As Hurricane Dorian approaches the Atlantic coast, Florida’s three state-created nonprofit insurance entities are well capitalized to pay damage claims, according to Moody's Investors Service.

The entities are Citizens Property Insurance Corp., an insurer of last resort; the Florida Hurricane Catastrophe Fund, an entity that provides low-cost reinsurance for private insurance company’s residential losses; and the Florida Insurance Guaranty Association, which helps pay claims owed by insolvent insurers.

All were created by the Florida Legislature.

“All three entities have built up multiple sources of liquidity available to pay claims in the event of a large storm before turning to bonds” to finance losses, said Moody’s analyst Genevieve Nolan.

Citizens has claims-paying resources of $11.5 billion, including $6.4 billion in total liquid resources, nearly $1.5 billion of risk transfer through traditional reinsurance and capital markets risk transfer, and $2.2 billion in reimbursements from the FHCF, Moody’s said. Citizens has $1.3 billion of outstanding bonds.

The FHCF, also known as the Cat Fund, has nearly $13.8 billion in total available resources for 2019-2020. It consists of $11.2 billion in accumulated reimbursement premiums, $920 million of projected reinsurance and $1.7 billion from 2013A and 2016A bond issues. These resource cover 81% of the fund’s cap on the amount of reimbursements it can make, which is $17 billion.

For fiscal year 2018, which ended Dec. 31, FIGA reported $288.9 million in available cash and investments to pay claims. It has no outstanding bonds.

All three entities can issue debt to fund storm damage claims and levy tax-like assessments on insurers or policyholders to pay for debt service. For Citizens and FHCF, the assessments typically range from 6% to 10% and are placed on a wide variety of products such as property and casualty and car insurance policies.

Citizens and the FHCF may be required to issue additional debt to pay claims in the wake of a large storm, Nolan said.

Based on reported figures for possible future losses, she said an additional $5.5 billion of debt could be necessary in the event of a one, very large hurricane. In the event of two back-to-back events, an additional $5.1 billion may need to be issued by both entities.

“The additional bonding for Citizens and FHCF would only occur after each drew down of all available cash surplus and reinsurance coverage, per state statute,” said Nolan. “For Citizens, state law also requires full use of collections from the policy surcharge and regular assessment before turning to the market.”

Florida created the Cat Fund in 1993, a year after Hurricane Andrew devastated south Florida, forcing many private insurance companies into insolvency; others left the state because of the risk. The Cat Fund helped stabilize the real estate market because home mortgages must be insured.

Citizens was created in 2002, and assumed the operations of the Florida Residential Property and Casualty Joint Underwriting Association and the Florida Windstorm Underwriting Association.

Florida has 8,400 miles of coastline, the second-longest among states after Alaska, and its property and casualty insurers face unique challenges, the Janney Investment Strategy Group said in a report Friday.

“A hurricane season of multiple storms and extensive property damage could overwhelm insurers,” the report said.

Citizens, the Cat Fund and FIGA are all closely linked to the state government, with governing boards appointed by or comprised of senior state officials.

“A history of strong state oversight is a credit positive for all three insurers,” said the report.

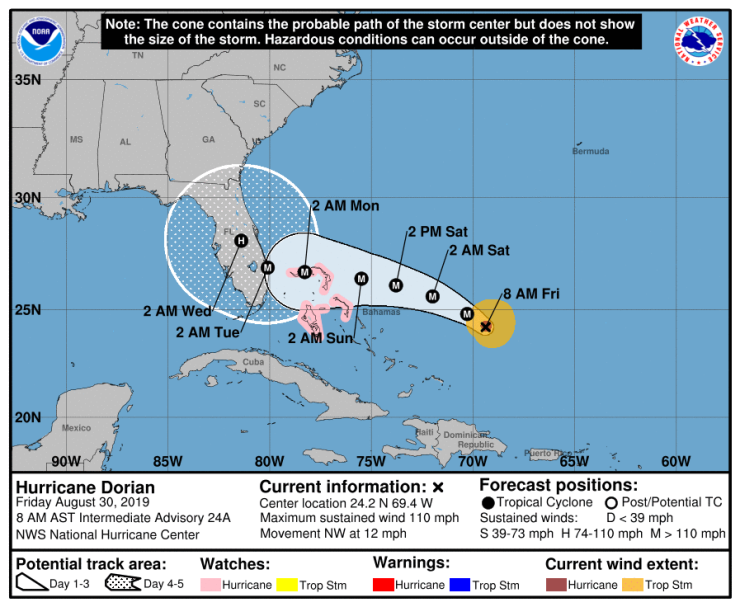

Florida Gov. Ron DeSantis Thursday issued a state of emergency for all 67 counties due to the uncertainty of Hurricane Dorian’s path.

Forecasters said they believed that Dorian could make landfall on the east coast as a Category 4 hurricane with sustained winds of between 130 mph and 156 mph, and that it could affect much of the state Tuesday and Wednesday.