Deals came in waves in the busiest day of the week Wednesday, with the market firming and most issuers able to lower yields.

Primary market

In the negotiated sector, Siebert Cisneros Shank priced the New York Triborough Bridge and Tunnel Authority’s $728.02 million of Series 2017C general revenue refunding bonds for MTA bridges and tunnels for institutions after holding a one-day retrial order period.

The $528.02 million of series 2017C-1 bonds were priced for institutions to yield from 1.51% with a 5% coupon in 2023 to 2.11% with a 5% coupon in 2028. The $200 million series 2017C-2 bonds were priced to yield 2.67% with a 5% coupon in a 2042 bullet maturity. The deal is rated Aa3 by Moody’s, AA-minus by S&P and Fitch and AA by Kroll Bond Rating Agency.

"This was one of the more aggressive deals of the day, but it ended up paying off," said a New York trader. "In general, people were still reaching but not quite as much as the past few sessions. Hopefully we get some clarity on this tax reform stuff soon. Things are okay now but if things stay as is as far as tax reform, the rush to issuance will change the market dynamic."

Bank of America Merrill Lynch priced Massachusetts' $593.255 million of Series 2017A transportation fund revenue bonds for rail enhancement and accelerated bridge programs and Series 2017A transportation fund revenue refunding bonds.

The $350 million of revenue bonds were priced as 5s to yield from 1.10% in 2019 to as 4s to yield 2.84% in 2036. The bonds were also priced to yield from 3.09% with a 3% coupon and 2.89% with a 4% coupon in a split 2038 maturity to 2.69% with a 5% coupon in 2043. The deal is rated Aa1 by Moody’s and AAA by S&P.

Citigroup priced Harris County, Texas’ $341.625 million of Series 2017A permanent improvement refunding bonds, road refunding bonds, and flood control district contract tax refunding bonds.

The $137.945 million of permanent improvement refunding bonds were priced as 5s to yield from 1.08% in 2018 to 2.67% in 2038; a 2043 maturity was priced as 4s to yield 3.06%.

The $35.36 million of road refunding bonds were priced as 5s to yield from 1.55% in 2022 to 2.60% in 2031.

The $168.1 million of flood control district contract tax refunding bonds were priced to yield 1.08% with a 5% coupon in 2018 and from 1.76% with a 5% coupon in 2024 to 3.01% with a 4% coupon in 2039.

The deal is backed by the Permanent School Fund guarantee program and is rated AAA by S&P and Fitch.

Bid/wanted lists showed signs that tax reform worries were still running rampant. In particular, California Health Facilities Financing Authority was drawing attention, as the House weighed a plan to curtail the tax exemption for future hospital deals.

“Given the potential changes that could occur with tax reform, people seem to be tossing that name around while they still can,” said a New York trader.

Pennsylvania sold $973.99 million of its first refunding series of 2017 general obligation refunding bonds. JPMorgan won the bonds with a true interest cost of 2.3629%. The bonds were priced to yield from 1.10% with a 5% coupon in 2018 to 1.25% with a 5% coupon in 2019. The deal was also priced to yield 1.47% with a 5% coupon and from 1.75% with a 5% coupon in 2023 to 3.00% with a 3% coupon in 2031.

The deal is rated Aa3 by Moody’s Investors Service, A-plus by S&P Global Ratings and AA-minus by Fitch Ratings.

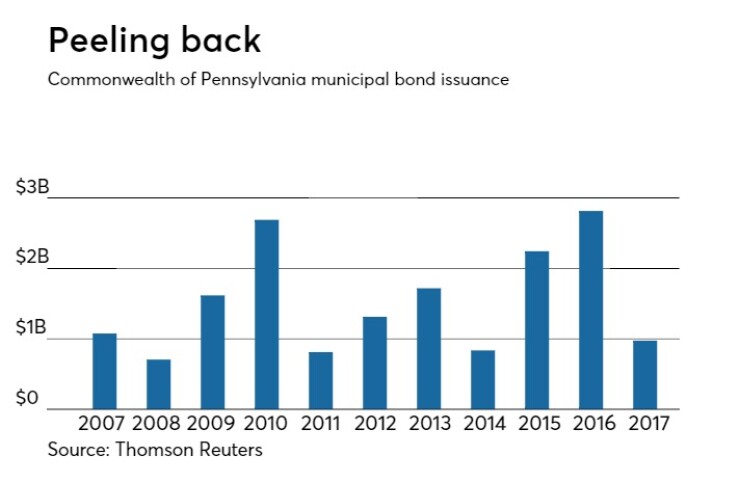

Since 2007, the Keystone State has issued about $16.8 billion of debt with the most issuance occurring in 2016 when it sold $2.81 billion and the least in 2008 when it sold $705 million.

Also in the competitive arena, the Washoe County School District, Nev., sold $252.25 million of GOs in two separate sales.

Bank of America Merrill Lynch won the $200 million of Series 2017C limited tax GO school improvement bonds additionally secured by pledged revenues with a TIC of 3.3203%.

The issue was priced to yield from 1.31% with a 5% coupon in 2020 to 3.26% with a 3.125% coupon in 2040. A 2042 maturity was priced as 3 1/4s to yield 3.32% and a 2047 maturity was priced as 4s to yield 3.30%.

The bonds are rated A1 by Moody’s and AA by S&P except for the 2035 through 2040 and 2042 maturities which are insured by Assured Guaranty Municipal and are rated A2 by Moody’s and AA by S&P.

JPMorgan won the $52.25 million of Series 2017D limited tax GO school refunding bonds with a TIC of 2.4191%. The deal is rated A1 by Moody’s and AA by S&P.

AP-MBIS 10-year muni at 2.227%, 30-year at 2.745%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was stronger around the market close on Wednesday.

The 10-year muni benchmark yield fell to 2.227% from the final read of 2.236% on Tuesday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

Secondary market

Top-quality municipal bonds were stronger to close out Wednesday. The yield on the 10-year benchmark muni general obligation fell one basis point to 1.91% from 1.92% on Tuesday, while the 30-year GO yield dropped two basis points to 2.58% from 2.60%, according to a final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were narrowly mixed on Wednesday at the market close. The yield on the two-year Treasury was flat from 1.64%, the 10-year Treasury yield gained to 2.32% from 2.31% and yield on the 30-year Treasury increased to 2.78% from 2.77%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 82.3% compared with 83.3% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 92.7% versus 93.9%, according to MMD.

NYC MWFA to sell $400M next week

The New York City Municipal Water Finance Authority said on Wednesday that it plans to sell $400 million of tax-exempt fixed-rate bonds on Tuesday, Nov. 14, after holding a one-day retail order period.

Proceeds from the sale will be used to fund capital projects and refund outstanding debt, the MWFA said.

The bonds will negotiated through the authority’s underwriting syndicate led by bookrunning lead manager Barclays and joint lead manager The Williams Capital Group. Raymond James and Siebert Cisneros Shank & Co. will serve as co-senior managers.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.