Massachusetts and the Chicago Public Schools came to market with big note deals on Tuesday. And the municipal market absorbed the new issues with no trouble, with tighter spreads on some deals, according to municipal traders and managers.

“It doesn't appear the teacher's strike impacted the Chicago BOE sale, which came at a tighter spread than the previous sale in June,” said Peter Delahunt, managing director of municipals at Raymond James & Associates.

The larger new issues were well received — even with a weaker tone— and that had a huge impact on the secondary market, according to a New York trader.

“The supply bulk is definitely affecting the liquidity of the secondary market,” he said Tuesday. “Major and regional dealers have lots of new issues to work on, so secondary trading is taking a back seat and will continue to do so into the near term unless volume slows down.”

Some trades like New York State Thruway bonds saw a lot of activity Tuesday, according to Bill Walsh, president of Hennion & Walsh in Parsippany, N.J.

“Prices have moved up on these a bit from yesterday, but they are still cheap relative to what else is out there in New York,” Walsh said. “The discounts on the long end are attractive and we’ve seen a lot of retail activity there,” he added.

While he said that the new supply has created a slightly weaker tone over the past few days, Walsh said in the grand scheme of the market, municipals remain “strong and should continue that way.”

Primary market

Massachusetts (MIG1/SP1+/F1+/NR) sold $1.4 billion of general obligation revenue anticipation notes in three offerings.

Two groups won the $500 million of Series A RANs including JPMorgan Securities and RBC Capital Markets. Three groups won the $500 million of Series B RANs including JPMorgan, Morgan Stanley and RBC. Six groups won the $400 million of Series C RANs including RBC, Loop Capital Markets, Goldman Sachs, Barclays Capital, JPMorgan and Jefferies. Acacia Financial Group was the financial advisor; Mintz Levin was the bond counsel.

And despite the citywide teachers’ strike, the Chicago Board of Education sold $250 million of Series 2019A tax anticipation notes. JPMorgan Securities won the TANs with a bid of 1.69%, an effective rate of 1.692247%. PFM Financial Advisors was the financial advisor; Ice Miller and Pugh Jones Johnson were the bond counsel.

The BOE's rate on the unrated TANs had a roughly 55 basis point spread to the Municipal Market Data’s AAA 1-year bond. The rate appeared on par to better than the competitive TAN sales over the last year.

JPMorgan is the top provider of CBOE’s direct placement note issues and lead manager on many CBOE long-term deals in recent years. Several market participants said they expected the bank, and others, to step-up on bids in a show of civic support for Mayor Lori Lightfoot’s administration during the strike. Lightfoot has oversight of the district as she appoints board members.

The last competitive sale of $250 million of notes in June that was divided into tranches paid interest rates of 2% and 2.125%. The notes matured in October and the spread was about 70 basis point more than the Municipal Market Data’s AAA 1-year bond.

In 2018, the district began selling some notes competitive in the aftermath of $1 billion in new state aid and pension funding and local property tax support that helped wipe out its deficit. A $200 million issue that sold competitively in late 2018 with a March 2019 maturity landed at rates of 2.40 % and 2.65 %, a 55 to 80 bp spread. Another $200 million TAN that sold in late 2018 landed at 2.45%, about 55 basis points over the one-year. The district used both direct purchases and competitive sales on its TANS.

The district paid punishing rates of 4.8% in prior fiscal years before it’s still junk-bond ratings stabilized and began inch up the speculative grade ladder.

It has relied heavily on TANs to manage operations although it did cut the amount of notes outstanding at any time down to $845 million in fiscal 2019 from a high of $1.55 billion three years ago. Property tax receipts that secure the notes go directly from the county collector to an escrow agent. The collection rate has historically been around 97%.

Chicago teachers

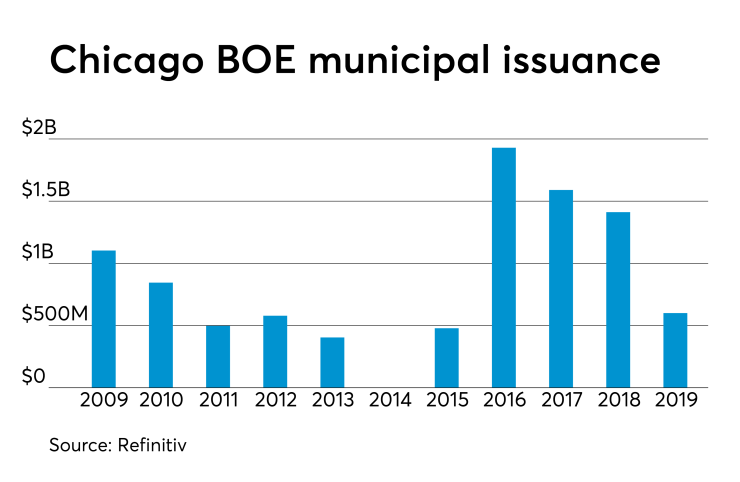

Since 2009, CPS has sold over $9 billion of securities, with the most issuance occurring in 2016 when it offered $1.9 billion. It did not come to market in 2014.

The North St. Paul Independent School District No. 622, Minn., (Aa2/NR/NR/NR) sold $193 million of GOs. Citigroup won the bonds with a true interest cost of 2.9968%. Ehlers was the financial advisor; Knutson Flynn Mendota was the bond counsel. Proceeds will be used to improve school sites and facilities.

The Napa Valley Unified School District, Calif., (A1/A+/NR/NR) sold $119 million of GOs. Morgan Stanley won the deal with a TIC of 3.2598%. KNN Public Finance was the financial advisor; Stradling Yocca was the bond counsel. Proceeds will finance repair, upgrading, acquisition, construction and equipping district sites.

