BRADENTON, Fla. — Investors will see triple-A rated Broward County, Fla., in the market over four days next week pricing $462 million of new-money and refunding bonds.

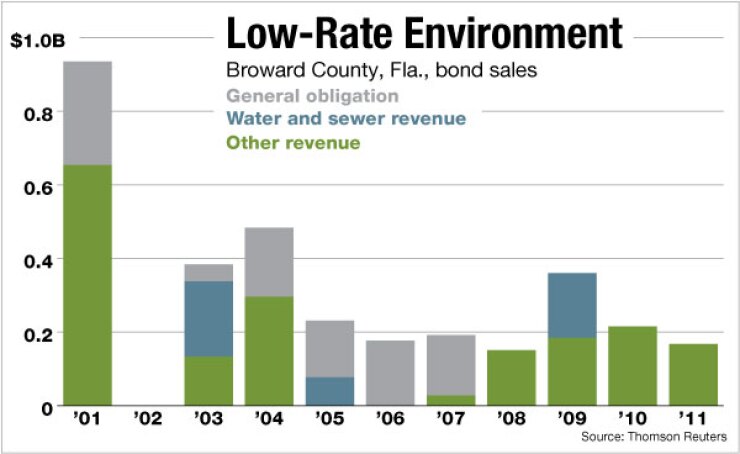

The county hopes to take advantage of the low market-rate environment by selling $138.2 million of new bonds and $324.2 million of revenue refunding bonds, according to David Moore, a managing director at Public Financial Management Inc., which is co-financial advisor with Fidelity Financial Services LC.

Retail pricing begins Monday for $135 million of general obligation refunding bonds, with institutional sales on Tuesday. On Wednesday, retail pricing begins on $327.4 million of new and refunding water and sewer bonds, with institutional sales on Thursday.

Moore said the two offerings will appeal to different buyers, and provide an opportunity to lock in low interest rates. “These are two very highly rated credits so we expect investor demand to be very strong,” he added.

The GO bonds are rated triple-A by Fitch Ratings and Moody’s Investors Service, and AA-plus by Standard & Poor’s.

The deal will refund all or a portion of Series 2004 and 2005 GO bonds with fixed-rate debt, and expects present-value savings in excess of $10 million, or 10%.

The water and sewer revenue bonds are rated AA-plus by Fitch, Aa2 by Moody’s and AA by Standard & Poor’s.

The water and sewer deal is structured as $138.2 million of new bonds, $141.4 million of tax-exempt refunding bonds, and $47.8 million of taxable bonds.

The tax-exempt refunding is expected to achieve $9.8 million in net present-value savings or 9.81% over the life of the bonds.

The taxable bonds will refund previously advance-refunded bonds. Though the county’s present-value savings threshold is 3%, the taxable bonds are currently expected to capture $1.8 million in net PVS, or 4.06%.

The refunding transactions were initiated at the behest of Broward County Mayor John Rodstrom, who was monitoring the market as a banker for Sterne Agee & Leach Inc.

“I’d been seeing refunding numbers and what got my attention was savings into the double digits,” said Rodstrom, whose firm does not participate in county transactions. “That set off the alarm bells.”

Broward’s refundings were quickly prepared for sale over a six- to eight-week period, he said, adding that the savings is expected to be “significant” for the county budget.

“Obviously, we’re seeing the lowest interest rates of our lifetimes,” said Rodstrom, a long-time commissioner who will be term-limited out of office in November.

Though Broward’s economy has been stressed due to the recession, Rodstrom said he is gratified that Fitch and Moody’s maintained the county’s gilt-edged ratings.

“It was a reaffirmation of what I thought I knew,” he said. “We’ve been very conscientious about not dipping into our reserves like others have. We don’t have an enormous amount of debt, but addressing our ratings has been a top priority.”

Broward is the second-most populated county in Florida with nearly 1.8 million residents. It is part of the South Florida metropolitan area, which includes Miami-Dade County.

The GO refunding bonds are being sold by book-runner Bank of America Merrill Lynch, Goldman, Sachs & Co., and Ramirez & Co. Edwards Wildman Palmer LLP and Carol D. Ellis PA are co-bond counsel. Bryant Miller and Olive PA and Steve E. Bullock PA are co-disclosure counsel. Underwriters’ counsel is Moskowitz, Mandell, Salim & Simowitz PA.

The water and sewer deal is being sold by book-runner Citi, Goldman, Sachs & Co., Morgan Stanley, and JPMorgan. Bryant Miller and Olive and Steve E. Bullock are co-bond counsel.

Edwards Wildman Palmer and Carol D. Ellis are co-disclosure counsel. Greenspoon Marder PA is counsel to the underwriters.