CHICAGO — The Greater Cleveland Regional Transit Authority is bringing $41.7 million of highly rated sales-tax-backed bonds to market Thursday.

To attract investors, the authority boosted bondholder protections on the debt, which prompted Fitch Ratings to upgrade its outstanding debt to AA-minus from A-plus.

Standard & Poor’s rates the 2012 sales tax bonds AAA. Moody’s Investors Service rates the debt Aa2. Both maintain stable outlooks on the authority. Fitch did not rate the 2012 bonds.

Under the new security, investors will now benefit from a stronger additional bonds test that requires two times coverage of existing and planned debt from sales tax collections, as well as a move to put the authority’s general obligation on par with its revenue bonds, with both payable from gross sales tax revenues.

Holders of the authority’s 2012 bonds also benefit from the trustee intercept feature, which requires Ohio to collect the sales and use taxes and make monthly deposits directly to the bond trustee.

The 1% sales tax, levied by Cuyahoga County, is a key revenue source for the authority, and accounted for more than 80% of its operating revenue in 2011.

After struggling through recession-related sales tax dips starting in 2007, the agency has recently enjoyed a fiscal rebound. Sales tax collections have been better than expected, rising more than 6% in 2010. The increase was largely due to an expansion of the tax base to include managed health care services, according to credit analysts.

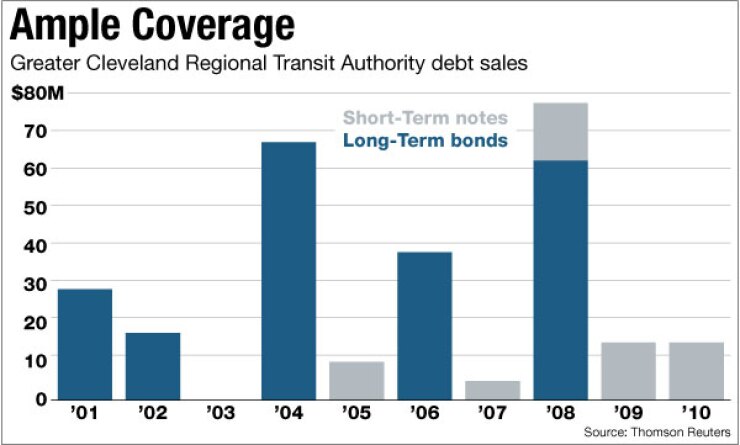

Despite recent volatility, “the sales tax generates ample coverage for the bonds and provides diversity to the revenue stream, offsetting fluctuations in fare revenue,” Fitch analyst Jessalynn Moro wrote in a recent upgrade report.

The $41.7 million is a mix of new money and refunding, with a 2031 final maturity. Roughly $25 million includes new money that will be used to finance various capital projects, including bus purchases. The refunding will retire 2004 bonds to achieve interest-rate savings.

Fifth Third Securities Inc. is the senior manager. Keybanc Capital Markets Inc. and Rice Financial Products Co. round out the underwriting team. Public Financial Management Inc. is the authority’s financial advisor. Peck, Shaffer Williams LLP and Horton & Horton Co. are co-bond counsel.

Created in 1974, the authority provides virtually all mass transit services in Cuyahoga County and Cleveland.

The authority has a short-term borrowing program that allows it to privately place one-year notes with Fifth Third. No debt is currently outstanding in that program, according to bond documents.