The growing investor acceptance of taxable municipal bonds over the past year appears to have hit a stumbling block.

Build America Bonds — the taxable municipal securities created under last year’s stimulus law — had been on a long-term strengthening trajectory. But starting with May’s Treasury rally, the spread to BABs has widened. And more recently, BAB rates are rising.

Taxable debt from municipal governments like California and Illinois, after facing some initial apprehension from the market in the BABs program’s infancy beginning in April 2009, had rallied almost nonstop since November.

The New Jersey Turnpike Authority is emblematic of the trend. The authority, which operates the New Jersey Turnpike and the Garden State Parkway, was one of the first to sell BABs, offering $1.38 billion in April 2009, at a spread of 370 basis points over comparable Treasuries.

After issuance, the spread narrowed steadily and stayed under 300 basis points for a year.

Many analysts and portfolio managers portrayed the tightening as a natural evolution of the market, demonstrating that initial skepticism about the asset class was over and a gradual embrace of a new product had begun.

The average yield on BABs compressed from more than 6.4% at the end of last year to less than 5.9% at the end of June, according to a Wells Fargo index tracking the sector.

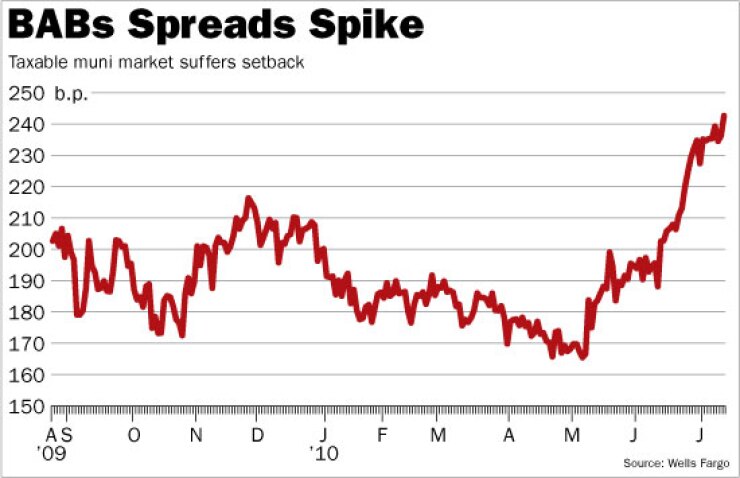

The average spread of BABs over comparable Treasury bonds shrank from almost 200 basis points at the end of 2009 to as low as 165 basis points in May, based on the Wells Fargo index.

But the evolution appears to have stunted. Spreads blasted out over the past 10 weeks, and yields on BABs have crept higher.

The “option-adjusted spread” on BABs — the excess of BAB yields over comparable Treasury yields after subtracting the value of any options embedded in the bonds — averages 242 basis points, according to the Wells Fargo index. That is up 75 basis points in the past 10 weeks, and is the highest spread since Wells Fargo began keeping track of spreads last August.

The spread on the New Jersey Turnpike Authority’s bonds is back up to 355.

“Outperformance has not been in the cards for Build America Bonds, which are trading at the widest spreads observed since BAB tracking began,” Alan Schankel, managing director at Janney Montgomery Scott, wrote in a report this week.

Schankel said the relentless nail-biting over municipal credit in the mainstream press curtailed demand for the product.

Because many BAB investors are foreigners with limited experience investing in U.S. state and local government debt, Schankel said “the recent run of stories and headlines about credit concerns among state and local issuers have served to dial back demand somewhat.”

John Hawley, a portfolio manager with Aviva Investors, thinks the bump in spreads is primarily technical and largely attributable to the impending putative expiration of the BABs program.

BABs were created under the American Recovery and Reinvestment Act in February 2009. It authorized municipalities, which customarily sell bonds with interest payments that are tax-free to the investor, to instead sell taxable bonds and collect a federal cash subsidy equal to 35% of the interest costs.

States and local governments have sold $120 billion of BABs.

The ARRA contained a sunset clause under which the BAB program is to expire at the end of this year. While most people expect the program to be extended in some form, Hawley said renewal remains uncertain. Legislation extending the program another two years is pending in the Senate after passing the House. Even if the program is renewed, it would likely be with a lower subsidy, giving issuers an incentive to sell BABs in 2010 rather than receive a lower subsidy later.

Those conditions prompted some issuers to sell bonds even when market conditions were not favorable, Hawley said. Municipalities pushed out some heavy BAB slates in May and June, Bloomberg data shows. Issuers sold $3.34 billion of BABs the week ended June 25, $2.69 billion the week ended June 11, and $2.99 billion the week ended May 28.

“They were just basically forcing that new supply onto the market at a time when the market was somewhat risk-averse,” he said.

As an example, Hawley pointed to New York’s Metropolitan Transit Authority, which at the end of last month sold $467.7 million of BABs at a spread of 275 basis points.

Issuers’ rush to borrow money this year has kept some investors from buying these bonds, Hawley said. Even investors who like municipal credits would probably wait for any supply bottlenecks to clear before committing money, he said.

“If you’re wanting to add exposure to the market and you know there’s a lot of supply coming and you have concerns about how well that’s going to be absorbed, you’re going to be well served to sit on the sidelines,” he said.

Hawley believes the knot of new supply has worked its way through and spreads are poised to resume narrowing. The sector’s fundamentals are strong, he said, and the tone of demand remains resilient.

Hawley pointed to Illinois’ $900 million BAB deal this week, which at the long end priced at 325 basis points over Treasuries — about 20 basis points stronger than expected.

Evaluating a product based on spreads is often tricky during flights to safety. Because spreads are assessed against Treasury bonds, which benefit most from risk-aversion, sometimes a wider spread is more a function of Treasuries doing well than municipals doing poorly.

During the retrenchment that struck global markets in early May, this was certainly the case. As investors panicked over Greece’s debt levels, BABs held in just fine. The average yield on BABs decreased 14 basis points in the month of May, even as most of the rest of the world sold off.

The spread of BABs over Treasuries, though, catapulted almost 30 basis points that month. The reason is that Treasuries did even better than BABs.

As the spread continued to spiral through June and early July, it could no longer be blamed on the Treasury rally.

BABs were not just underperforming Treasuries. They were selling off.

The average yield on BABs is now 6.1%, up 20 basis points in July.

The strange thing about this snapback in the BAB market is that it coincides with tax-exempt municipal bonds rallying strongly.

Benchmark 10-year tax-exempt triple-A rated municipal bonds yield 2.64%, according to Municipal Market Data, only seven basis points off the all-time low.

Even 30-year munis, traditionally a sore spot where municipalities like to sell and retail investors hate to buy, yield just 3.99% this week, 18 basis points above the record low.

While BABs yields are up 20 basis points in July, long-term tax-exempt yields are down five basis points, according to Municipal Market Advisors.

Schankel said it makes some sense for tax-exempts to be rising even when taxable municipals fall. Demand for tax-exempt paper stems principally from rich retail investors looking to cocoon their savings from taxes, he said. Much of the demand for tax-exempt bonds stems from the perception that tax rates are heading higher, Schankel said. Taxable municipals derive no such benefit.

Bill Larkin, director of fixed income at Cabot Money Management, said a number of things are keeping BAB spreads elevated — which is just fine by him because he is a buyer at these yields.

Larkin concurred with Schankel that the flurry of bad press is keeping some buyers out of the market. Larkin also cited poor disclosure and the uncertain renewal of the program as impediments.