Falls Church, Va., (Aaa/AAA/AAA) sold $118.545 million of GOs. Morgan Stanley won the bonds with a TIC of 2.7094%. Davenport was the financial advisor; McGuireWoods was the bond counsel. Proceeds will be used for the cost of certain capital improvement projects and to refund the city’s Series 2019 GO public improvement notes.

In the negotiated sector, Goldman Sachs priced the New York and Presbyterian Hospital’s (Aa2/NR/AA/NR) $500 million of Series 2019 taxable corporate CUSIP bonds.

Citigroup priced the Cypress-Fairbanks Independent School District, Harris County, Texas’s (PSF: Aaa/AAA/NR/NR) $352.895 million of Series 2019A unlimited tax school building bonds.

Barclays Capital circulated an indications of interest wire on the San Francisco Bay Area Rapid Transit District, Calif.’s (NAF/AA+/AA+/NAF) $296.385 million of sales tax revenue bonds

Tuesday’s municipal sales

New York, New York

The New York City Transitional Finance Authority said it intends to competitively sell about $250 million of building aid revenue bonds on Monday, Oct. 28. The BARB will mature from 2021 through 2049. Proceeds will be used to fund capital projects.

Separately, New York State said it will competitively sell $891.4 million of general obligation bonds in three offerings on Monday, Oct. 28. The deals consist of $317.63 million of Bidding Group 3 Series 2019B taxable refunding GOs, $305.17 million of Bidding Group 1 Series 2019B taxable refunding GOs and $291.805 million of Bidding Group 2 Series 2019B taxable refunding GOs.

Secondary market

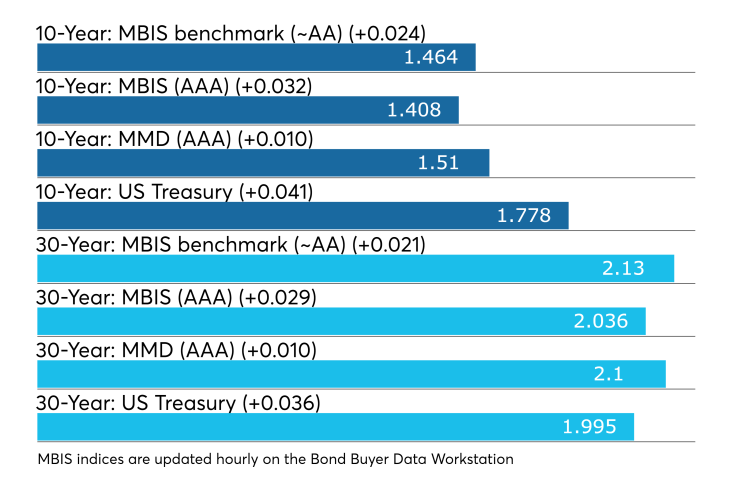

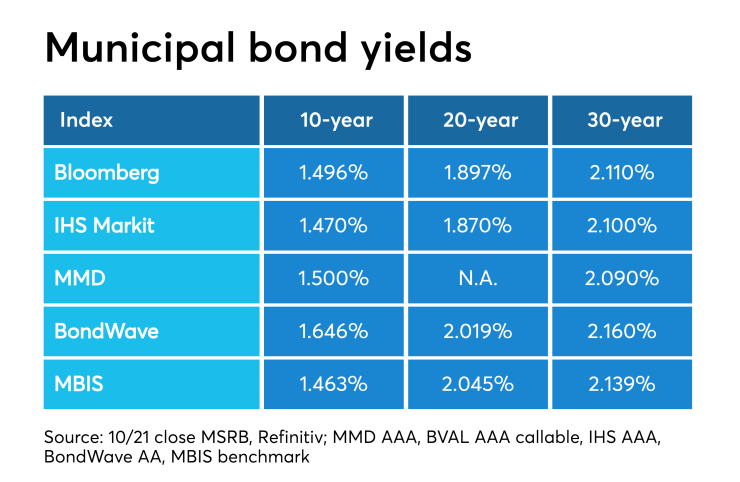

Munis were mixed on the MBIS benchmark scale, with yields rising by less than one basis point in the 10-year maturity and falling by less than a basis point in the 30-year maturity. High-grades were stronger, with yields on MBIS AAA scale falling by less than one basis points in the 10-year maturity and by three basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO rose one basis points to 1.51% while the 30-year rose one basis point to 2.10%.

“The ICE muni yield curve is one basis point higher as the market has a softer tone while focusing on the heavy new issue calendar,” ICE Data Services said in a Tuesday market comment. “High-yield is one basis point higher as well. Tobaccos are flat to one basis point higher. Puerto Rico is unchanged.”

The 10-year muni-to-Treasury ratio was calculated at 85.3% while the 30-year muni-to-Treasury ratio stood at 93.3%, according to MMD.

Stocks were trading mixed as Treasuries strengthened. The Treasury three-month was yielding 1.649%, the two-year was yielding 1.611%, the five-year was yielding 1.601%, the 10-year was yielding 1.778% and the 30-year was yielding 2.262%.

Previous session's activity

The MSRB reported 28,633 trades Monday on volume of $6.33 billion. The 30-day average trade summary showed on a par amount basis of $10.81 million that customers bought $5.90 million, customers sold $3.03 million and interdealer trades totaled $1.88 million.

New York, California and Texas were most traded, with the Empire State taking 18.242% of the market, the Golden State taking 15.846% and the Lone Star State taking 9.623%.

The most actively traded securities were the New York State Thruway Authority taxable Series 2019M 3.5s of 2043, which traded 24 times on volume of $64.82 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.