DALLAS — The Colorado State University System is going to the bond market for the second time this year with an $87.7 million refunding that includes taxable and tax-exempt debt.

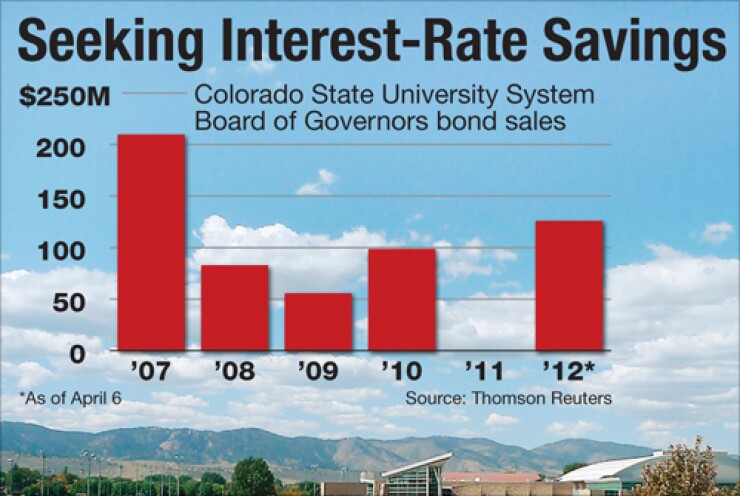

In February, the CSU Board of Regents issued $126 million for expansion projects on the Fort Collins and Pueblo campuses.

The deal, which expected to price this week, is designed for interest-rate savings.

The issue will offer investors $82.4 million of tax-exempt system revenue bonds and $5.3 million of taxable bonds.

The CSU system will have about $631 million of outstanding debt after this issue, according to Moody's Investors Service.

With guarantees from Colorado's higher education revenue bond intercept program, the bonds carry enhanced ratings of AA-minus from Standard & Poor's and Aa2 from Moody's Investors Service. The underlying ratings are A-plus and Aa3, respectively, with stable outlooks.

"The Aa3 underlying rating and stable outlook reflect the system's large and diversified enrollment base, improved operating performance and operational flexibility, research growth, and legally pledged revenues providing sufficient debt-service coverage," Moody's analysts wrote. "These credit strengths are offset by the system's rapid increase in leverage over the last five years and cuts in state operating and capital support."

Colorado State University, based in Fort Collins about 60 miles north of Denver, is the state's land-grant university, authorized under federal legislation in 1862 and 1869.

Founded as the Colorado Agricultural College in 1870, six years before the Colorado Territory gained statehood, the university opened with a freshman class of five students in 1879.

Today, the CSU system enrolls 27,500 students, and has 1,540 faculty in eight colleges and 55 academic departments.

Bachelor's degrees are offered in 65 fields of study, and master's degrees in 55 fields.

Known for its veterinary school, CSU's research provided $330 million for research in 2011, ranking second in the nation for public universities without a medical school.

Colorado Statecompetes for students with the University of Colorado System and the nearby University of Northern Colorado in Greely.

The CSU system could issue another similarly sized offering in the next two years for a parking garage, additional student housing, and renovations to the Pueblo campus student center, according to analysts.

"The stable outlook reflects that we anticipate continued balanced operating results on a cash basis, the maintenance of adequate levels of financial resources, and stable enrollment and demand measures during the next one to two years," wrote Standard & Poor's analyst Jessica Lukas.

"Significant weakening of financial resource measures through the issuance of additional debt or deterioration of the balance sheet or operating deficits on a cash basis could result in a negative rating action during the next one to two years," she added.

The February bond issue provided $4 million for the construction of the Engineering II building on the Fort Collins campus.

Work on the 122,000-square-foot building began a year ago, and completion is expected by the beginning of the 2013 fall semester.

The February offering also provided the funds for CSU to buy the University Village at Walking Stick student housing facility at the CSU-Pueblo campus in southern Colorado.

With the addition of Walking Stick, the Pueblo campus offers housing for nearly 1,200 students through Belmont Residence Hall and the new three-building residential complex opened over the last two years that includes Crestone, Greenhorn and Culebra halls.

Mike Farley, the interim vice president of finance and administration at CSU-Pueblo, said the Colorado State University Research Foundation helped finance the complex.

The enhanced rating of the upcoming bond deal rides on the fortunes of the state, whose Legislature is hashing out the budget for the next fiscal year beginning July 1.

Though Colorado did not suffer as deep of a housing crisis as neighboring Arizona, the recession forced cuts in programs that had been spared in previous economic crises.

Colorado's rating could improve as a result of strong economic and revenue growth, leading to greater budgetary flexibility and reserves, according to Moody's.

State and local lawmakers are constrained by the Taxpayer Bill of Rights, or TABOR, amendment to the state constitution.

Approved by voters in 1992, TABOR restricts revenues for all levels of government. State and local governments could not raise tax rates under TABOR without voter approval, and they also could not spend revenues collected under existing tax rates if revenues grew faster than the rate of inflation and population growth.

Revenue in excess of the limit, commonly referred to as the "TABOR surplus," had to be refunded to taxpayers, unless voters approve a revenue change as an offset in a referendum. Under TABOR, the state has returned more than $2 billion to taxpayers.

In November 2005, voters passed Referendum C, a ballot measure that eased many of the TABOR restrictions. The measure allowed the state to keep and spend existing revenue above the TABOR limit each year, beginning in fiscal 2005-06.

The state was allowed to spend all revenue subject to TABOR for five years through fiscal 2009-10.

Beginning in fiscal 2010-11, the state was allowed to spend revenue above the TABOR limit known as the "Referendum C cap."

Under the $8 billion state budget submitted to the House, debate has focused on cuts in property taxes for senior citizens or restoring funding to state agencies.

The higher education sector is still facing a cut of just under $6 million, but that's a big improvement from cuts of several hundred million dollars during the last five years.

Schools make up about 40% of the budget and colleges about 9%. The budget's other major programs include prisons and human services, including mandatory spending on Medicaid, an entitlement more people are eligible for because of the weak economy.

Last month, lawmakers found they had about $200 million to spend after the budgeting they had completed so far.