Top-shelf municipal bonds ended unchanged on Tuesday as eight separate groups won portions of the big Texas note deal.

Primary Market

Action got underway in the competitive arena as Texas sold $5.4 billion of Series 2017 tax and revenue anticipation notes.

Eight groups won the TRANs, including Wells Fargo Securities, Citigroup, RBC Capital Markets, Barclays Capital, Piper Jaffray, JPMorgan Securities, Goldman Sachs & Bank of America Merrill Lynch.

JPMorgan won $2.5 billion of the deal, taking $1.5 billion with a bid of 4%, a premium of $45,090,000, an effective rate of 0.977438% and taking $1 billion with a bid of 4%, a premium of $30,240,000, an effective rate of 0.959339%.

Wells Fargo won $1.1 billion, taking $200 million with a bid of 4%, a premium of $6,030,000, an effective rate of 0.968388%, taking $200 million with a bid of 4%, a premium of $6,070,000, an effective rate of 0.948278%, taking $200 million with a bid of 4%, a premium of $6,050,000, an effective rate of 0.958333%, taking $150 million with a bid of 4%, a premium of $4,621,500, an effective rate of 0.902025%, taking $150 million with a bid of 4%, a premium of $4,621,500, an effective rate of 0.908058%, taking $100 million with a bid of 4%, a premium of $3,045,000, an effective rate of 0.938223%, taking $50 million with a bid of 4%, a premium of $1,527,500, an effective rate of 0.928168%, and taking $50 million with a bid of 4%, a premium of $1,532,500, an effective rate of 0.918113%.

Citi won $961.11 million, taking $461.11 million with a bid of 4%, a premium of $13,856,355, an effective rate of 0.978444%, taking $350 million with a bid of 4%, a premium of $10,522,500, an effective rate of 0.968388%, taking $50 million with a bid of 4%, a premium of $1,517,500, an effective rate of 0.948278%, taking $50 million with a bid of 4%, a premium of $1,527,500, an effective rate of 0.938223%, and taking $50 million with a bid of 4%, a premium of $1,512,500, an effective rate of 0.958333%.

BAML won $368.89 million with a bid of 4%, a premium of $11,085,144, an effective rate of 0.978444%.

RBC won $225 million, taking $50 million with a bid of 4%, a premium of $1,510,000, an effective rate of 0.963361%, taking $50 million with a bid of 4%, a premium of $1,507,500, an effective rate of 0.968388%, taking $50 million with a bid of 4%, a premium of $1,507,500, an effective rate of 0.968388%, taking $25 million with a bid of 4%, a premium of $758,750, an effective rate of 0.948278%, taking $25 million with a bid of 4%, a premium of $756,250, an effective rate of 0.958333%, and taking $25 million with a bid of 4%, a premium of $752,250, an effective rate of 0.974421%.

Barclays won $160 million, taking $70 million with a bid of 4%, a premium of $2,116,800, an effective rate of 0.959339%, taking $45 million with a bid of 4%, a premium of $1,356,300, an effective rate of 0.969394%, taking $25 million with a bid of 4%, a premium of $757,250, an effective rate of 0.954311%, and taking $20 million with a bid of 4%, a premium of $606,800, an effective rate of 0.949284%.

Goldman won $50 million with a bid of 4%, a premium of $1,504,500, an effective rate of 0.974421%.

Pipe Jaffray won $35 million, taking $25 million with a bid of 4%, a premium of $752,700, an effective rate of 0.972612% and taking $10 million with a bid of 4%, a premium of $302,500, an effective rate of 0.958333%.

The notes, due Aug. 20, 2018, are rated MIG1 by Moody’s Investors Service, SP1-plus by S&P Global Ratings, F1-plus by Fitch Ratings and K1-plus by Kroll Bond Rating Agency.

