-

Illinois will sell $725 million of junior sales tax revenue bonds in a competitive deal pricing Tuesday. The Build Illinois bonds will fund capital projects.

March 5 -

Short-end U.S. Treasuries rallied mid-morning, while UST yields were little changed out long, but ended the day weaker across most of the curve with the greatest losses out long. Munis were steady throughout the day.

March 4 -

The New York City Transitional Finance Authority plans to make an impact on the municipal market this month with $1.8 billion of bond sales.

March 4 -

S&P Global Ratings primarily cited a "precipitous decline" in unrestricted cash to explain its triple-notch downgrade of the system.

March 4 -

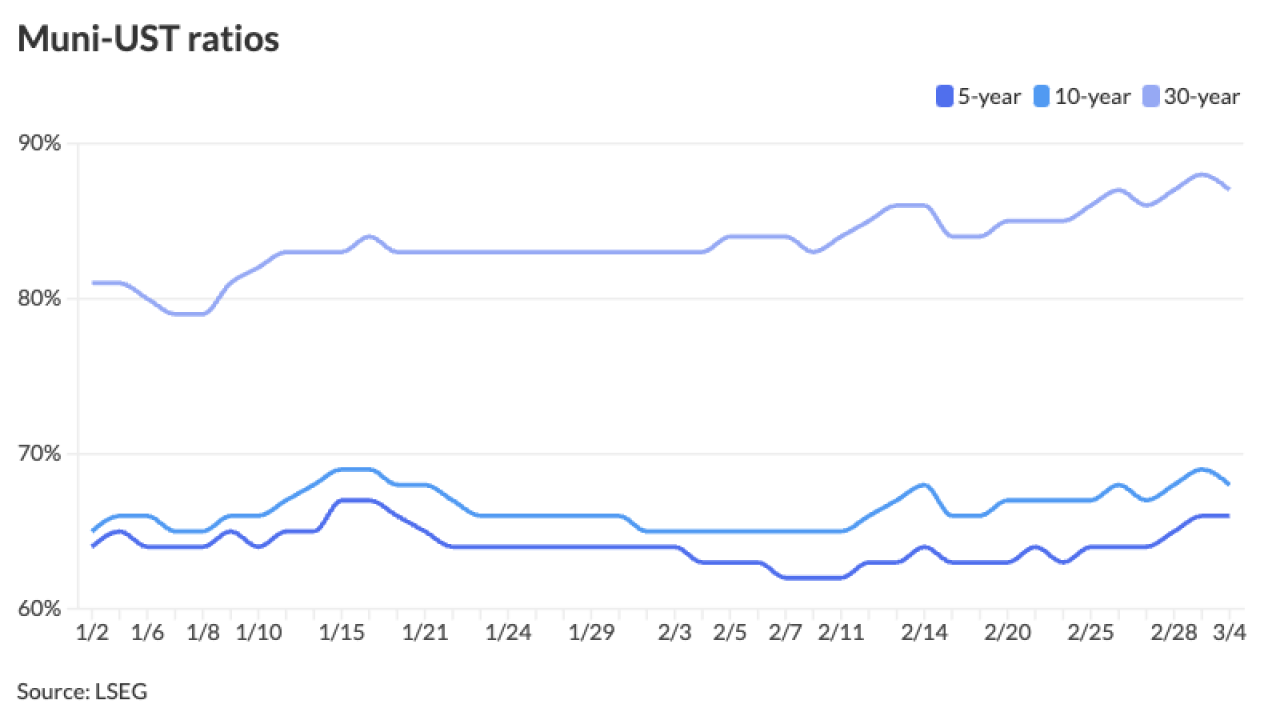

"Apathy and caution" were the theme of the past week, said Birch Creek strategists.

March 3 -

Wisconsin will be in the market Wednesday with $253.9 million of general obligation bonds, with some proceeds funding the Blatnik Bridge replacement project.

March 3 -

The Trump administration wants to shed federal office space, and bonds backed by those leases are feeling the heat.

March 3 -

The $2.5 billion Brightline West and $849 million Hawaii deals stood out among the rash of issuances last month alongside the ongoing tax exemption debate.

March 3 -

New York City leads the negotiated calendar with $1.4 billion of GOs, followed by the Regents of the University of California with $1.2 billion of general revenue bonds.

February 28 -

Bond trustee UMB Trust has engaged Lighthouse Management Group to serve as the receiver.

February 28