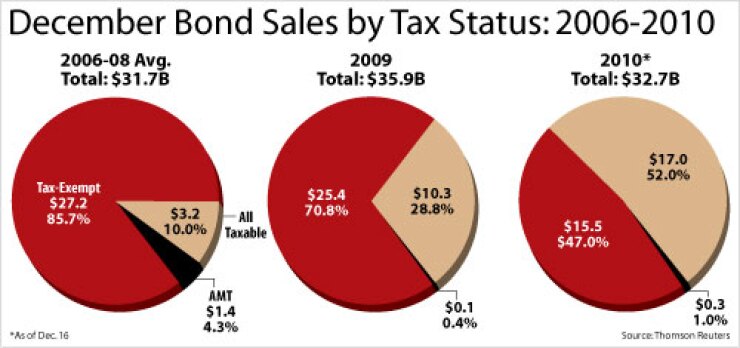

Thanks to a last-minute rush of Build America Bond issuance, monthly taxable volume is on pace to exceed tax-exempt borrowing for the first time ever in the municipal market.

State and local government borrowing for Dec. 1 through Dec. 16 includes 339 taxable issues worth $17.02 billion, versus 554 tax-exempt issues totaling $15.45 billion, according to Thomson Reuters.

That burst of activity already has pushed overall issuance of all kinds to a fourth-quarter record, with two weeks still to go in the October-December period. Total year-to-date issuance is $422.55 billion, just below the all-time record of $429.89 billion issued in 2007.

The cause of the heavy taxable volume is no mystery: the BAB program, which offers state and local governments a 35% federal subsidy to issue taxable debt, is set to expire on Dec. 31.

An extension of the BAB program was excluded from the compromise tax bill announced Dec. 6. The measure was passed by the Senate on Wednesday, approved by the House on Thursday, and signed by President Obama on Friday.

“With program extension unlikely at this juncture, issuers have been stuffing the channel as the expiration date approaches,” chief municipal bond strategist John Dillon at Morgan Stanley Smith Barney wrote in a Dec. 17 commentary.

There have been 174 BAB deals worth $13.7 billion issued so far this month. That flood has boosted quarterly BAB issuance to $42.2 billion so far in the October-December period — almost double the $21.3 billion issued in the third quarter.

The phenomenon has inspired nicknames that include “BAB-alanch” and “BAB-athon,” and has made the last two and a half months the most voluminous fourth quarter in muni market history. Total issuance in that period is currently at $123.69 billion, beating the previous fourth-quarter record of $121.92 billion in 2006. That volume also represents the second-largest quarter ever, behind the $146.26 billion sold in the second quarter of 2008.

The last comparable fourth-quarter rush occurred in 1985, when the Tax Reform Act placed new restrictions on municipal bonds.

The new law spurred a massive move to issue bonds before it took effect Jan. 1, 1986.

The second half of December is rarely an active time in the muni market, but with BABs and other stimulus bonds from the American Recovery and Reinvestment Act in the picture, this year won’t be typical.

The two weeks left on the issuance calendar are relatively light, making it unlikely that the additional $7.35 billion needed to reach a new annual record will be reached.

The calendar for rest of the month includes $7.2 billion of new product, counting bonds on the day-to-day schedule, which could very easily be delayed until 2011.

New issuance with a specific date totals just $709 million, according to The Bond Buyer.

Next week’s calendar includes $561.9 million of taxable debt, according to Bloomberg LP. The biggest taxable deal is the $350 million offering from New York’s Metropolitan Transportation Authority.

How the secondary taxable market will perform if BABs are no longer part of the issuance mix is unknown. One concern is that liquidity for the bonds could dry up.

Robert Novembre, managing director at Arbor Research and Trading, said it’s a simple supply and demand issue. Because much of the market for BABs is buy and hold, many of the BABs that have already been purchased are thinly traded. And if no new paper hits the market next year, spreads will potentially be tighter.

“There’s a sense in the market that there could be a scarcity bid,” Novembre said. “If people want to own these bonds going forward, they may be willing to pay higher prices.”

That trend is already apparent as the market anticipates a world without new BABs.

The average BAB yield, according to a Wells Fargo index, is 6.507%, or 30 basis points up from Dec. 6 when the tax bill was introduced. Since Oct. 25, the average yield has jumped 79 basis points.

If BABs were extended, dealers could have greater inventory generated from syndicates, which naturally would add to the secondary supply, Novembre said. With no extension, that kind of activity would go away, so prices would rise.

Dillon, who said current yields offer a favorable entry point for investors, recommends sticking to well-known issuers as a way to maintain liquidity.

“Bearing in mind the long duration of most related issuance,” Dillon said, “we prefer to mitigate future liquidity concerns by focusing on the dominate issuers.”