-

"It is important to remember that as long as the Fed's next move is to lower policy rates, bonds will do well," said Jack McIntyre, portfolio manager at Brandywine Global. "The employment market is in better balance, which is very important for the Fed — even more than inflation."

June 12 -

The Biden administration's accelerated deadlines for exiting dirty energy like coal could pressure utilities already facing growing demand, the rating agency said.

June 12 -

Driven by ongoing capital expenditure funding and current refunding opportunities, airport issuance is estimated at $21 billion in 2024, with a slew of from June through September and more planned in December, according to Ramirez.

June 12 -

"We will remain cautious until CPI and the FOMC are in the rear-view mirror and as long as these don't catalyze a sell-off (since that would trigger outflows) or catalyze a sharp rally (as municipals lag rates during a sharp rally and ratios can increase optically) ... " said Vikram Rai, head of municipal markets strategy at Wells Fargo.

June 11 -

Even after paring down the capital plan, the MTA will need to issue debt, and sooner than planned. It will be issued under the MTA's transportation revenue credit rather than its congestion pricing credit, so near-term debt service costs will be higher, CEO Janno Lieber said.

June 11 -

Many issuers are trying to understand rating agency methodology changes that could affect more than a third of them.

June 11 -

Munis should see better performance this week as issuance falls to $5.2 billion this week and cash still needs to be reinvested, said Jason Wong, vice president of Municipals at AmeriVet Securities.

June 10 -

The Water and Power Authority got good financial news from the U.S. Federal Emergency Management Agency but bad financial news from a federal court in Puerto Rico.

June 10 -

The ratings agency cited growing enplanement counts, expectations of resilience during future economic downturns, and strong management for its upgrade to AA from AA-minus.

June 10 -

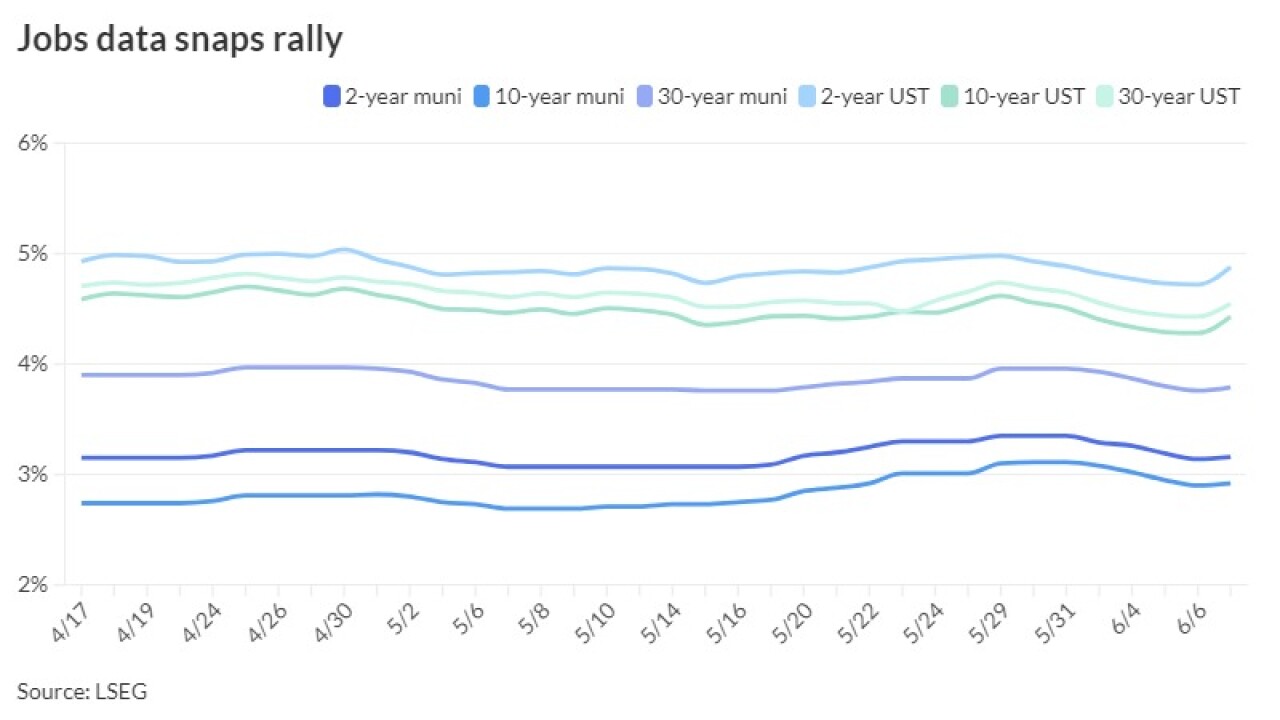

USTs spiked 17 basis points on the short end and 15 to 12 10-years and out following the release, while triple-A curves saw yields rise two to five basis points, depending on the yield curve, in a more muted and typical reaction for the asset class.

June 7