While Gov. Dannel Malloy and the legislature examine a far-reaching report on Connecticut’s fiscal crisis, warnings emerged that the state’s credit could further diminish.

Nuveen senior vice president Glen Anderson expects neither a reigniting of the economy nor a default.

“A more probable scenario would be additional downgrades of Connecticut’s bond ratings, should the state not execute and follow a long-term solution to these challenges,” Anderson said in a commentary.

The state's 14-member Commission on Fiscal Stability and Economic Growth last week painted a dire picture of a state whose fiscal disorder – and that of some of its largest cities, including capital Hartford – belie high per-capita wealth metrics.

“The time to act is now,” said the commission, which based its

The commission recommended a “revenue-neutral” rebalancing of state taxes that would reduce the income tax across all brackets; selectively increase business taxes; raise the sales tax by less than 1%; raise the gas tax and phase in electronic tolling, which is already up for debate; cut exemptions and exclusions from all taxes by 14%; and eliminate the dwindling estate and gift taxes.

It also called for a $1 billion annual cut from annual operating expenses; reinvestment in transportation and cities; the construction of a major tech campus in one city in partnership with a major university; changes to binding arbitration laws to enable labor compromises; and diversifying revenue streams beyond the regressive property tax.

Malloy, in the last of his eight years as governor, said the report “presents Connecticut with an opportune moment to engage in a meaningful conversation.”

Getting the state's divided legislature to act in an election year is a tall order. The Senate is split 18-18 between Democrats and Republicans while the Democrats hold an 80-71 edge in the House of Representatives.

All four bond rating agencies downgraded Connecticut last year. Moody's Investors Service rates Connecticut's general obligation bonds A1. S&P Global Ratings and Fitch Ratings assign A-plus ratings, while Kroll Bond Rating Agency rates the GOs AA-minus. S&P’s outlook is negative, the others stable.

The commission reported that fixed costs represent 52% of total general fund expenses in fiscal 2018. Budget deficits could balloon to $3.5 billion by fiscal 2022.

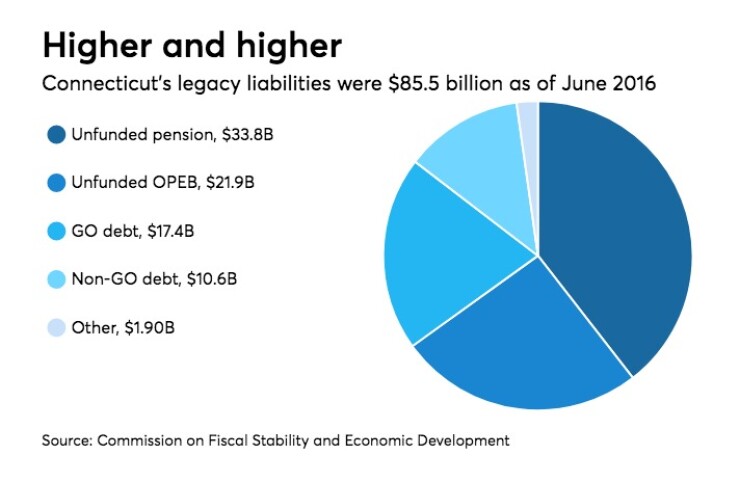

The state’s $86 billion of liabilities, including unfunded pension and other post-employment benefit liabilities, and GO and non-GO debt, could spike to $100 billion if the state’s pension systems trim their investment return assumptions to 6%, according to an analysis by Pew Charitable Trusts.

Moody’s estimates Connecticut’s 13.3% debt service to revenue ratio as the nation’s highest.

According to the commission, Connecticut is losing ground to neighboring states in several key measures: tax climate, business climate, transportation quality and urban vitality.

“State government’s fiscal instability is itself a root cause of our poor economic growth because it leads to a lack of confidence by the business community and among state residents,” said its report.

While default risk is minimal and states may not file for bankruptcy, “bonds sold prior to maturity could suffer trading losses due to deteriorated market conditions brought on my credit weakness,” said Anderson.

Issuance of new debt in 2017, including state and local issues, totaled $6.3 billion in 2017. “With such a dependence on the capital markets, for itself and its school districts, Connecticut is unlikely to risk losing access to the markets by defaulting on its debt,” said Anderson.

Anderson noted that high quality of some local GO and revenue bonds, including Yale University and the Town of Fairfield.

“Lower-quality Connecticut paper is also available, but should be carefully evaluated. Investors would be well-served to know how dependent a local credit is on state aid, as this assistance is a likely target for reduction, should the state’s fiscal condition deteriorate further.”