A day after a big correction stemming from the negotiations between the U.S. and China, the White House sent mixed signals on Friday, with the President now saying he has not agreed to roll back tarrifs — setting up a possible flight-to-quality for munis next week.

"I'm continuing to be cautious with munis, now with confusing signals from the White House about China," said one New York trader. "Based on the pounding we got Thursday, the trade war could go either way on the drop of a dime — cautiousness is the way go right now."

The muni market is expected to see $11.15 billion of new paper for the week of Nov. 11, slightly down from the revised total of $11.67 billion in the past week. The calendar consists of $8.41 billion of negotiated deals and $2.74 billion of competitive sales. The estimated volume is way above the year's weekly average of $8.96 billion.

The big issuance will hit during a short week, as the bond market is closed on Monday in observance of Veterans Day. It will be the second week in a row where volume is $10 billion or more and only the seventh week of the year — all of those occurrences have taken place from September on.

The month of November is off to a good start issuance wise, although we should not expect volume to be as high as it was in October, when $52.19 hit the market.

“I think November will be busier than other 2019 months, although totals may not surpass those of October,” Alan Schankel, managing director and municipal strategist at Janney Capital Markets, said.

There are 32 scheduled deals of $100 million or larger, with seven of those coming competitively — eight of those $100-million-or-larger scheduled deals are either partially or completely taxable.

“Recently higher Treasury yields could slow the use of taxable refunding issues in next few weeks, although I expect the taxable portion of volume to remain above historical, post-BABs levels,” he said.

"Taxable refunding is here as long as the math works," said a Texas trader. "A lot of talk about ultimate impact on tax-exempts as demand for taxable is more widely accepted. Right now any prediction is just a guess outside of a major rise in rates. Predictions for taxable supply next year are close to $100 billion from several larger shops."

Morgan Stanley is scheduled to price the largest deal of the week — District of Columbia’s (Aa1/AAA/AA+) $944.825 million of income tax secured revenue and revenue refunding bonds on Wednesday.

RBC Capital Markets is expected to price Texas Transportation Commission’s (Aaa/AAA/AAA) $789.550 million of state highway improvement general obligation taxable refunding bonds on Thursday. The deal is expected to mature serially from 2021 through 2034 and include a term bond in 2044.

JP Morgan is slated to price Harris County Cultural Education Facilities Finance Corporation, Texas’ (A1/A+/NR) $566.7 million of hospital revenue forward delivery taxable bonds on Wednesday.

"TTC and Harris are two different animals," said one Texas trader. "The TTC will draw in foreign buyers due to the size of the loan, in particular the 2044 term that will be index eligible. There is demand for spread therefore Harris will do fine. Size will trump the spread. In general the taxable market is cheap vs corporate credits and have room to tighten."

The largest municipal issuer in 2019 will be adding to its already $50.16 billion of muni issuance, when California (Aa2/AA-/AA) hits the competitive market with $682.435 million of various purpose GO and refunding bonds on Wednesday.

"Demand for California paper will remain strong given the large tax advantage to in-state investors, with Moody’s October upgrade providing a tailwind," Schankel said.

Fitch Ratings upgraded the state’s general obligation bonds in August to AA from AA-minus while Moody’s Investors Service elevated the GO rating to Aa2 from Aa3 on Oct. 14. S&P rates the

bonds AA- and hasn't boosted the ratings since 2015. All have stable outlooks.

"Demand for CA paper remains high," the Texas trader said. "Supply has dropped off a bit but I don’t expect the strong demand for Cal to change."

Volume is still strong, but the Texas trader noted that you have to keep in mind tax-exempt issuance is not heavy.

"If you strip out the taxable loans and compare relative to past years you will see that issuance is manageable. With the latest back up we are hearing rumors of some refunding’s being shelved," he said.

He continued to say that ultimately the impact on supply is unknown, but the belief is there will be some impact.

"Many predictions had supply easing up into end of October, so far supply is heavier than some thought for November. Keep in mind Thanksgiving will have an impact on pricing dates also as issuers want to get out in front of it."

He noted that volume has been easily absorbed, however, the impact on secondary volumes has been negative.

“Buy side demand appears to be right sized versus supply,” he said. “Until rates rise further we won’t see a meaningful impact from retail. So far November redemption cash has been helpful.”

Lipper sees fifth consecutive billion-dollar inflow

For 44 weeks in a row investors have poured cash into municipal bond funds, according to the latest data released by Refinitiv Lipper on Thursday.

Tax-exempt mutual funds that report weekly received $1.103 billion of inflows in the week ended Nov. 6 after inflows of $1.61 billion in the previous week. This marks the fifth week in a row and eighth time in the past 12 weeks inflows have exceeded $1 billion.

