Munis strengthened at Friday’s close, as yields were as much as two basis points lower on some maturities, according to traders.

Market participants are already anticipating next week as big name issuers from California and Texas will lead an expected $7.2 billion slate.

Primary Market

Municipal volume for the week ahead is estimated by Ipreo at $7.19 billion, up from the revised total of $5.57 billion sold in the past week, according to Thomson Reuters. The calendar consists of about $4.40 billion of negotiated deals and $2.79 billion of competitive sales.

The issuer with the largest sale of the upcoming week was the top municipal issuer in the first quarter with $2.95 billion: California.

The Golden State will be selling three separate competitive sales totaling roughly $1.49 billion on Tuesday. The largest of the trio of deals will be $645.3 million of tax-exempt various purpose general obligation refunding bonds. The issue is expected to be split between $176 million of VP GO bonds and $469.3 million of VP GO refunding bonds.

The second largest sale will be $606.7 million of tax-exempt various purpose GO refunding bonds. The issue is expected to be split, with $56.2 million of VP GO bonds and $550.5 million of VP GO refunding bonds.

The third sale will be $236.795 million of taxable various purpose GO bonds. The deals are rated Aa3 by Moody’s Investors Service, AA-minus by Standard and Poor’s and A-plus by Fitch Ratings.

Bank of America Merrill Lynch is expected to price the largest negotiated issue, The Texas Transportation Commission’s $615 million of state highway improvement GO bonds on Tuesday. The deal is rated triple-A by all three rating agencies.

JPMorgan is scheduled to price the state of Louisiana’s $359.295 million of GO refunding bonds on Wednesday. It is anticipated that the deal will be broken down into $283.94 million of tax-exempts and $75.355 million of taxable.

State officials say the par amount of the deal depends on market conditions. The state bond commission had authorized a sale up to $600 million. Fitch downgraded Louisiana to AA-minus from AA with a stable outlook earlier this month, while Moody's lowered the state’s GO ratings to Aa3 from Aa2, and maintained a negative outlook in February, though it didn’t rate this transaction. Standard & Poor's maintained its AA, and negative outlook recently.

“Louisiana’s fiscal challenges may hurt somewhat in terms of borrowing costs, but this should be mitigated by favorable muni technicals, such as strong demand via fund inflows and moderate supply,” said Alan Schankel, a managing director at Janney Capital Markets. “In a time when states like Pennsylvania and Illinois are politically polarized, I was heartened to see the governor’s proposals to close the budget gap were not reliant on one time fixes as we’ve seen in the past.”

Secondary Market

The yield on the 10-year benchmark muni general obligation was one basis point lower to 1.61% from 1.62% on Thursday, while the 30-year muni yield was two basis points lower to 2.54% from 2.56%, according to a final read of the Municipal Market Data's triple-A scale.

U.S. Treasuries were stronger on Friday afternoon. The yield on the two-year Treasury fell to 0.73% from 0.76% on Thursday, while the 10-year Treasury yield decreased to 1.75% from 1.78% and the yield on the 30-year Treasury bond dropped to 2.56% from 2.60%.

The 10-year muni to Treasury ratio was calculated at 92.0% on Friday compared with 91.0% on Thursday, while the 30-year muni to Treasury ratio stood at 99.2% versus 98.7%, according to MMD.

The Week's Most Actively Quoted Issues

Puerto Rico and California issues were among the most actively quoted names in the week ended April 15, according to data released from

On the bid side, the Puerto Rico GO 8s of 2035 were quoted by 15 unique dealers. On the ask side, California revenue 5s of 2045 were quoted by 15 unique dealers. And among two-sided quotes, California taxable 7.55s of 2039 were quoted by 8 dealers.

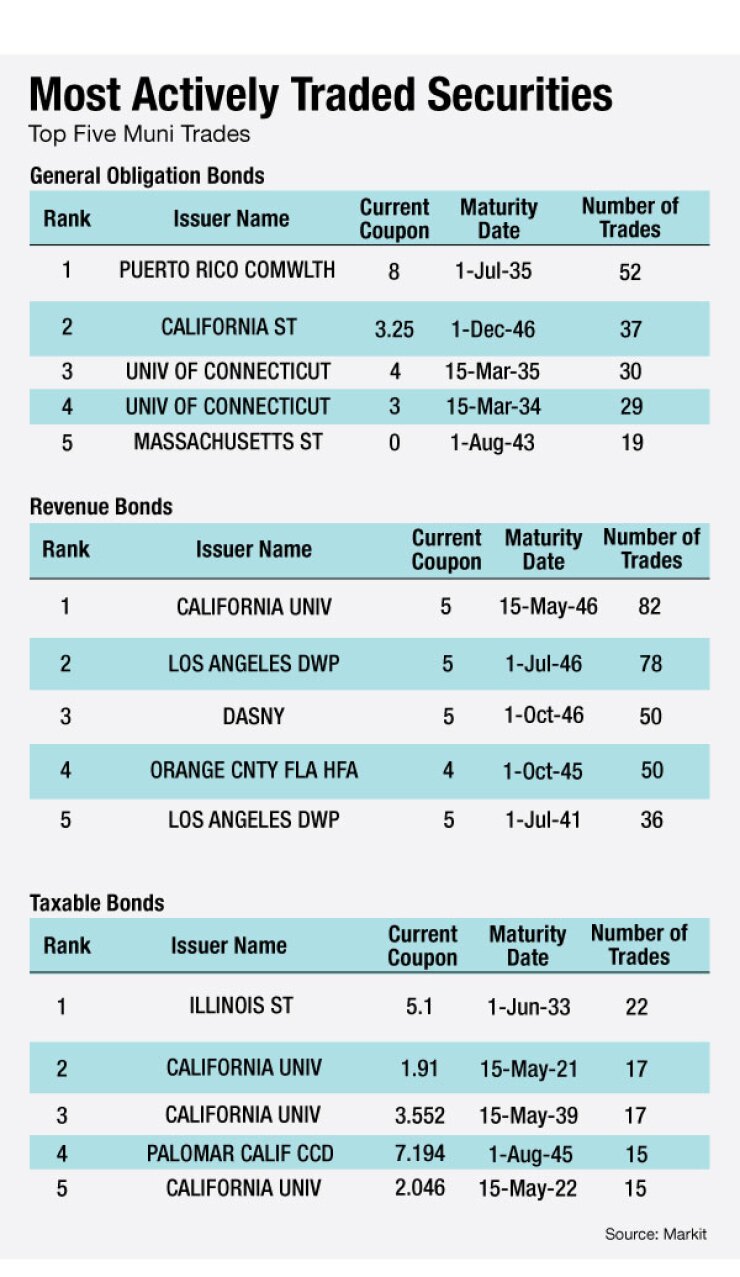

The Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended April 15 were in Puerto Rico, California and Illinois, according to Markit.

In the GO bond sector, Puerto Rico commonwealth 8s of 2035 traded 52 times. In the revenue bond sector, University of California 5s of 2046 traded 82 times. And in the taxable bond sector, Illinois 5.1s of 2033 traded 22 times, Markit said.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar rose $210 million to $11.16 billion on Monday. The total is comprised of $4.25 billion of competitive sales and $6.91 billion of negotiated deals.