As Gov. Dannel Malloy and Connecticut lawmakers continue talks on an overdue state budget, state Treasurer Denise Nappier struck a cautionary note on several counts.

Nappier called for a cap on bond-funded capital spending to match any cap on bond issuance; full funding of actuarially required contributions for the state’s pension plans; adherence to the bond covenant adopted in 2008 in conjunction with the sale of pension obligation bonds to boost the resources of the Teachers’ Retirement Fund; and direct deposits of increased employee pension contributions by teachers into the teachers fund, not the general fund.

The latter, she said, is necessary to avoid tax liability and jeopardizing the TRF’s tax-exempt status.

“I must urge caution on [these] important issues that have been widely reported as remaining on the table,” said Nappier.

Last Wednesday, top lawmakers announced a tentative agreement on a $41 billion biennial spending and revenue plan, but House and Senate leaders said they would have to return to their respective caucuses.

Malloy told reporters Friday at the state capitol in Hartford that he has yet to see any agreement.

“Obviously I cannot give feedback on something that I have not seen and reviewed,” Malloy said. “Give me a full document I can review and then we’ll meet.”

The governor has run the state by executive order since July 1. He and lawmakers have remained gridlocked. Malloy, a Democrat, vetoed a Republican-crafted $40.7 billion package in mid-September.

The Senate is split 18-18 between Democrats and Republicans while the Democrats hold a narrow 79-72 advantage in the House of Representatives.

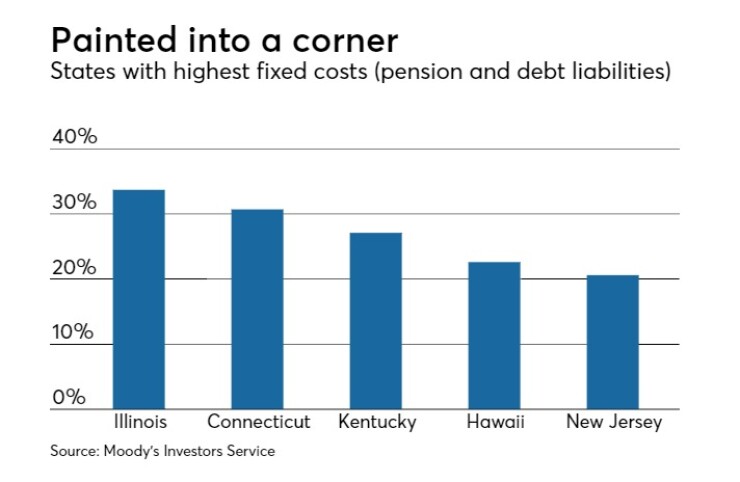

Rating agencies have delivered a series of general obligation bond-rating hits to Connecticut over the past year. S&P Global Ratings delivered the most recent on Oct. 13, lowering its outlook on state GOs to negative from stable while affirming its A-plus rating.

Fitch Ratings also rates Connecticut GOs A-plus. Moody’s Investors Service and Kroll Bond Rating Agency assign A1 and AA-minus ratings, respectively.

In addition, Moody’s last week placed ratings of 26 Connecticut municipalities and three Connecticut regional school districts under

According to Nappier, if Connecticut spends more on capital projects than it can raise through bond sales, it would need to cover those project costs with the state’s operating cash from its cash pool. “This would drain cash resources, and could require external borrowing,” she said.

The pipeline of capital projects already under way, she said, stunts the ability to achieve short-term savings.

Nappier said that since her office does not control expenditures, any effective cap on bond funded capital expenses should place the responsibility for enforcing the cap on the governor, the Office of Policy and Management and state agencies.