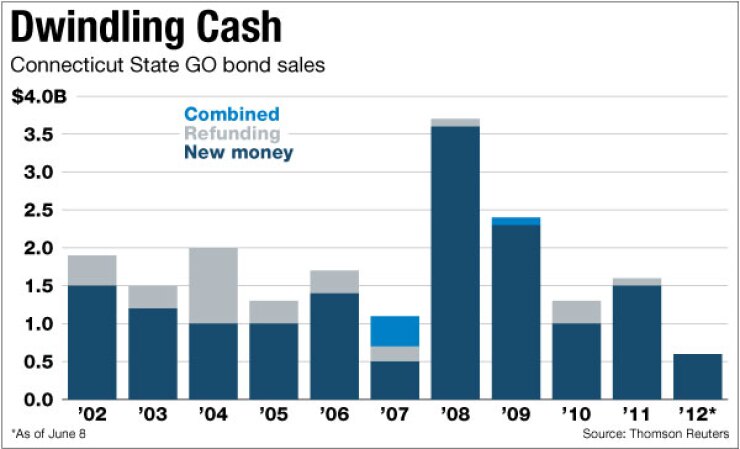

Connecticut has scheduled a $518 million general obligation refunding bond sale for Tuesday, while concerns mount over the state’s dwindling available cash and the possible need for extra borrowing to pay bills.

“The common cash pool is trending downward over time and the need for temporary transfers or other resources is growing,” Treasurer Denise Nappier said in a letter last week to the Joint Committee on Finance, Revenue and Bonding.

Nappier said Connecticut’s balance stood at $121 million as of May 26, compared with $895 million at the same point a year earlier. She cited a $200 million budget deficit for fiscal 2012, the accumulated unfunded deficit under generally accepted accounting principles and the depletion of the rainy-day fund.

Continued cash-flow pressure, Nappier said, would require more extensive transfers to the common cash pool and “possibly the need for external funding sources.” Short-term options, she said, could include temporary notes or a line of credit, while longer-term options include the issuance of bonds to more rapidly fund the GAAP deficit.

“While the need for external funding sources is possible, it is not probable at this point. We are not currently planning to request authority for any short-term cash flow borrowing,” said Nappier, a Democrat and former treasurer of capital city Hartford.

Connecticut operates from a common pool that combines tax revenues, fee and license receipts, federal grants and borrowed money. The treasurer’s office may transfer funds temporarily between operating and capital programs.

Gov. Dannel Malloy wants to convert the state to GAAP, but state budget officials scrapped related payments to cover the deficits.

House Republican Leader Lawrence Cafero of Norwalk and Deputy Republican Leader Vincent Candelora of North Branford have asked Nappier to appear before a joint hearing of the Appropriations and Finance, Revenue and Bonding committees to explain what triggered the state’s cash-flow problems.

“For months, we have been calling upon the legislature to deal with the fact that Connecticut spends more money than it takes in, but were rebuffed each time and accused of playing politics. After all the assurances we were given that 'everything is fine,’ the treasurer’s office has finally gotten around to acknowledging the depths of this problem,’’ Cafero said.

Fitch Ratings, Standard & Poor’s and Kroll Bond Ratings assign AA ratings to the Series 2012C GO bonds, while Moody’s Investors Service rates them Aa3, affecting $13.5 billion of debt outstanding. The bonds will mature from 2013 to 2025. Bond proceeds will be used for level debt service savings without extending maturities.

Moody’s, which lowered its rating from Aa2 in January, cited “depleted reserves with slim prospects for near-term replenishment” in Friday’s report. It also called out Connecticut for high combined fixed costs for debt service and post-employment benefits relative to the state’s budget, and pension-funded ratios among the lowest in the country “and likely to remain well below average.”

Fitch called Connecticut’s tax-supported debt high for a U.S. state. “Most GO bonds, excluding GO bonds issued to fund the teachers’ retirement system, amortize rapidly,” Fitch wrote.

The state employee retirement system funded ratio is 48%, and the teachers retirement system’s is 61%, under the most recent data available. The Pew Center on the States considers 80% an acceptable threshold.

Wells Fargo Securities LLC is lead manager for the bond sale.

Acacia Financial Group Inc. is the financial advisor. Day Pitney LLP is lead bond counsel and lead disclosure counsel. Wiggin and Dana LLP and Hardwick Law Firm LLC are co-underwriters counsel. Robinson & Cole LLP is lead tax counsel.