Connecticut on Thursday sold its first bond offering since it passed a budget last month as new-issuance euphoria and interest rate apprehension collided with municipals continuing to outperform Treasuries.

Primary market

Connecticut (A1/A/A+/AA-) sold $244 million of Series 2019B unlimited tax GO refunding bonds. JPMorgan Securities won the bonds with a true interest cost of 1.6706%. The non-callable deal was priced as 5s to yield from 1.19% in 2020 to 1.92% in 2029. Proceeds will refund bonds issued in 2009.

Acacia Financial Group and PFM Financial Advisors are co-financial advisors. Day Pitney is lead bond counsel and lead disclosure counsel while Robinson & Cole is lead tax counsel.

The deal was well bid, with the 10-year spread to Bloomberg triple-A tight relative to recent history at 37 basis points, said Alan Schankel, managing director of research at Janney.

“Despite very high fixed costs, I believe investors were encouraged by this biennium’s structurally balanced and on-time budget as well as the recent increases in reserves,” Schankel said.

The sale marked the state's first issuance since passing a $43.8 billion biennial budget last month.

The budget includes moves aimed at improving the sustainability of the Teachers' Retirement System. Changes include reducing the assumed rate of return to 6.9% from 8%; re-amortizing unfunded liability over a new 30-year period, a 17-year extension; and transitioning to level dollar amortization over a level percent of payroll, phased in over five years. They mirror the 2017 adjustments to the State Employees’ Retirement System.

Other budget provisions lower state GO issuance to $1.6 billion per fiscal year — except for University of Connecticut offerings — to reflect Gov. Ned Lamont’s “debt diet” initiative.

In March, S&P Global Ratings revised its outlook on the state to positive from stable while early this month Kroll Bond Rating Agency bumped up its outlook to stable from negative. Outlooks from Moody's Investors Service and Fitch Ratings are stable.

Last week, Moody’s warned that retirement liabilities, including support for teacher benefits, still drag on state's credit. According to Moody’s, Connecticut's balance-sheet leverage is among the highest of the 50 states.

Municipal Market Analytics weighed in on the budget regarding the changes in the teachers’ pension system and on the Connecticut Pension Sustainability Commission's request to consider an asset transfer mechanism and possibly the use of lottery proceeds.

"This is another example of fiscal stress breeding creativity and it is notable that states most receptive to ideas like these include the cohort with significant structural budget imbalance and unfunded pension liabilities," MMA said.

Also on Thursday, Raymond James & Associates received the written award on the Metropolitan District of Hartford County, Connecticut’s (Aa3/AA/NR) $157.875 million of issue of 2019 general obligation bonds, consisting of the Series A GOs and Series B and C refunding GOs.

BofA Securities priced and repriced the San Francisco Bay Area Toll Authority’s (A1/AA-/AA-) $203.27 million of Series 2019 S-8 toll bridge revenue bonds.

PNC Capital Markets priced Charlotte, North Carolina’s (Aaa/AAA/AAA) $189.585 million of Series 2019A GO refunding bonds.

Jefferies received the written award on the Board of Regents of the Texas A&M University System’s (Aaa/AAA/AAA) $429.645 million of taxable Series 2019B revenue financing system bonds.

New York City general obligation bonds from Wednesday’s deal were freed up and bonds were trading at a slight premium to original yields, a New York trader said. “The bonds were well placed.”

Thursday’s bond sales

Mixed emotions on munis

In trading activity Thursday, Schankel said although a touch easier on the long end, the muni market showed minimal reaction to softer Treasury market trading. “A rate cut from next week’s FOMC meeting seems all but certain, with the main dispute being over whether the Fed Funds rate is lowered by 25 or 50 basis points.”

While the muni market continues to exhibit firm undertones, there is a tentative sense ahead of next week’s Federal Open Market Committee meeting, Jeffrey Lipton, managing director of credit research at Oppenheimer & Co. Inc. said on Thursday. He noted that there is a safe bet for a 25 basis-point cut in short term rates. But he questioned “will this be enough to satiate the markets?”

“In our view, tax-exempt bond prices should break free from their currently tight trading range once the FOMC has concluded and we posture that yields could trend lower given still supportive market technicals,” Lipton said.

