GREENWICH, Conn. -- Buried deep in Connecticut's 900-page state

The assets would be managed through a professionally run trust under Section 180 of the $41 billion biennial spending plan, which established the Connecticut Pension Sustainability Commission. Gov. Dannel Malloy

Malloy’s approval marked the end of a five-month stalemate between the governor and lawmakers that put the state in the crosshairs of bond-rating agencies.

The rating agencies have frequently called out Connecticut for its high fixed costs, including general obligation debt and unfunded pension liability. The state’s funded ratio stands around 50%, while Pew Charitable Trusts considers 80% an acceptable threshold.

The commission would consist of 13 members appointed by various political higher-ups including the governor and House and Senate leaders. It would submit its findings by Jan. 1, 2019.

It would perform a preliminary inventory of state capital assets to determine “the extent and suitability of those assets for including those assets for inclusion in such a trust"; study their potential for minimizing unfunded liability; and recommend on the appropriateness of such a move and the steps necessary to establish a trust.

“The commission will evaluate the feasibility of transferring capital assets to a trust and growing the asset values over time for the benefit the pension plans,” said Michael Imber, an expert in municipal fiscal distress who has worked on three Chapter 9 cases, including Detroit’s. “The management and governance of the trust is absolutely essential to driving the success of this concept and maintaining public integrity.”

The idea is not uncommon, said Greg Mennis, director of Pew's public sector retirement project.

“We’ve seen it come up in our field work, although translations into activity are few and far between," he said. “But I can't think of anything this comprehensive.”

Mennis said the concept could work well when combined with other measures necessary to improve the pension system.

“There's progress being made in Connecticut but there’s still a lot of work to be done with better financing and restructuring of the state pension system,” he said. “That needs to happen.”

State Sen. Scott Frantz, R-Greenwich, said he is open-minded about the plan.

“The idea of taking state assets and putting them into a trust to benefit the pensions is intriguing, but I am hard pressed to identify many state assets that cash flow enough to support the pensions’ needs,” said Frantz, who co-chairs the legislature’s finance, revenue and bonding committee.

James Spiotto, a managing director with Chapman Strategic Advisors LLC in Chicago, said discussions about using the value of government assets to secure unfunded pension obligations often center on whether the assets in question are essential service assets or are separate and apart from essential governmental services.

“Obviously the devil is in the details and as this proposal develops the advantageous and disadvantages will become more apparent,” he said of the Connecticut plan.

Pension management and funding have become more essential for state and local issuers.

The Volcker Alliance said paying not only for current workers’ promised retirement benefits, but also for promises made in past years that were never fully funded, has resulted in formidable legacy costs.

"The fiscal pressure is not likely to disappear anytime soon," said the Volcker

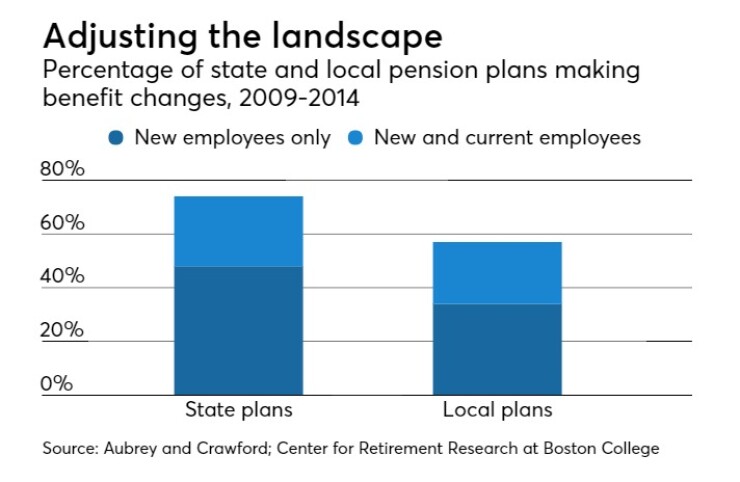

According to the Center for Retirement Research at Boston College, bond rating agencies have begun accounting for public pension funding and have downgraded accordingly.

“Since the financial crisis, rating agencies have begun to explicitly account for pensions in their methodologies; New Jersey, Illinois, and the city of Dallas were downgraded, in part, due to their pension challenges,” said a BC

Nationally, the unfunded public pension liability is estimated at roughly $3 trillion.

“If you were to calculate the market value of state and local government capital assets, it’s likely a multiple of the unfunded pension liabilities,” said Imber. “If governments could unlock just a portion of that, they could make a real dent in the unfunded liability.

“Maximizing the utility of capital assets can create an alignment of interests among pensions, government employees and the private sector, and at the same time drive economic growth for the community.”

On a smaller scale in Connecticut, capital city Hartford, which is striving to avoid a Chapter 9 bankruptcy filing, transferred Batterson Park to the city's pension fund last year to offset $5 million of its required pension contribution.

The city owns the park, though it straddles suburbs West Hartford and Farmington.