-

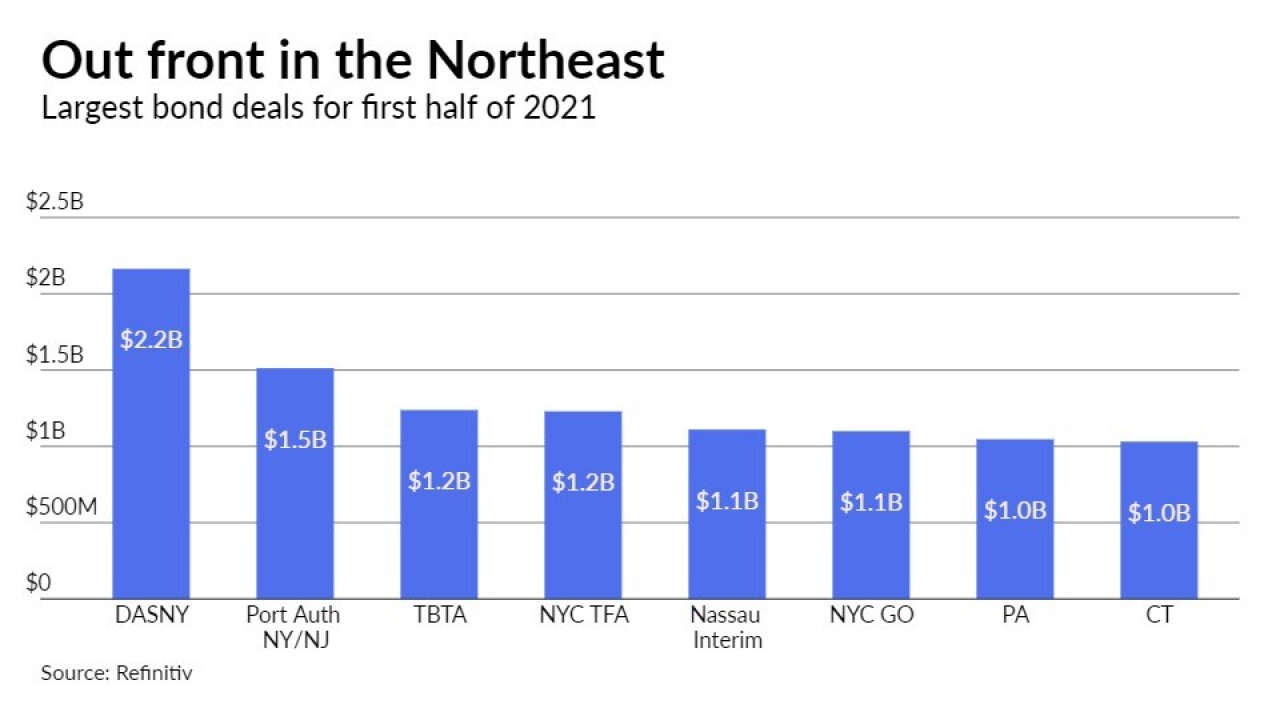

Issuers sold nearly $60 billion of debt as states, cities and agencies adjusted to the COVID-19 environment and other variables.

August 20 -

The reserve was used to make a $9.3 million Aug. 2 payment on about $290 million of debt. About $9.3 million is left in the fund, enough for the Feb. 1 payment.

August 6 -

Better funding levels prompted S&P Global Ratings to revise the outlook on the state's BBB-plus GO bond rating to positive from stable.

August 5 -

The New Jersey Educational Facilities Authority and the Ivy League university named Ramirez Asset Management, in their first collaboration with an MWBE firm.

July 19 -

A brightening revenue and liquidity picture and improved fiscal governance and management were cited as Moody's assigned a positive outlook.

July 14 -

Ridership displacement, remote work and online shopping amplify pre-pandemic challenges such as large capital plans.

July 1 -

A $3.7 billion transfer from the general fund would cover $2.5 billion for retiring and defeasing state debt, and $1.2 billion to backstop capital construction projects.

June 29 -

The U.S. Department of Transportation secretary and elected leaders from New York and New Jersey pitched the $11.6 billion project, citing economic and safety concerns.

June 29 -

The agreement over middle-class tax relief could set the stage for passage of the fiscal 2022 budget.

June 22 -

The businessman and former Assembly member looks to prevent the first re-election of a Democratic governor in more than 40 years.

June 9 -

The environmental impact ruling and record of decision are a major milestone for the multibillion-dollar Gateway infrastructure project.

May 28 -

In California, where state revenues are pouring in well ahead of projections even before American Rescue Plan funds arrive, lawmakers have spending plans.

May 13 -

A favorable response would enable pre-construction work for the long-awaited $11.6 billion upgrade of New Jersey-New York train tunnels.

May 13 -

Regina Egea, president of the Garden State Initiative, analyzes New Jersey's fiscal landscape, including the proposed state budget, unfunded pension liability and deficit borrowing. Paul Burton hosts. (20 minutes)

May 4 -

The bistate agency’s exports link increasingly to information-based services, an NYU Rudin Center study says.

April 27 -

Refinitiv Lipper reported $1.889 billion of inflows, with $641 million in high-yield. Negotiated deals repriced to lower yields while competitive loan yields were compelling from New Jersey and Los Angeles USD.

April 22 -

Sub-1% 10-year municipals and low ratios may test investor appetite for the asset class but it is hard to ignore the strong fundamentals and substantial fund flows in the backdrop.

April 16 -

New Jersey lines up $400M sale with outlook boost

April 15 -

Dynamics at play in New Jersey include the pandemic, an election year, massive borrowing, significant federal aid and a major pension liability problem.

March 19 -

U.S. Deputy Transportation Secretary nominee and former New York City official Polly Trottenberg called it 'a project of national significance.'

March 8