After lagging Treasuries and their taxable counterparts in June, municipals are playing catch up in July, noted Anthony Valeri, Executive Vice President and director of Investment Management at Zions Wealth Management.

“High-quality munis are outperforming high-quality taxable bonds month to date,” he said. “July and August are seasonally strong months for munis and 2019 so far is in keeping with that trend.”

Municipal outperformance in July has led to more expensive valuations, Valeri said, which is measured by lower municipal-to-Treasury yield ratios. “I still think valuations are fair to only modestly expensive given the relatively low supply outlook over the remainder of 2019.”

Valeri added that strong inflows into both ETFs and mutual funds suggest municipals remain strong as they have throughout 2019.

“We still find taxable-equivalent yields attractive and municipals remain one of our preferred fixed income sectors,” he said.

The past nine months have been very strong for bond investors, as referenced by the Barclays Bloomberg Municipal Bond Index, returning 6.9% from September 30, 2018 through the end of June 2019 — and increased those returns into July.

“That pace of performance is unsustainable,” Valeri said. “Much of the good news regarding future rate cuts and a low inflation environment has been priced in.”

The upside is limited, according to Valeri, but he doesn’t expect a lot of downside given persistent low inflation and continued signs of a slowing economy.

“We expect high-quality municipal bonds to track more toward to a 2-3% total return environment over the coming 12-months,” he said. “Still, we find municipal bonds one of the better options among high-quality bonds, particularly for higher tax-bracket investors.”

Secondary market

Munis were stronger in late trading on the

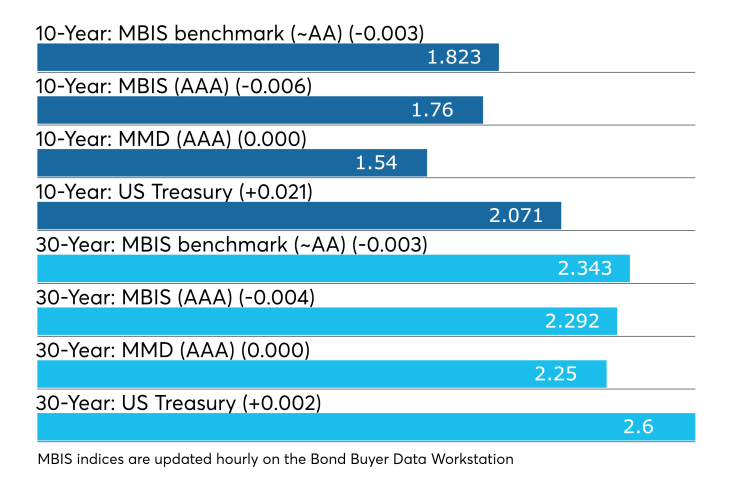

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GOs remained unchanged at 1.54% and 2.25%, respectively.

“Puerto Rico’s governor resigned this morning following two weeks of protests over a corruption probe and texting scandal,” ICE Data Services said in a Thursday market comment. “The island’s bonds are mixed on the news with the PREPA electric power bonds down 1 7/8 points [cents on the dollar] and the 2012 dated GO bonds up 1 1/8 points.”

Among actively traded securities reported to the MSRB on Thursday, the Puerto Rico Sales Tax Financing Corp.’s restructured capital appreciation zeros of 2051 were trading at a high price of 16.887 cents on the dollar in 16 trades totaling $5.35 million, according to EMMA. On Wednesday, the zeros were trading at a high price of 16.879 cents in 79 trades totaling $6.98 million. The COFINA restructured Series A-1 revenue 5s of 2058 were trading at a high price of 100.067 cents on the dollar in 28 trades totaling $10.02 million. On Wednesday, the 5s traded at a high price of 100.354 in 97 trades totaling 24.91 million.

The 10-year muni-to-Treasury ratio was calculated at 74.2% while the 30-year muni-to-Treasury ratio stood at 86.4%, according to MMD.

Treasuries were weaker as stocks traded lower. The Treasury three-month was yielding 2.115%, the two-year was yielding 1.857%, the five-year was yielding 1.850%, the 10-year was yielding 2.071% and the 30-year was yielding 2.600%.

Previous session's activity

The MSRB reported 33,397 trades Wednesday on volume of $11.81 billion. The 30-day average trade summary showed on a par amount basis of $11.09 million that customers bought $5.86 million, customers sold $3.27 million and interdealer trades totaled $1.96 million.

