CENTRAL FALLS, R.I. - The logos of Harvard and Massachusetts Institute of Technology, among other universities, adorn a sign in front of Central Falls City Hall that proclaims where some of this year's high school senior class is headed.

“We’ve never had anyone go to Harvard or MIT before,” said Jim Diossa, the city's 31-year-old mayor.

It's another way for 19,000-population, one-square-mile Central Falls - Rhode Island's smallest and poorest city -- to celebrate itself less than five years after emerging from a bankruptcy filing that generated national headlines and resonated through the capital markets.

Central Falls received a boost in March when S&P Global Ratings upgraded its general obligation bond rating three notches to investment-grade BBB from junk-level BB.

S&P, which kept its outlook at positive after the upgrade, said the city is operating under a “much stronger economic and management environment” after exiting Chapter 9 in September 2012. Central Falls filed 13 months earlier, reporting an $80 million unfunded pension liability.

Many see the city’s rebound as the kind of needed feel-good story in a state punctured over the years by the 38 Studios bond financing fiasco, the banking scandal of the early 1990s, political corruption on various fronts and economic struggles.

“It's a great positive story,” said Alan Schankel, a managing director at Janney Capital Markets.

The triple upgrade was a pleasant shock to Diossa.

“Obviously we've had a lot of conversations with the rating agencies and I was hoping we'd get an upgrade of at least one notch,” he said during an interview at the El Paisa restaurant on Dexter Street.

“When we got the triple upgrade, first, I was surprised and second, it reaffirmed the work that we're doing. Our bonds are no longer junk. We're investment level. It's like getting good news at a health checkup.”

S&P cited several years of sound budgeting and full adherence to a six-year post-bankruptcy plan that state-appointed receiver Robert Flanders crafted and federal Judge Robert Bailey approved.

While in Chapter 9 and with state assistance, Central Falls negotiated reductions in the annual cost of living benefit for retirees, cut pensions by as much as 55% -- though some restorations came later - and tweaked the health insurance package. It also reached a collective bargaining agreement with labor unions through mid-2016.

“They stepped up to the plate,” Schankel said of the unions. “Look at places like Chicago and Illinois. They have incredible problems.”

Central Falls is among the roughly 25% of Rhode Island municipalities with locally administered pension plans. A proposal by state General Treasurer Seth Magaziner, which the General Assembly will consider, would lessen restrictions from entering the state-run Municipal Employees' Retirement System.

Magaziner said the move would boost investment returns and reduce costs for municipalities.

Diossa, meanwhile, said he is “fully committed” to the fiscal discipline that applied while under state oversight.

Central Falls had a general fund surplus of 11% of expenditures for 2016. “That reserve fund is very important,” said Diossa.

The city also expects a surplus for fiscal 2017. In addition, expenses are 3% below budget.

Central Falls’ $18 million fiscal 2017 budget lowered the residential property tax rate for the first time in a decade. The city spent 1% less than previous year budget, earmarked 107% of its annual required contribution to the pension plan and contributed $100,000 toward its future other post-employment benefits, or OPEB, liability.

Revenue contingency and regional credit stability, said S&P, should help Central Falls mitigate possible volatility.

Central Falls' bankruptcy was "an interesting experiment," according to municipal bankruptcy expert James Spiotto.

Rhode Island's passage of a law earlier in 2011 that gave bondholders waterfall priority in any municipal bankruptcy filing essentially set up Central Falls a quick, tidy stay in Chapter 9, said Spiotto.

"That gave them access to the markets at a stable borrowing cost, and it helped stopped contagion, vis-à-vis Providence," he said. “Without that, you question whether or not there would have been an upgrade.”

Central Falls, said Schankel, reflects well on the state. "Bondholders emerged unscathed and it helped the prospects for bond issuers around that state."

The city filed amid a wave of municipal bankruptcies over a two-year span.

The City Council in Pennsylvania capital Harrisburg filed in 2011 without the mayor’s approval, though a federal judge nullified it.

Jefferson County, Ala. filed the same year. California cities Stockton, Mammoth Lakes and San Bernardino filed a year later.

