-

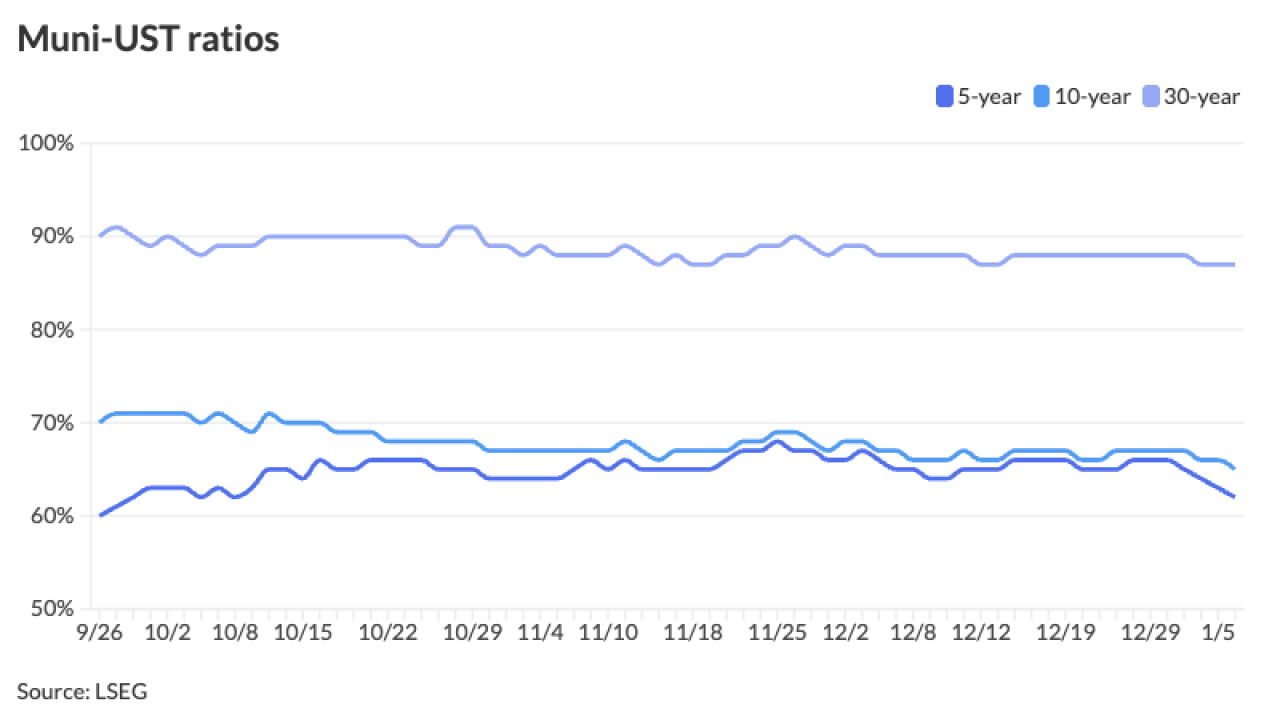

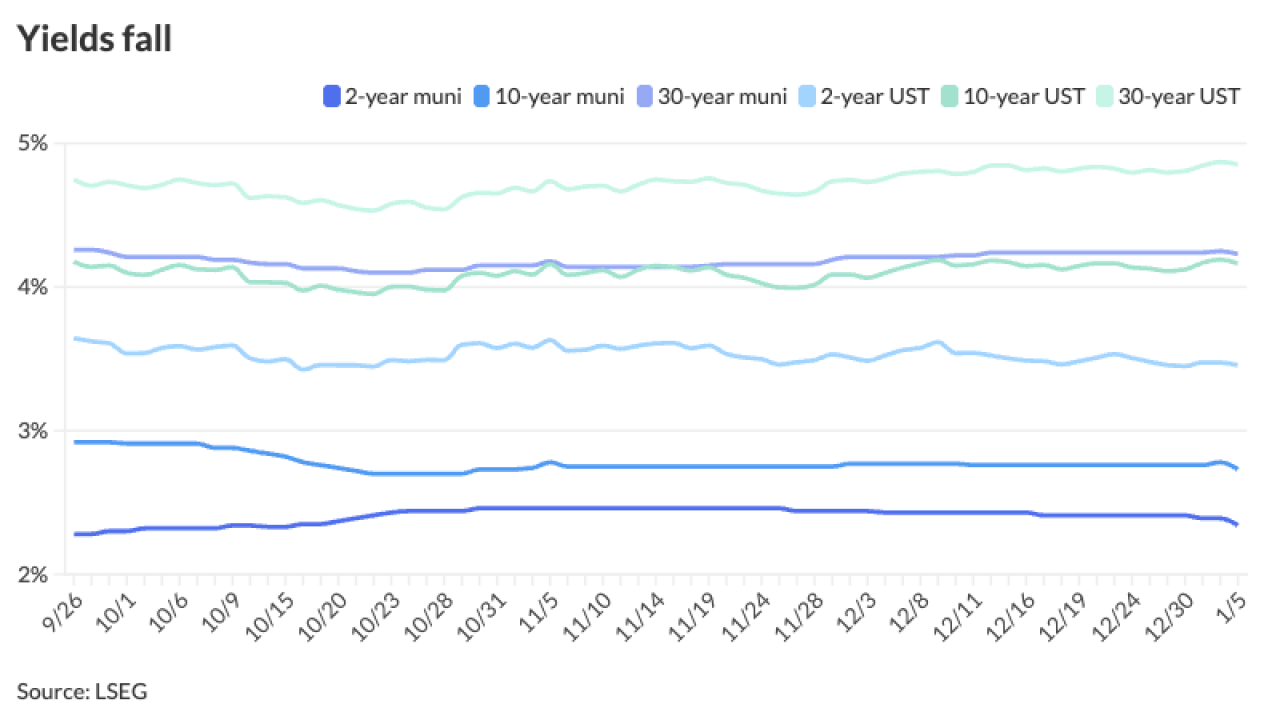

Surprisingly, the expected surge in net supply last year did not elicit a major repricing in the muni market, said Pat Luby, head of municipal strategy at CreditSights.

