Municipal bond yields fell significantly on Thursday. Coupled with more inflows into the asset class, munis closed out the month strong.

With another federal funds rate cut in the books, munis saw some issuance on Thursday and a big drop in yields to close out the week and the month.

This year has seen the scale tipped in favor of municipals, thanks in large part to continued inflows into the asset class. It seems as though munis are as popular as ever.

“The muni asset class has become a tax shelter more so than it ever has been,” said Peter Block, managing director at Ramirez & Co. “Clearly, we keep seeing new entrants into the market. People hadn’t thought of munis as part of their allocation, but now they do.”

Block says the market will continue to see strong fund flows as long as there is a tax incentive to do so and the latest Lipper numbers support that theory. Lipper reported $1.161 billion of inflows into the asset class, marking the 43rd week in a row of inflows.

“The picture looks bright for fund flows to continue, don’t see anything that will change that anytime soon,” Block said.

Majority of Bond Buyer yield indexes increase

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was unchanged from 3.62% the week ended Oct.17 from 3.59% in the previous week. The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was higher by four basis points to 2.79% from 2.75% from the week before.

The 11-bond GO Index of higher-grade 11-year GOs also gained four basis points, to 2.33% from 2.29% the prior week.The Bond Buyer's Revenue Bond Index increased four basis points to 3.27% from 3.23% last week. The yield on the U.S. Treasury's 10-year note lowered to 1.69% from 1.77% the week before, while the yield on the 30-year Treasury decreased to 2.18% from 2.26%.

Primary market

A few deals priced to close out the week. As the calendar turns to November, issuance is not expected to continue

Bank of America Securities priced Broward County, Fla.’s (A1/A+/A+) $1.25 billion of airport system revenue and revenue refunding bonds, featuring alternative minimum tax bonds and taxable bonds.

Barclays priced Oneida County Local Development Corporation, New York’s ( /AA/ ) $265.24 million of revenue bonds for Mohawk Valley Health System Project, consisting of tax exempt and taxable bonds. The deal has an underlying rating of BB+ but Assured Guaranty insured the entire deal, raising the rating to AA by S&P Global Ratings.

In the competitive arena, the New York Metropolitan Transportation Authority (A1/A/AA-/AA+) sold a total of $242.24 million in two separate sales.

Bank of America Securities won the larger sale of $141.245 million with a true interest cost of 1.6706%.

BofAS made it a clean sweep and won the $100.995 million sale with a TIC of 3.5888%. Assured Guaranty insured the 2046 maturity totaling $32.64 million and the 2048 maturity totaling $35 million and are rated AA by S&P Global Ratings.

Thursday’s bond sales

Muni money market funds reverse course and go red

Tax-exempt municipal money market fund assets fell $485 million, lowering its total net assets to $138.07 billion in the week ended Oct. 28, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 188 tax-free and municipal money-market funds fell to 0.82% from 0.89% from the previous week.

Taxable money-fund assets were up $32.33 billion in the week ended Oct. 29, bringing total net assets to $3.331 trillion. The average, seven-day simple yield for the 806 taxable reporting funds was slipped to 1.50% from 1.54% from the prior week.

Overall, the combined total net assets of the 994 reporting money funds increased $31.84 billion to $3.469 trillion in the week ended Oct. 29.

Secondary market

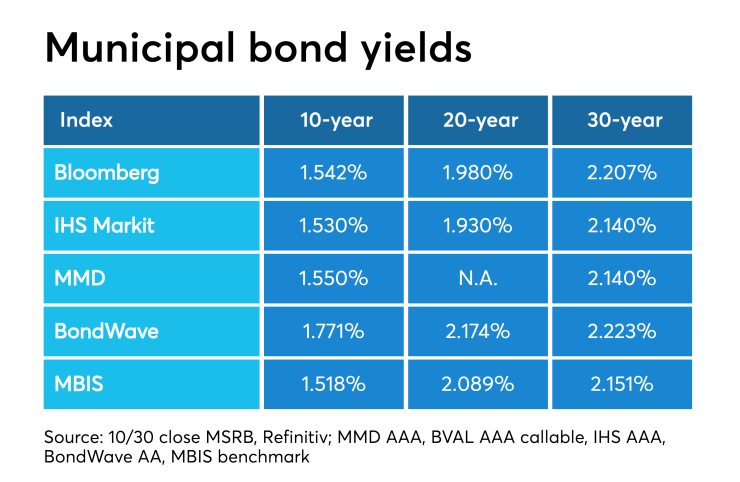

Munis were stronger on the MBIS benchmark scale, with yields lower by two basis points in both the 10- and 30-year maturities. The MBIS AAA scale was also stronger, with yields decreasing by three basis points in the 10-year maturity and by 13 basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year maturity was six basis points lower to 1.49% and the 30-year maturity dropped eight basis points to 2.06%.

The 10-year muni-to-Treasury ratio was calculated at 86.5% while the 30-year muni-to-Treasury ratio stood at 93.9%, according to MMD.

Treasuries yields were trading lower and stocks were in the red. The Treasury three-month was down and yielding 1.542%, the two-year was down and yielding 1.524%, the five-year was down and yielding 1.515%, the 10-year was down and yielding 1.693% and the 30-year was down and yielding 2.179%.

Previous session's activity

The MSRB reported 35,242 trades Wednesday on volume of $14.93 billion. The 30-day average trade summary showed on a par amount basis of $10.69 million that customers bought $5.87 million, customers sold $2.93 million and interdealer trades totaled $1.89 million.

California, New York and Texas were most traded, with the Golden State taking 17.899% of the market, the Empire State taking 11.714% and the Lone Star State taking 9.682%.

The most actively traded security was the California Municipal Finance Authority revenue 4s of 2029, which traded 25 times on volume of $56.905 million.

Treasury auctions bills

The Treasury Department Thursday auctioned $55 billion of four-week bills at a 1.570% high yield, a price of 99.877889.

The coupon equivalent was 1.598%. The bid-to-cover ratio was 2.83.

Tenders at the high rate were allotted 76.46%. The median rate was 1.540%. The low rate was 1.500%.

Treasury also auctioned $40 billion of eight-week bills at a 1.560% high yield, a price of 99.757333.

The coupon equivalent was 1.590%. The bid-to-cover ratio was 3.21.

Tenders at the high rate were allotted 83.78%. The median rate was 1.540%. The low rate was 1.520%.

Treasury bill announcement

The Treasury Department said Thursday it will auction $45 billion 91-day bills and $42 billion 182-day discount bills Monday.

The 91s settle Nov. 7, and are due Feb. 6, 2020, and the 182s settle Nov. 7, and are due May 7, 2020.

Currently, there are $38.995 billion 91-days outstanding and no 182s.

Treasury also announced a $28 billion 364-day bill selling Nov. 5, settling Nov. 7 and maturing Nov. 5, 2020.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.