Then, Detroit in 2013 filed a record $18 billion bankruptcy, the largest ever in the U.S. It exited a year later.

“I think Central Falls is a microcosm of all of them,” said Diossa. “I followed Detroit and heard all the discussions. They had the same issues that we had ... sky-high costs, not budgeting appropriately.”

Diossa, a former councilman and the son of Colombian immigrants, filled out the mayoral term of Charles Moreau, who resigned under scandal in May 2012 and served one year in prison on federal corruption charges. Moreau admitted he took bribes from businessman friend Michael Bouthillette for a contract to board up foreclosed homes in the city.

Moreau’s opaque ways included scheduling council meetings at noon on workdays, which inhibited public attendance and effectively froze out Diossa, who worked full-time and at the time was the only Latino on the council.

Since taking office, Diossa has sought to make the city more transparent. “We put our budget online and provide monthly status updates to the council,” he said.

Central Falls has lost much, but not all, of its manufacturing base, prompting Diossa to seek a diversified approach.

“I’d like to see them bring something in to create economic activity,” said Spiotto.

One hope is transit-oriented development that could come with the addition of a Massachusetts Bay Transportation Authority commuter rail station. The Pawtucket-Central Falls stop, near the city line, is scheduled to open in 2019.

Diossa said the city has converted some old factory buildings into lofts while a task force has worked at moving some blighted properties to the tax rolls.

“The state’s been very involved,” said Diossa, who has worked with governors Lincoln Chafee and Gina Raimondo during the city’s recovery. Raimondo’s advocacy, he said, was “very critical” in landing the train station commitment from the MBTA.

Central Falls’ crime rate has improved, though still a concern, according to the mayor.

Central Falls has earmarked some capital funds for street and road improvements and renamed one thoroughfare after Emmy and Tony award-winning actress Viola Davis, who grew up in the city. In addition, actor Alex Baldwin has donated money to the city’s library.

“We’re only one square mile, so any issue becomes more noticeable, even next door,” said Diossa. “We suffer from that.”

Amid the three notch upgrade, S&P raised red flags.

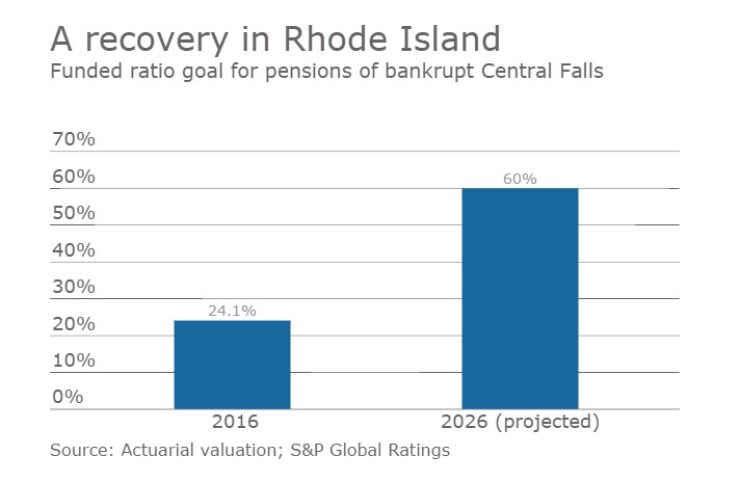

“The city’s debt and contingent liability profile is very weak,” said S&P. “We view the pension and other post-employment benefit [OPEB] liabilities as a credit concern given the very low funded ratio and high fixed costs.”

S&P said it could remove its positive outlook should those pressures affect the budget.

“They are still a concern with wealth metrics and resources that are probably below average for Rhode Island, so that's a bit of a disadvantage,” said Schankel. “That adds more importance to the fact that they achieved an investment-grade rating through what I think is pretty good financial management and getting their house in order.”

The city’s location, said Diossa, is another means to trumpet the city.

“We’re 45 minutes from Boston and 10 to 15 minutes from Providence. That’s two major markets. Smaller cities are intimate and we have a welcoming culture.

“We’re on the upswing.”