-

The correction to the municipal market has improved muni to UST ratios while uncertainty hangs over ahead of the election. J.P. Morgan's Peter DeGroot said the firm expects the end of next week "will mark the end of the difficult technical period in 2024 and believe that net supply in November will lead to better valuations broadly in the municipal market."

October 25 -

As federal funding dries up, cites are searching for new funding sources.

October 18 -

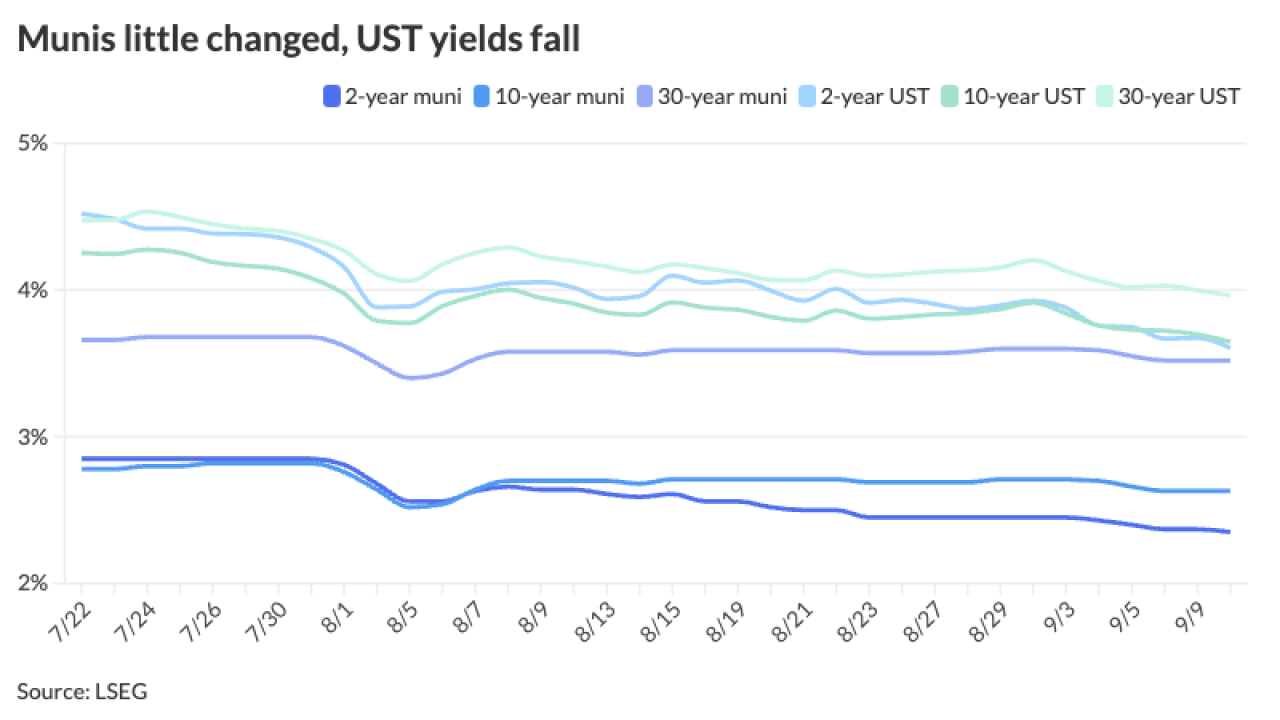

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Months after the SEC approved several spot bitcoin exchange-traded product shares, a number of Midwest public pension funds are dabbling in crypto investments.

August 14 -

When Wisconsin priced $253.755 million of GO refunding bonds on July 23, it was the state's second forward delivery deal in recent months.

August 7 -

Every state in the Midwest has clean water and drinking water financing programs. Those financing mechanisms may face greater strain in the years ahead.

July 10 -

Milwaukee Public Schools is months late in submitting the annual financial audit reports amid turmoil that has seen its superintendent and comptroller depart.

June 12 -

St. John's Lutheran Church in Madison is redeveloping its property to build affordable housing blocks from the Capitol in the booming East Washington corridor.

June 5 -

Fitch Ratings cited new rating criteria and increases in state funding in giving Milwaukee a three-notch bond rating boost. The outlook is stable.

May 15 -

States are increasingly turning to public-private partnerships with developers to create new workforce housing so residents can afford to live where they work.

April 17 -

Duluth-based St. Luke's affiliation with Aspirus Inc. has lifted the prospects for its speculative-grade bonds; S&P placed the hospital on CreditWatch positive.

April 15 -

With cyberattacks on the rise, issuers have had to keep fortifying their defenses against criminals targeting the public sector.

April 10 -

Voters in the Milwaukee Public Schools District passed a referendum Tuesday that would raise property taxes to fund $252 million of additional spending.

April 8 -

Three Pillars Senior Living has already pre-sold 70% of the planned units that will support the bonds.

March 25 -

This spring brings a bevy of school referendums in the Midwest. With inflation and property tax fatigue, voters may be increasingly reluctant to say yes.

March 20 -

Despite several larger deals entering the primary, the vast amount of cash on hand has not allowed munis to cheapen amid UST volatility and ultra-rich ratios

March 19 -

Rural hospitals and clinics are closing in Wisconsin while Democratic Gov. Tony Evers battles the state's Republican legislature over Medicaid expansion.

March 13 -

Some public colleges in the Midwest are facing budgetary squeezes paired with programming directives from state legislators, a departure from trends elsewhere.

February 28 -

Larger deals, fewer issues: those were the overarching municipal bond sale trends, along with a surge in tax-exempt deals, across the Midwest in 2023.

February 21 -

A private university in Milwaukee will borrow $163.7 million through tax-exempt bonds to build new emergency response facilities for the state and county.

February 20