Municipal bonds ended mixed on Monday ahead of this week’s $4.4 billion of planned bond issuance.

Even though demand generally remains healthy, there wasn’t much to get municipal investors interested in the market as July begins winding down, according to municipal market participants.

“Activity in municipals seems relatively muted although there [are] some bid wanted lists, and that is generating some attention from dealers because of their size,” Michael Pietronico, chief executive officer at Miller Tabak Asset Management said on Monday.

In addition, he observed that the short end of the market is seeing excessive demand relative to the value offered. “There remains a host of investors who sense long rates might be due for a spike,” Pietronico said.

Consequently, he said that slope of the curve is a challenging place to be. “Once again the short end of the market remains the most difficult area of the curve to find value,” he said.

Meanwhile, despite recent softness, the supply-demand imbalance is lifting the market, while credit quality continues to improve, according to Stephen Winterstein, managing director of municipal credit research at Wilmington Trust.

“The municipal bond market was softer last week in sympathy with U.S. Treasuries,” he said in a report released Monday. “While this was the first down week in seven, demand appears to be solid and lagging supply continues to serve as a support mechanism.”

While Wilmington Trust remains concerned by unfunded pension liabilities and other post-employment benefits [OPEB], it views improving credit quality as a boost for the market.

“We believe credit quality is largely healthy,” Winterstein said, noting that Moody’s Investors Service upgraded the District of Columbia’s general obligation debt to Aaa, from Aa1 earlier this month, while S&P Global Ratings last week upgraded the state of Michigan to AA, from AA-minus and the state of Minnesota to AAA, from AA-plus, both with stable outlooks.

Muni performance over the last 10 years

Bank of America Merrill Lynch looked at total returns of the ICE-BAML U.S. Municipal Securities Index over the past decade.

Over the last 10 years, munis had average monthly total returns of 3.65% compared to Treasury and corporate average returns of 2.58% and 4.21%, respectively.

“Though past performance does not guarantee future performance, we do see munis had decent total returns with tax-exempt income. The worst yearly total return was in 2008, with a negative 3.953%, while the best followed right after in 2009 with 14.454%,” Sophie Yan, BAML muni research strategist, wrote in Monday’s report. “We also show the rolling 12-month total returns of munis, comparing it to Treasuries and corporates. The volatility and divergence between these asset classes were very high between 2008 and 2010, becoming more stable and consistent in recent years.”

For 2018, the muni index has returned negative 0.031% through July 26, outperforming both the Treasury and agency master index and the corporate index, which had total returns of negative 1.633% and negative 2.677%, respectively.

The best performance in munis for the year-to-date has been in the one- and three-year maturities and in the BBB-rated sector, Yan said.

Secondary market

Municipal bonds were mixed on Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the one-year, three-year and 29- to 30-year maturities, rose less than a basis point in the eight- to 13-year and 15- to 27-year maturities and remained unchanged in the two-year, four-year- to seven-year, 14-year and 28-year maturities.

High-grade munis were also mixed, with yields calculated on MBIS’ AAA scale falling less than one basis point in the one- to eight-year and 30-year maturities, rising less than a basis point in the nine- to 27-year maturities and remaining unchanged in the 28- and 29-year maturities.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed both the 10-year muni general obligation yield and the yield on the 30-year muni maturity rising one basis point.

Treasury bonds were stronger as stocks traded lower.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 82.4% while the 30-year muni-to-Treasury ratio stood at 97.0%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 30,306 trades on Friday on volume of $9.92 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 16.128% of the market, the Empire State taking 15.764% and the Lone Star State taking 10.942%.

Primary market

The week’s slate consists of $3.5 billion of negotiated deals and $932 million of competitive sales.

On Tuesday, JPMorgan Securities is set to price

Bank of America Merrill Lynch is expected to price the Louisiana Public Facilities Authority’s $305 million of Series 2015 A1, A2 A3 and 207 hospital revenue bonds for the Louisiana Children’s Medical Center. The deal is rated A-plus by S&P.

Wells Fargo Securities is set to price the

Citigroup is expected to price the Forsyth County School District, Ga.’s $147 million of Series 2018 general obligation bonds on Tuesday. The deal is rated triple-A by Moody’s and S&P.

In the short-term competitive sector, the Miami-Dade County School District is selling $335 million of Series 2018 tax anticipation notes on Tuesday.

On Wednesday, Citigroup is set to price the Washington State Convention Center Public Facilities District’s $974 million of Series 2018 lodging tax bonds and subordinate lodging tax bonds. The bonds will finance part of the construction associated with building an addition.

In the competitive arena, Maryland is selling two deals totaling over $500 million on Wednesday. The deals consist of $275.3 million of Bidding Group 1 state and local facilities loan of 2018 second series tax-exempt bonds and $234.71 million of Bidding Group 2 state and local facilities loan of 2018 second series tax-exempt bonds.

Bond Buyer 30-day visible supply at $10.03B

The Bond Buyer's 30-day visible supply calendar increased $2.15 billion to $10.03 billion for Tuesday. The total is comprised of $3.40 billion of competitive sales and $6.63 billion of negotiated deals.

Prior week's top underwriters

The top municipal bond underwriters of last week included JPMorgan Securities, Bank of America Merrill Lynch, RBC Capital Markets, Wells Fargo Securities and Citigroup, according to Thomson Reuters data.

In the week of July 22 to July 28, JPMorgan underwrote $1.4 billion, BAML $1.1 billion, RBC $873 million, Wells Fargo $608.6 million, and Citi $353.9 million.

