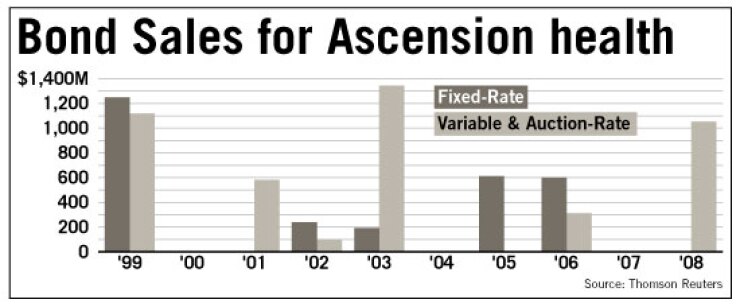

CHICAGO - St. Louis-based Ascension Health today will remarket $570 million of weekly variable-rate bonds as fixed-rate debt in the first of three planned mode conversions over the next month.

As the highly rated health-care giant seeks to reduce its variable-rate exposure, it will conduct the transactions through several conduit issuers. The first two transactions will convert variable-rate demand bonds into fixed-rate debt while the third conversion will feature what the finance team describes as a new short-term debt product dubbed "windows mode" that features a seven-month put.

The largest not-for-profit health-care system in the country and one of the top rated, Ascension's $4.3 billion debt portfolio includes about $1.4 billion of weekly variable-rate demand obligations. The conversions will cut the amount of its weekly VRDOs nearly in half. Although one piece remains in variable rate, the remarketing was extended to one month from seven days and the use of the windows mode gives Ascension more time to repay the debt in the event the put feature is triggered.

The transactions are part of Ascension's long-term plan to scale back its exposure to seven-day tenders, particularly in light of broader economic pressures and liquidity pressures that have grown over the last year. The finance team had originally planned to convert the debt last fall, but opted to wait given the market turmoil and steep cost of issuing fixed-rate debt to attract investors.

In advance of the deal, Standard & Poor's revised its outlook to stable from positive on Ascension's outstanding debt - citing in part pressure on its balance sheet from investment losses - while affirming its AA rating. Moody's Investors Service affirmed its Aa1 rating with a stable outlook on the system's senior-lien debt, and Fitch Ratings affirmed its AA-plus rating.

In today's transaction, Ascension plans to convert roughly $570 million in weekly VRDOs into fixed-rate mode with maturities of one year to two-and-a-half years, according to Steve Gilmore, Ascension's director of capital finance. The deal includes a conversion of $371 million through the Connecticut Health and Educational Facilities Authority and the Michigan State Hospital Finance Authority, as well as nearly $200 million through the Indiana Health Facility Financing Authority.

On Feb. 26, Ascension plans to convert another $28 million into fixed-rate debt with similar maturities, and on March 10 will convert another $82 million in weekly variable-rate debt into "windows mode" with a one-month remarketing period and seven-month put feature. Those bonds include 30-year maturities.

Citi and Morgan Stanley are the co-senior managers on the transactions. Kaufman, Hall & Associates Inc. is financial adviser and Orrick, Herrington, & Sutcliffe LLP is bond counsel.

"We always planned to reduce our exposure to the seven-day product," Gilmore said. "This gives us some breathing room." Ascension provides its own liquidity on its debt, and expects to continue to do so, he added.

Like most health care issuers, Ascension suffered declines in its liquidity last year, stemming largely from a nearly 21% loss in its investment portfolio - which fell from roughly $6 billion to $4.9 billion as of Dec. 31, 2008. The losses cut the system's days-cash-on-hand to 139 days as of the end of last year from 183 days of June 30, 2008, Gilmore said.

The "seven-month window VRDB" product, crafted by Citi, is a new product that has yet to be used in the tax-exempt debt market, according to Citi bankers Jim Blake and Adam Rudner. The one-month remarketing window and the six-month put window - Citi also offers a 12-month put window product - give borrowers more time to deal with potential tenders.

"Other products have a very short fuse for borrowers to come up with funding sources," Rudner said. "This seven-month window VRDB has a much longer remarketing and refinancing window in which to decide how to handle the pending tender."

Citi designed the product as a way to deal with the recent lack of bank-backed liquidity, said Blake, a managing director.

"We've spent the last six months talking to investors and borrowers about their concerns," he said. "It's a way to have a self-liquidity product that borrowers like and at the same time has the amount of time that investors like."

Part of the product's attraction is that it allows money market funds and other buyers to decrease the amount of bank-backed paper in their portfolios, according to Rudner.

"Investors are looking to diversify away from bank exposure, given the problems in 2008 and weakness in financial guarantors," he said. "This allows them to diversify their portfolios and take a direct credit exposure, which is what they want."

The seven-month put period will give Ascension more time to deal with potential tenders, Gilmore said. "It gives us more time to react, more flexibility," he said. "If it's successful, we could broaden our exposure to the product."

Despite its relatively large exposure to weekly tenders, the system did not experience any failed remarketings last year amid the market turmoil. In fact, Ascension has enjoyed interest rates around 0.5% on its variable-rate debt over the last five months, according to Gilmore.

The three transactions will be converted through a handful of conduits used by the multi-state system. They include the Michigan State Hospital Finance Authority, the Connecticut Health and Educational Facility Authority, the Indiana Health Facilities Finance Authority, the Illinois Finance Authority, and the Nashville and Davidson County Metro Government Health and Educational Facilities Board.

Of Ascension's $4.3 billion in debt, roughly 54% is in fixed rate and 46% in floating rate prior to today's transactions. Overall $1.03 billion of the floating-rate debt is tied to swaps. The current mark-to-market valuations of the swaps are largely negative and favor Ascension's two counterparties, Citi and Morgan Stanley. Though negative, the swap valuations remain above the negative $125 million valuation that would trigger the need for Ascension to post collateral, said Gilmore.

The system's chief credit strength is its size and geographic diversity, with facilities that generate more than $12 billion in operating revenue annually. Ascension operates 73 hospitals in 20 states and the District of Columbia.

In revising its outlook to stable from positive, Standard & Poor's noted that despite its strengths, Ascension has seen some financial weakening over the last year.

"We believe that the deterioration to Ascension Health's key balance sheet metrics due to the volatile equities market, and slightly softer financial results thus far in fiscal 2009, have combined to produce a more stable credit profile, effectively limiting the current rating at AA over the near term despite Ascension Health's considerable credit strengths," analyst Kevin Holloran said in a release on the upcoming transaction. "A higher rating is possible over the longer term if Ascension Health's key balance sheet measures begin to improve and operational strength demonstrated in recent years continues."

The system does not plan to sell new-money debt in the near future, according to Gilmore. Ascension is in the middle of a large capital plan that includes spending about $1.3 billion annually over the next five years, but most of the plan will be financed with cash, he said.