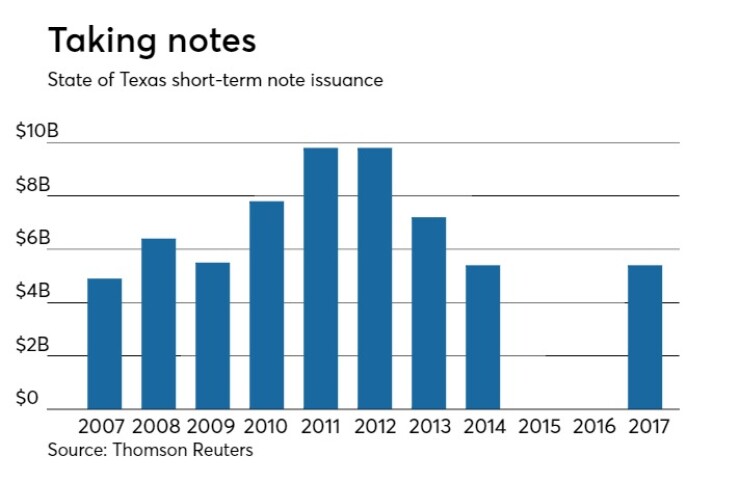

Since 2007 Texas has issued $62.2 billion in short-term notes with the most issuance occurring in 2011 and 2012, $9.8 billion each year. The Lone Star State did not sell notes in 2015 or 2016.

The Bend La Pine Administrative School District No. 1, Ore., competitively sold $175 million of Series 2017 general obligation bonds.

Mesirow Financial won the deal with a true interest cost of 2.81%. Pricing information was not available.

The deal, which is backed by the Oregon School Bond Guaranty program, is rated Aa1 by Moody’s and AA-plus by S&P.

In the negotiated sector, Wells Fargo priced the Washington Health Care Facilities Authority’s $256.4 million of Series 2017 revenue bonds for the Virginia Mason Medical Center.

The bonds were priced to yield from 2.52% with a 5% coupon in 2025 to 3.51% with a 5% coupon in 2037. A term bond in 2042 was priced to yield 3.96% with a 4% coupon.

The deal is rated Baa2 by Moody’s and BBB by S&P.

Piper Jaffray priced the South Dakota Health and Education Facilities Authority’s $212.22 million of Series 2017 revenue bonds for Regional Health.

The bonds were priced to yield from 0.88% with a 5% coupon in 2018 to 3.62% with a 3.5% coupon and 3.57% with a 4% coupon in a split 2037 maturity. A term bond in 2040 was priced to yield 3.25% with a 5% coupon.

The deal is rated A1 by Moody’s and A-plus by Fitch.

Bank of America Merrill Lynch priced Jacksonville, Fla.’s $144.71 million of special revenue and refunding bonds.

The $113.14 million of Series 2017A special revenue and refunding bonds were priced to yield from 0.85% with a 3% coupon in 2018 to 3.35% with a 4% coupon in 2038; a 2042 term bond was priced as 5 1/4s to yield 3.09% and a 2047 term was priced as 5 1/4s to yield 3.15%.

The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Barclays priced the Foothill/Eastern Transportation Corridor Agency’s $125 million of Series 2013B toll road refunding revenue bonds as a remarketing.

The Subseries B-1 term-rate current interest bonds were priced at par to yield 3.95% in a bullet 2053 maturity. The first coupon is on Jan. 15, 2018 and interest starts accruing on Aug. 24, 2017.

The deal is rated Baa3 by Moody’s and BBB-minus by S&P and Fitch.

Citi priced the Mecklenburg County Public Facilities Corp., N.C.’s $119.13 million of Series 2017 limited obligation refunding bonds.

The issue was priced to yield from 0.76% with a 3% coupon in 2018 to 2.17% with a 5% coupon in 2028.

The deal is rated Aa1 by Moody’s and AA-plus by Fitch and S&P.

Piper Jaffray priced the Conroe Independent School District, Texas’ $97.93 million of unlimited tax refunding bonds on Tuesday.

The bonds were priced to yield 0.78% with a 5% coupon in 2018 and to yield from 1.34% with a 5% coupon in 2023 to 3.01% with a 4% coupon in 2035.

The deal is insured by the Permanent School Fund guarantee program and is rated triple-A by Moody’s and S&P.

Secondary market

The yield on the 10-year benchmark muni general obligation was steady from 1.90% on Monday, while the 30-year GO yield was flat from 2.75%, according to the final read of Municipal Market Data's triple-A scale.

Treasuries were weaker on Tuesday. The yield on the two-year Treasury rose to 1.32% from 1.30% on Monday, the 10-year Treasury yield gained to 2.21% from 2.18% and the yield on the 30-year Treasury bond increased to 2.79% from 2.77%.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 85.9%, compared with 87.2% on Monday, while the 30-year muni-to-Treasury ratio stood at 98.6% versus 99.5%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 31,000 trades on Monday on volume of $5.45 billion.