Texas, California and New York were most traded, with the Lone Star State taking 13.56% of the market, the Golden State taking 13.174% and the Empire State taking 12.455%.

The most actively traded security was the Hays County, Texas, Series 2019 revenue 3s of 2044, which traded 10 times on volume of $25.81 million.

All BB indexes move lower

In the week ended July 25, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices dipped to 3.68% from 3.69% the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields dipped two basis points to 3.43% from 3.45% the week before. It is at its lowest level since Dec. 14, 2017, when it was at 3.41%.

The 11-bond GO Index of higher-grade 11-year GOs was two basis points lower to 2.97% from 2.99% the previous week. It is at its lowest level since Jan. 4, 2018, when it was at 2.94%.

The Bond Buyer's Revenue Bond Index declined two basis points to 3.91% from 3.93% the week before. It is at its lowest level since Dec. 14, 2017, when it was at 3.89%.

The yield on the U.S. Treasury's 10-year rose to 2.08% from 2.03% and the 30-year Treasurys increased to 2.60% from 2.56%.

Treasury auctions notes, bills

The Treasury Department Thursday auctioned $32 billion of seven-year notes, with a 1 7/8% coupon and a 1.967% high yield, a price of 99.401112. The bid-to-cover ratio was 2.27. Tenders at the high yield were allotted 6.34%. All competitive tenders at lower yields were accepted in full. The median yield was 1.920%. The low yield was 1.488%.

Treasury also auctioned $35 billion of four-week bills at a 2.110% high yield, a price of 99.835889. The coupon equivalent was 2.149%. The bid-to-cover ratio was 2.91. Tenders at the high rate were allotted 45.39%. The median rate was 2.080%. The low rate was 2.050%.

Treasury also auctioned $35 billion of eight-week bills at a 2.140% high yield, a price of 99.667111. The coupon equivalent was 2.183%. The bid-to-cover ratio was 2.77. Tenders at the high rate were allotted 67.48%. The median rate was 2.115%. The low rate was 2.080%.

Treasury announces auctions

The Treasury Department said Thursday it will auction $36 billion 91-day bills and $36 billion 182-day discount bills Monday.

The 91s settle Aug. 1, and are due Oct. 31, and the 182s settle Aug. 1, and are due June 30, 2020. Currently, there are $35.999 billion 91-days outstanding and $26 billion 182s.

Muni money market funds see outflow

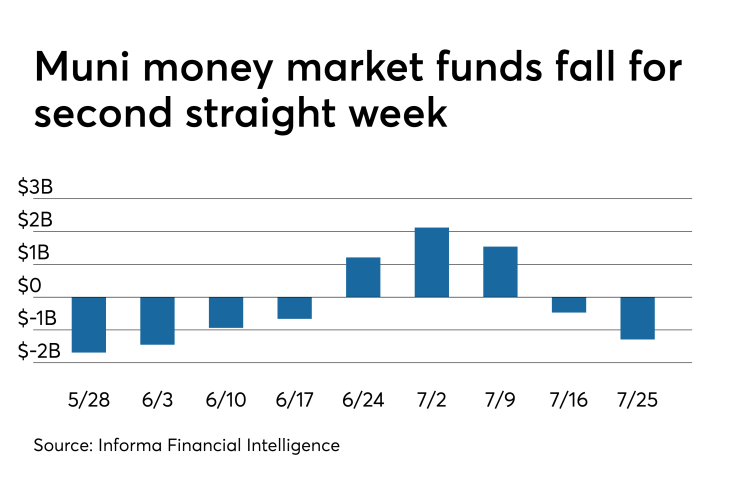

Tax-exempt municipal money market fund assets fell by $1.29 billion, lowering total net assets to $137.64 billion in the week ended July 22 according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds increased to 0.90% from 0.86% in the previous week.

Taxable money-fund assets gained $30.23 billion in the week ended July 23, bringing total net assets to $3.103 trillion, the sixth consecutive week that the taxable total has reached or exceeded $3 trillion.

The average, seven-day simple yield for the 804 taxable reporting funds dipped to 1.96% from 1.97% the prior week.

Overall, the combined total net assets of the 991 reporting money funds rose $28.94 billion to $3.240 trillion in the week ended July 23.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.