-

Municipal bond insurers wrapped $18.592 billion in the first half of 2024, a 19.5% increase from the $15.561 billion insured in the first half of 2023, according to LSEG data.

August 19 -

New York state's issuers topped the Northeast charts as issuance rose in nearly every sector of the market during the first half of 2024.

August 19 -

Barclays rate strategists believe the 10-year part of the Treasury curve has room to cheapen. "In that case, tax-exempts will likely not only follow, but underperform."

August 16 -

The state plans to price the bonds in early October.

August 16 -

Municipal bond mutual funds saw inflows as investors added $528.7 million to funds after $674.1 million of inflows the week prior, according to LSEG Lipper. This marks seven straight weeks of inflows.

August 15 -

Long-term liabilities have gone down and revenues have gone up, Fitch said.

August 15 -

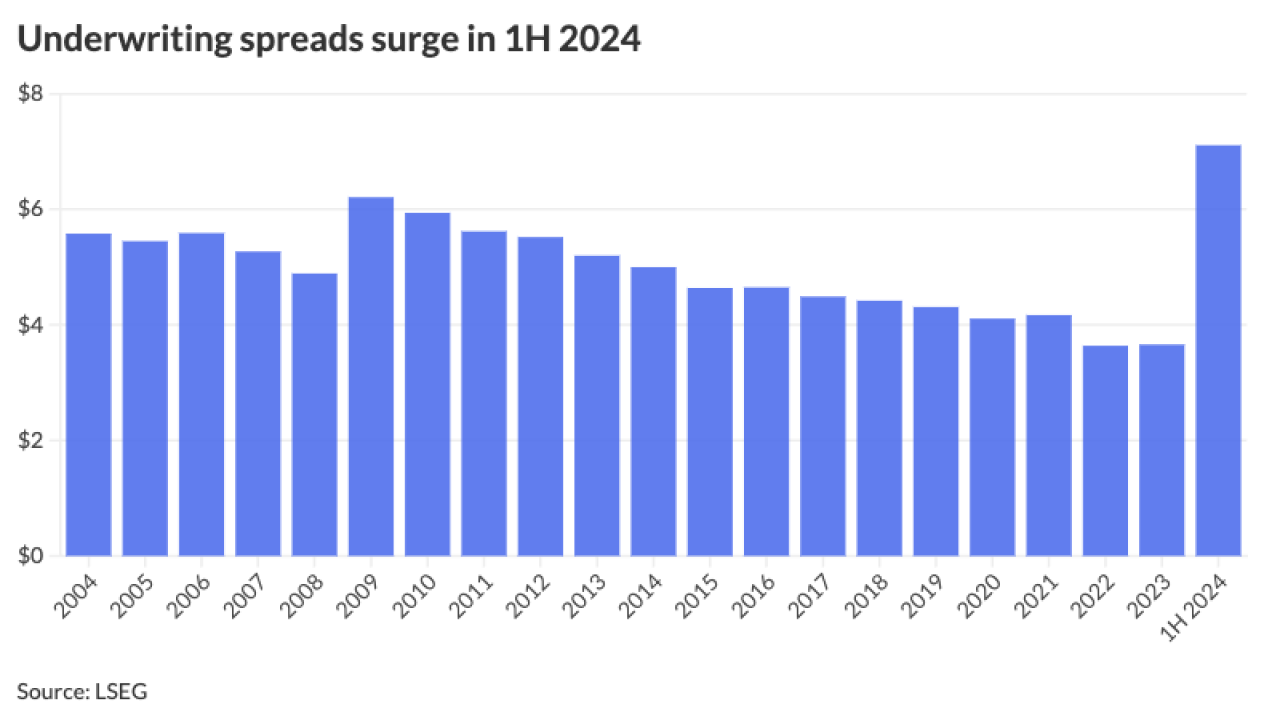

Underwriting spreads rose to $7.11 in the first half of 2024 from $3.70 in the first half of 2023.

August 15 -

The state has selected a stretch of Interstate 24 between Nashville and Murfreesboro to be its first "Choice Lane," an optional toll lane to bypass congestion.

August 15 -

The Investment Company Institute reported $839 million of inflows into municipal bond mutual funds for the week ending Aug. 7 after $442 million of outflows the week prior. Exchange-traded funds saw $680 million of inflows after $950 million of inflows the previous week.

August 14 -

Moody's sees strength in New Jersey's economy and governance.

August 14