January 7 -

Market Intelligence analyst Jeff Lipton, in the second installment of his three-part 2026 outlook series, maps out quality-centric portfolio shifts, barbell and long-end strategies, and sector tilts across hospitals, higher education and housing as record supply and net inflows drive the muni market.

January 7 The Bond Buyer

The Bond Buyer -

Boys Town, Nebraska, home of a high-profile sanctuary for troubled kids, heads into the bond market after a two-notch downgrade and recent abuse claims.

January 7 -

Confidence in the muni market is "well placed," said Matt Fabian, president of Municipal Market Analytics.

January 6 -

The National Association of State Treasurers officially announced new leadership for 2026, including new president Michigan State Treasurer Rachael Eubanks.

January 6 -

In the first of his three-part 2026 municipal outlook series, Market Intelligence analyst Jeff Lipton forecasts for sub-5% returns, continued demand, possibly more curve steepening as the Fed eases slowly, the economy skirts recession, and AI, tariffs and midterm politics potentially reshaping risks across public finance sectors.

January 6 The Bond Buyer

The Bond Buyer -

Improved risk sentiment after the capture of Venezuelan President Nicolás Maduro helped pull investors into all markets and munis are a "beneficiary" of that shift, said James Pruskowski, an investor and market strategist.

January 5 -

Late last month, PureCycle Technologies amended the indenture and loan agreement for the bonds issued for its Ironton, Ohio, project.

January 5 -

The Maine Municipal Bond Bank is bringing back its transportation revenue bond program, with a few changes to bolster the bonds' credit.

January 5 -

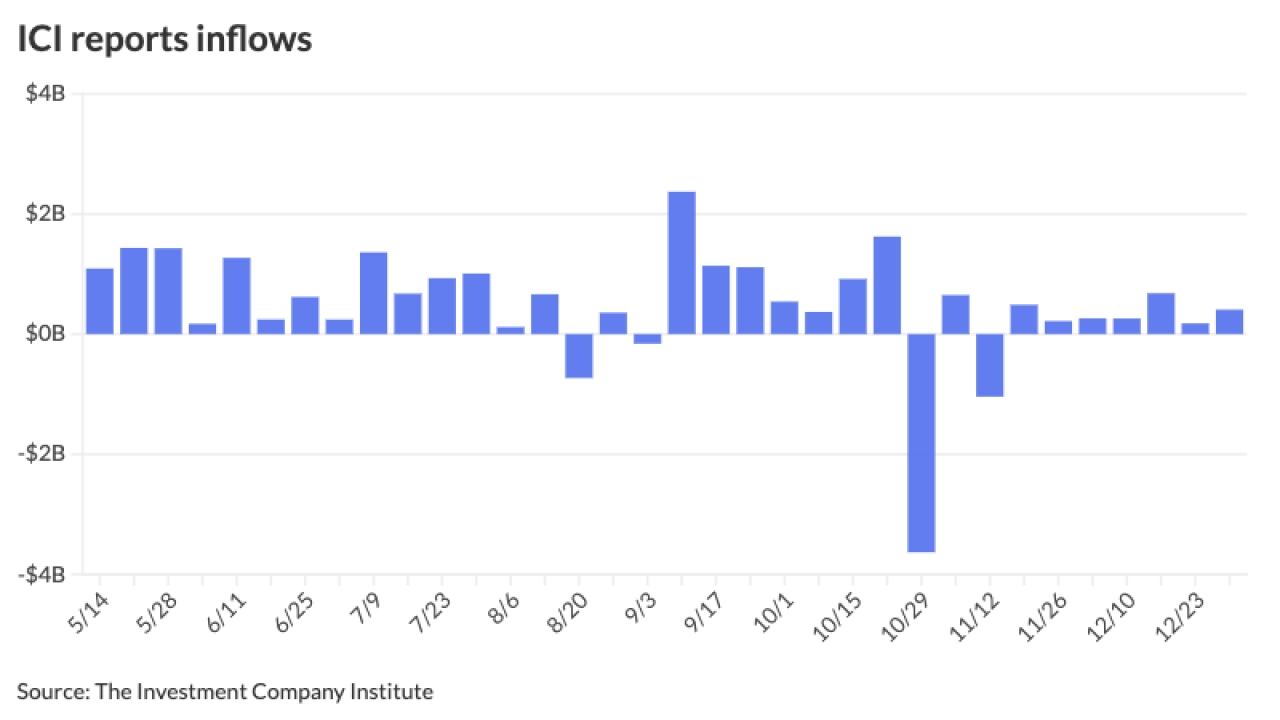

With the muni calendar "heating up" ahead of another projected year of record issuance, Jeff Lipton, The Bond Buyer's market intelligence strategist, expects "investor demand to comfortably digest the new supply given reinvestment needs and compelling yield and income opportunities."

January 2