Fortuitous forecast

Combining interest-rate stability, low muni yield volatility, and below average year-to-date issuance with a flatter yield curve and benign credit conditions, Morgan Stanley Wealth Management maintains a “blue-sky setting” for municipals, according to executive director Matthew Gastall in a monthly municipal report.

“Though some U.S. Treasury volatility has been apparent, the laggard response that municipals exhibit versus broader fixed income price action has helped volatility in our market to remain subdued,” he wrote.

This year’s gross primary issuance is running roughly 13% below the primary market’s year-to-date historical average, he noted, recognizing that the decline is a result of the limitations placed on advance refundings following the passage of last year’s Tax Cuts and Jobs Act. In addition, only 14% of this year’s gross supply has been issued solely for refinancings, compared to such deals accounting for approximately 34% of all volume between 2009 and 2017.

Roughly two-thirds of the state and local government asset class is controlled by households, he pointed out, since the vast majority of its investors seek wealth preservation and an income stream that is exempt from federal income taxes.

“As the securities are not as directly exposed to the global flows of the prodigious international base, municipals often outperform Treasury weakness and underperform rallies because of their slower response,” he added.

Consequently, volatility metrics have hovered at minimal levels since the first quarter, he noted, with the five-, 10-, and 30-year triple-A Municipal Market Data benchmark yields trading within ranges of 28, 16, and 29 basis points, respectively, Gastall noted.

“Interest-rate stability and lower volatility have granted many investors comfort, helping the municipal asset class to perform well,” he said in the report.

With trading activity slowing for the summer, Gastall believes this period is an advantageous one for investors to complete midyear portfolio reviews, including proper yield-curve positioning, coupon structure, credit-quality, sector/state diversification, and tax exposure.

Meanwhile, current trade tensions and the uncertainties of this year’s midterm elections may bolster a flight-to-quality sentiment that could strengthen bond prices further, according to Gastall. “Simplistically, we believe this may be a smart time to study for the test, but not necessarily take it just yet … unless a pressing issue is uncovered,” he wrote.

“Investors should also remain cautious about overcommitting at present levels, as many catalysts that could incite additional fixed income weakness still exist,” he continued. “These include changes in global monetary policy, U.S. deficit spending and borrowing concerns, transitioning inflationary metrics, above consensus economic growth,” among others, he added.

Gastall suggests investors should maintain the appropriate exposures to cash, which has become increasingly attractive due to the bear-flattening of the yield curve and the continued possibility for additional weakness.

Prior week's actively traded issues

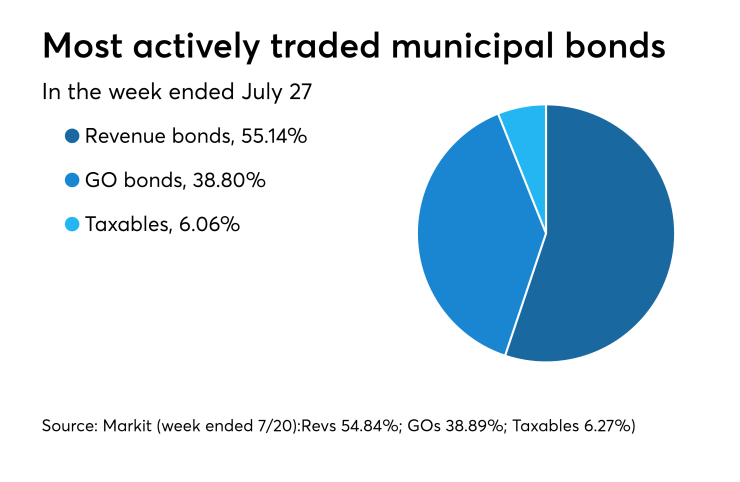

Revenue bonds comprised 55.14% of new issuance in the week ended July 27, up from 54.84% in the previous week, according to

Some of the most actively traded munis by type in the week were from New York, California and Illinois issuers.

In the GO bond sector, the New York City zeros of 2038 traded 24 times. In the revenue bond sector, the Los Angeles 4s of 2019 traded 56 times. And in the taxable bond sector, the Illinois 5.1s of 2033 traded 38 times.

Treasury plans to borrow $329B in Q3

The Treasury Department said it plans to borrow $329 billion in the third quarter, compared to an earlier estimate of $273 billion.

The borrowing assumes a $350 billion cash balance at quarter’s end, the same as the prior estimate.

Treasury borrowed $72 billion in the second quarter, compared to the estimated $75 billion, ending with a $333 billion cash balance, compared to the expected $360 billion.

In the fourth quarter, Treasury expects to borrow $440 billion, ending the calendar year with a $390 billion cash balance.

Treasury to sell $65B 4-week bills

The Treasury Department said it will sell $65 billion of four-week discount bills Tuesday. There are currently $93.007 billion of four-week bills outstanding.

Treasury sells discount bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the three-months incurred a 2.000% high rate, up from 1.970% the prior week, and the six-months incurred a 2.160% high rate, up from 2.140% the week before.

Coupon equivalents were 2.038% and 2.214%, respectively. The price for the 91s was 99.494444 and that for the 182s was 98.908000.

The median bid on the 91s was 1.970%. The low bid was 1.940%. Tenders at the high rate were allotted 71.22%. The bid-to-cover ratio was 2.87.

The median bid for the 182s was 2.140%. The low bid was 2.110%. Tenders at the high rate were allotted 73.19%. The bid-to-cover ratio was 3.14.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.