Exchange-traded muni funds reported inflows of $152.249 million after inflows of $240.027 million in the previous week. Ex-ETFs, muni funds saw inflows of $951.394 million after inflows of $921.574 million in the previous week.

The four-week moving average remained positive but fell below a billion at $899.269 million, after being in the green at $1.493 billion in the previous week.

Long-term muni bond funds had inflows of $738.369 million in the latest week after inflows of $1.339 billion in the previous week. Intermediate-term funds had inflows of $218.007 million after inflows of $125.413 million in the prior week.

National funds had inflows of $977.543 million after inflows of $1.033 billion in the previous week. High-yield muni funds reported inflows of $84.106 million in the latest week, after inflows of $402.256 million the previous week.

Secondary market

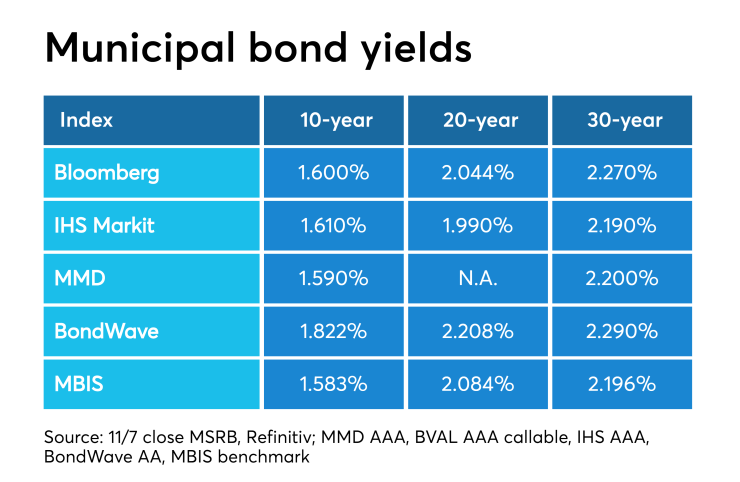

Munis were weaker on the MBIS benchmark scale, with yields rising by one basis point in the 10-year maturity and by less than a basis point in the 30-year maturity. High-grades were also weaker, with yields on MBIS AAA scale rising by no more than two basis points in the 10-year maturity and by less than a basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10- year was one basis point higher to 1.60%, while the 30-year GO increased two basis points to 2.22%.

The 10-year muni-to-Treasury ratio was calculated at 82.9% while the 30-year muni-to-Treasury ratio stood at 91.9%, according to MMD.

Treasuries were mixed, as were stocks with the Dow as the only index in the red. The Treasury three-month was down and yielding 1.548%, the two-year was down and yielding 1.670%, the five-year was up and yielding 1.742%, the 10-year was up and yielding 1.940% and the 30-year was up and yielding 2.422%.

"The primary market continues to dominate the overall flow of the market," said the Texas trader. "Secondary demand has slowed for many reasons including the drop off in retail demand, cheap muni/Treasury ratios have not been enough to draw buyers in, especially the arbitrage community."

He continued to say that frustrations on dealer secondary desks have been amplified with low trading volumes. Dealer-to-dealer and customer to dealer liquidity remains orderly, and not expected to change unless we begin to see a shift in the muni fund inflow picture.

"Going into year-end the dynamics will be interesting as customers have primarily gains and supply remains strong," he said. "Question is will dealers be comfortable creating a war chest to bring with them into January reinvestment period. Will the same fundamentals of the past line up again? Will issuers hit the ground running earlier in January in attempt to refund in the money financings? All unclear."

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Nov. 8 were from Puerto Rico and Florida issuers, according to

In the GO bond sector, the Commonwealth of Puerto Rico, 8s of 2035 traded 19 times. In the revenue bond sector, the Broward County, Florida, 4s of 2049 traded 57 times. In the taxable bond sector, the Broward County, 3.477s of 2043 traded 88 times.

Week's actively quoted issues

New York bonds were among the most actively quoted in the week ended Nov. 8, according to IHS Markit.

On the bid side, the New York State Thruway Authority revenue 3s of 2053 were quoted by 20 unique dealers. On the ask side, the New York State Thruway Authority revenue 3s of 2053 were quoted by 191 dealers. Among two-sided quotes, the New York State Thruway Authority revenue 3s of 2053 were quoted by 12 dealers.

Previous session's activity

The MSRB reported 35,961 trades Thursday on volume of $17.77 billion. The 30-day average trade summary showed on a par amount basis of $10.73 million that customers bought $6.03 million, customers sold $2.84 million and interdealer trades totaled $1.86 million.

California, New York and Texas were most traded, with the Golden State taking 13.072% of the market, the Empire State taking 10.659% and the Lone Star State taking 9.386%.

The most actively traded securities were Massachusetts School Building Authority, 3.395s of 2040 traded 17 times on volume of $50.95 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.