession, according to a presentation Singh gave to commissioners.

For the remaining seven months of fiscal 2020, TDT revenues could decline to $200 million from an anticipated record high of $290 million, a loss of $90 million or 31% that the county can absorb and "still pay the annual bills," Singh told The Bond Buyer in an email Tuesday. The county's fiscal year runs from Oct. 1 to Sept. 30.

Triple-A-rated Orange County had about $890 million of outstanding TDT revenue bonds as of Sept. 30, 2019, debt that was issued for the convention center's expansion and improvements. Annual debt service is $76 million. Total TDT cash reserves are $307 million, Singh said. That includes a debt service reserve funded at $82 million.

"For TDT, we had already received five months of record-breaking receipts reaching $130 million through February 2020," Singh said. "The presentation to the BCC showed the ability to absorb a 30% TDT revenue reduction.”

The county fully intends to pay debt service “and has ample resources to do so, now and in the future," he added.

Sales tax collections returned to the county as state revenue sharing are estimated to decline by $43 million, and local gas tax collections are projected to drop by $12 million.

Singh said the information shared with county commissioners didn't represent "official projections but rather stress tests on absorbing revenue losses that are expected but not specifically known at this time." The county, he said, consults with its financial advisor, Public Financial Management, as well as public and private sources who have experts in tourism and finance.

The TDT-backed bonds are rated AA by Fitch Ratings, Aa2 by Moody's Investors Service, and AA-minus by S&P Global Ratings. Fitch and S&P have negative outlooks on the debt, while Moody's outlook remains stable.

S&P revised the outlook on the hospitality sector to negative from stable on April 3, while affirming numerous underlying ratings on bonds secured by priority-lien tax revenue pledges, including Orange County's TDT bond ratings.

"The negative outlook reflects our view that the affected credits face at least a one-in-three likelihood of a negative rating action over the intermediate term, generally up to two years," said S&P analyst Joshua Travis. "As the COVID-19 pandemic persists and the social risk from the spread of the virus grows, the implications on the leisure and hospitality sector have been acute and dramatic."

Restrictions on travel and consumer activity driven by social distancing and stay-at-home orders intended to flatten the curve and slow the viral infection rate have led to hotel booking cancellations and deferrals, convention and conference cancellations, and the widespread closure of bars and restaurants, he said.

"Although the closure decisions are prudent, in our opinion, the health and safety aspect of this action in the near term will materially affect coverage, financial results and liquidity, which we believe might deteriorate further as a result of the onset of a global recession," said Travis.

"While the precise impact on bonds secured by hotel occupancy taxes and by sales taxes on prepared food and beverages is unknown, we believe that the decline in pledged revenue will be precipitous and likely last well into the second quarter," he added.

In the Orlando Metropolitan Statistical Area, the leisure and hospitality sector supports 280,900 jobs, an amount that is the largest part of the region's working economy at 20.8%, according to the Orlando Economic Partnership.

Sean Snaith, director of the Institute for Economic Competitiveness at the University of Central Florida, has projected central Florida's hospitality and leisure industry could see the greatest number of job losses, 109,400, by the end of the second quarter. The Orlando area could see other job losses totaling 97,500.

The "deep recession" that has formed as a result of the viral outbreak could be deeper than the recession in 2008, he told the Orange County Commission on April 7.

"We think we hit the bottom in terms of job losses in the third quarter of this year here in Orlando," he said.

After the most recent recession, Snaith said Florida's tourism "rebounded quite nicely" once the economic and financial situation stabilized in the U.S. economy. "I think that can happen again if that fear isn't there," he added.

Experts are positing what life will be like after all health measures are lifted. When Florida's theme parks, hotels and restaurants get back to business, it is believed they will need to limit the number of customers and continue to impose social distancing measures.

With so many people out of work, it’s expected they will have less disposable income to spend for things like vacations for some time to come. Even if attractions open, many potential visitors are likely to shy away from crowds without a coronavirus treatment or vaccine.

Florida has seen 33,193 positive cases of the virus, from which 1,218 people have died, according to the most recent figures from the Florida Department of Health.

On Wednesday, the Department of Commerce said the U.S. economy shrank at a 4.8% annual rate in the first quarter as the pandemic closed businesses and stunted consumer spending, triggering a recession that has ended the longest expansion on record.