DALLAS – Voters in Harris County approved a record $2.5 billion flood bond proposal on the anniversary of Hurricane Harvey’s landfall in Texas Saturday, but the bonds may not come to market anytime soon, officials said.

More than 85% of voters supported the bond proposal, a margin that Harris County Judge Ed Emmett called "remarkable."

In designing the bond proposal known as Proposition A, Harris County Commissioners who also govern the Harris County Flood Control District, said they needed voter authorization to provide a local match for federal funds when they become available.

“The bonds would be sold in increments over at least 10-15 years, as needed for the multiple phases of each project,” the Harris County Flood Control District noted in a report to county voters. “The actual timing of individual projects will depend on a variety of factors including environmental permitting and right-of-way acquisition.”

The district created a list of 237

“There must be some flexibility in maintaining this list as projects are defined, designed and constructed,” the district said.“Over the next several years, projects on the list could be altered based upon community input or design constraints, be removed, or new projects added, depending on future unknown conditions including right-of-way availability, changing environmental regulations and funding that may come available from other partners.”

The proposed bond projects would increase the average homeowner's property tax bill by $5 per year over the next 10 to 15 years, according to the district, though for the majority of senior homeowners, there would be no increases.

Emmett, who led informational sessions with voters throughout the county, called the vote the most important local election in his lifetime, while acknowledging that a tax increase would be required to support the bonds.

“Based on a likely borrowing schedule over approximately 15 years, the Harris County Budget Management Department estimates that the overall tax increase would be no more than 2-3 cents per $100 of assessed home valuation – meaning that most homeowners would see an increase of no more than 1.4% in their property tax,” Emmett said in a prepared statement. “Because of county property tax exemptions, homeowners with an over-65 or disabled homestead exemption on a home assessed at $200,000 or less would pay NO additional taxes for these bonds.”

The National Oceanic and Atmospheric Administration estimated that Harvey caused $125 billion in damages, the second costliest storm in U.S. history behind the $161 billion in damages inflicted by 2005's Hurricane Katrina that flooded New Orleans.

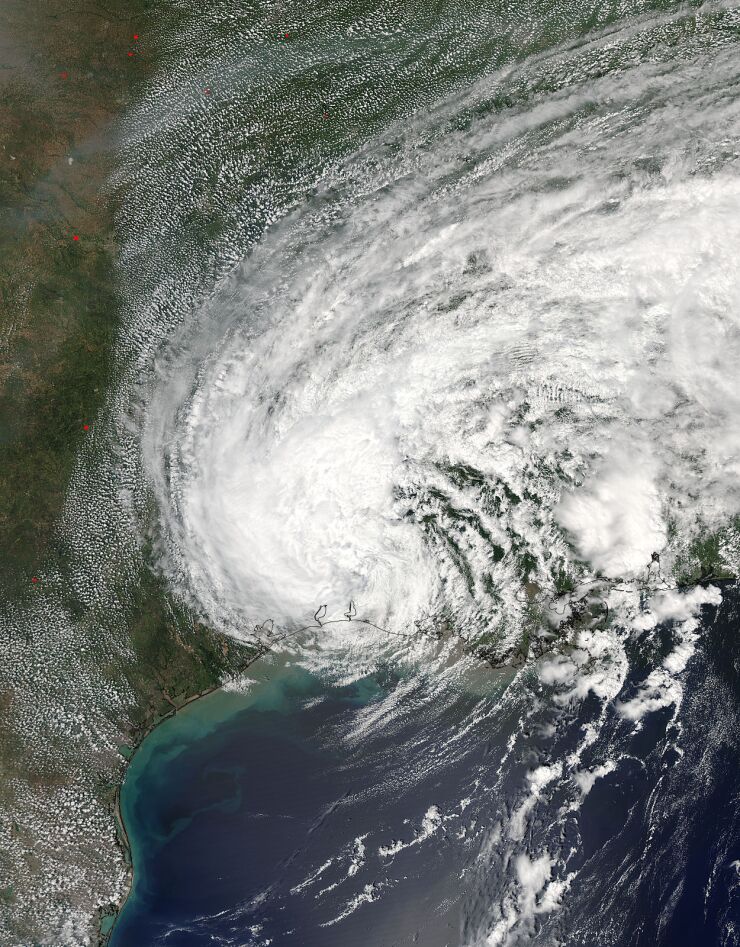

Once over land, Hurricane Harvey was downgraded to a tropical storm but dumped 27 trillion gallons of water on southeast Texas, flooding 204,000 Harris County homes and apartments and killing more than 50 people in the county.

Harris County, which includes Houston, is the most populous county in Texas and the nation's third most populous.

Despite the destruction, Harris County’s assessed property value has increased 2.8% since then, according to Moody’s Investors Service, which rates the county Aaa with a stable outlook.

Among cities, Houston's assessed value has increased 2.1% to $234.1 billion, according to preliminary 2019 data. That is down from 2.9% growth in fiscal 2018.

Among school districts, the state’s largest, Houston Independent School District, has seen its tax base grow Among cities, Houston's AV has increased 2.1% to $234.1 billion, according to preliminary 2019 data. That is down from 2.9% growth in fiscal 2018.

Property tax values for most of the municipal utility districts in the region suffered little damage due to proper land-use planning, Moody’s said. Only one MUD was downgraded and is likely to see its assessed value decline, analysts said.

S&P Global Ratings also rates the county triple-A with a stable outlook.

"We consider Harris County's economy very strong," said S&P analyst Andy Hobbs. "It has a projected per capita effective buying income of 103.1% of the national level and per capita market value of $95,524. Overall, the county's market value grew by 4% over the past year to $438.4 billion in 2018."

The Harris County Flood Control District was created by the Texas Legislature in 1937 and governed by Harris County Commissioners Court. The district provides programs and policies to protect homes and businesses and aid economic development.

The flood district controls storm and flood water of rivers and streams and the reclamation and drainage of overflow land. The district manages a storm water plan and more than 1,500 channels that run about 2,500 miles combined. Most of the county’s 4.6 million people live in the 1,778-square-mile district.

The district's staff of about 380 obtains virtually all engineering design work for capital projects or maintenance repairs through consulting contracts, and assigns all construction work through the public bidding process. Nearly 100% of the district's routine maintenance is performed through contracts with private companies.

The district may levy a tax rate up to 30 cents per $100 of assessed value. There is no limitation on the tax rate that may be set for debt service within the 30-cent tax rate limit. The tax rate for operations and maintenance is limited to the rate as may from time to time be approved by district voters. The maximum tax rate for O&M is 15 cents per $100 of AV. The district currently levies a total tax of 2.831 cents, of which 2.74 cents is for O&M and 0.1 cents is for debt service.

JPMorgan Chase Bank N.A. provides liquidity under a credit agreement that expires Dec. 11, 2020.

The district issued $65 million of commercial paper notes last year.