U.S. Virgin Island bonds have plunged since Hurricane Maria amid deepening concern over the territory's ability to make payments due in the coming year.

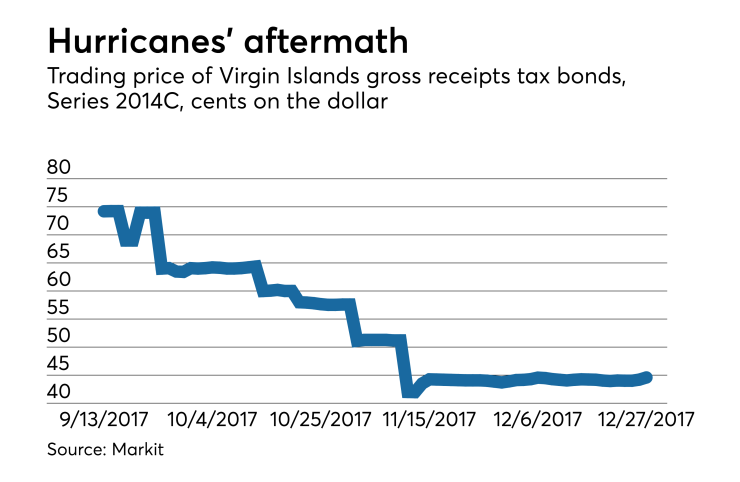

Prices of the Series 2014C U.S. Virgin Islands gross receipts tax bond in the secondary market have declined by 40%, according to Markit. The bonds are trading at about 44 cents on the dollar, down from about 74 cents in mid-September.

The rating agencies had already downgraded the islands’ GRT and matching fund (rum tax) bonds deep into speculative territory earlier this year. Including the debt of the financially strapped Water and Power Authority, the islands' government entities have over $2 billion in debt outstanding.

Hurricane Irma slammed the territory's two main northern islands in early September, followed by Maria, a category 5 storm -- the strongest type as rated by the National Hurricane center -- when its eye wall passed over the territory’s southern island of St. Croix.

“The government was unable or unwilling to address its economic and financial problems—economic and population decline, a large structural deficit, extremely weak liquidity, and the impending insolvency of the employees’ retirement system—prior to the hurricanes," Moody’s Investors Service senior vice president Ken Kurtz told The Bond Buyer. "It seems unlikely that officials will be able to address these problems in the near future, given that doing so will be more difficult in the wake of the storms than it was before.”

Moody’s doesn’t rate the GRT bonds. It rates the senior and subordinated matching fund bonds Caa1 and the subordinated indenture Diageo and Cruzan bonds Caa2.

This fall S&P Global Ratings and Fitch Ratings withdrew their ratings after the islands’ government stopped sharing financial information with them.

The federal government has approved a federal disaster loan for the Virgin Islands, which reportedly faces a 36% deficit this fiscal year, even if it accepts $300 million of the loan. In early December Virgin Islands Sen. Jean Forde said the Senate decided to accept no more than $500 million ultimately and $300 million immediately.

On Christmas Day the St. Croix Source news website published an article that asserted: “If the V.I. government and [the U.S.] Congress do not step up and take difficult, serious steps quickly, the unfilled budget shortfalls will play out painfully and chaotically.”

Moody’s Kurtz said, “The federal government appears willing to assist the Virgin Islands with the direct costs of the storms, the restoration or replacement of public buildings and infrastructure, and, through the community disaster loans, offset lost tax revenues.

“There is no indication that the federal government intends to assist the Virgin Islands address its underlying economic and financial problems,” Kurtz continued. “In fact, if the community disaster loans are not forgiven, the federal government has weakened the Virgin Islands’ financial position by increasing its debt load and reducing the amount of matching fund revenues and gross receipts taxes available to fund operations.”

The federal government has usually forgiven community disaster loans.

On Dec. 15 Municipal Market Analytics’ Default Trends said the GRT bonds “appear to not be making full monthly deposits ahead of their April 1 debt service payment date.” Based on this, Default Trends put the bonds in its “other” category.

Asked about the Default Trends report, a spokesman for the Virgin Islands said in an email, “all Monthly Transfer Requirements of GRT collections have been received on a timely basis as required under the GRT Indenture and the 2018 MFR debt service requirements were fully funded prior to October 1, 2017 in accordance with the requirements of the MFR Indenture.”

He added that the Virgin Islands had made its scheduled gross receipts tax and matching funds revenue bond payments.

MMA partner Matt Fabian said he had sources indicating the Virgin Islands hadn’t made the monthly transfers for a period. He added that the government may have cured the problem and the government statement made him believe the government was in fact making the monthly payments.

However, bondholders have bigger concerns concerning the U.S. Virgin Islands’ ability to pay its debt than the April 1 GRT payment, Fabian said. Default Trends also has the matching funds revenue and WAPA bonds in its “other” category.

In early October U.S. Rep. Rob Bishop, R-Utah, said the members of Congress would consider extending something like the Puerto Rico Oversight, Management, and Economic Stability Act to the U.S. Virgin Islands. This would open the door to a debt restructuring for the more than $2 billion in public sector Virgin Islands debt. Bishop is the chairman of the House committee that oversees Puerto Rico and the Virgin Islands.

Since early October there haven’t been significant further public developments in Congress extending PROMESA to the Virgin Islands.