-

Moody's revised the outlook on Nevada's GOs and COPs to stable from negative.

July 20 -

Brightline Holdings will wait until 2022 to try again to finance a passenger train to Las Vegas from Southern California with tax-exempt bonds.

June 24 -

Arizona and neighboring states are preparing for the first mandatory cuts in water from the Colorado River after 20 years of drought.

May 10 -

Gov. Steve Sisolak opted to form a joint committee to study the idea, rather than proposing legislation this session.

April 26 -

The three mining tax proposals would require a constitutional amendment because the current tax cap is baked into the constitution.

March 18 -

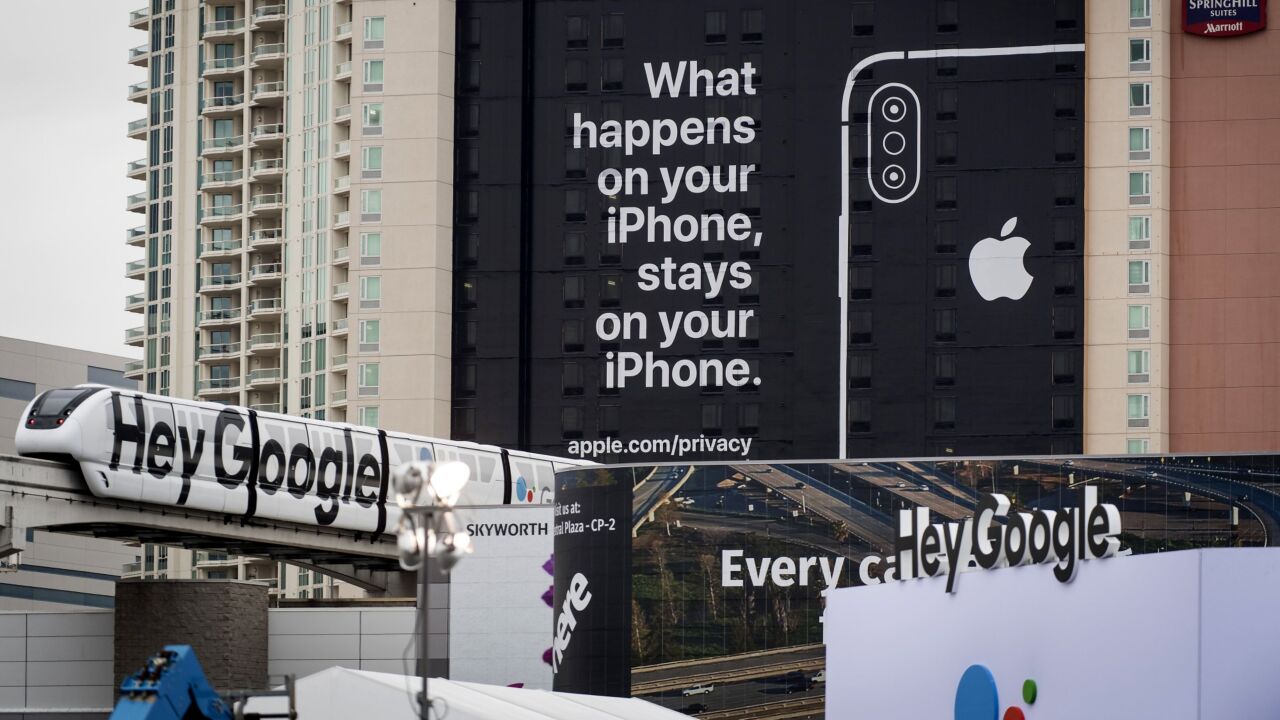

The second bankruptcy of the Las Vegas Monorail was much smaller than the first, and bondholder Preston Hollow LLC is getting paid a full $22 million.

December 14 -

Clark County, Nevada's reserve draw, brought about by low hotel tax revenues, has no rating impact on the limited tax general obligation bonds, Moody's said.

December 11 -

California will give the private activity bond capacity granted to the high-speed rail project to affordable housing projects and other qualifying ventures.

November 2 -

Pricing was delayed for a $3.2 billion municipal bond deal to finance a passenger railroad between southern California and Las Vegas.

October 16 -

The company's upcoming $3.2 billion deal marks the largest sale of unrated debt in the muni market.

October 1 -

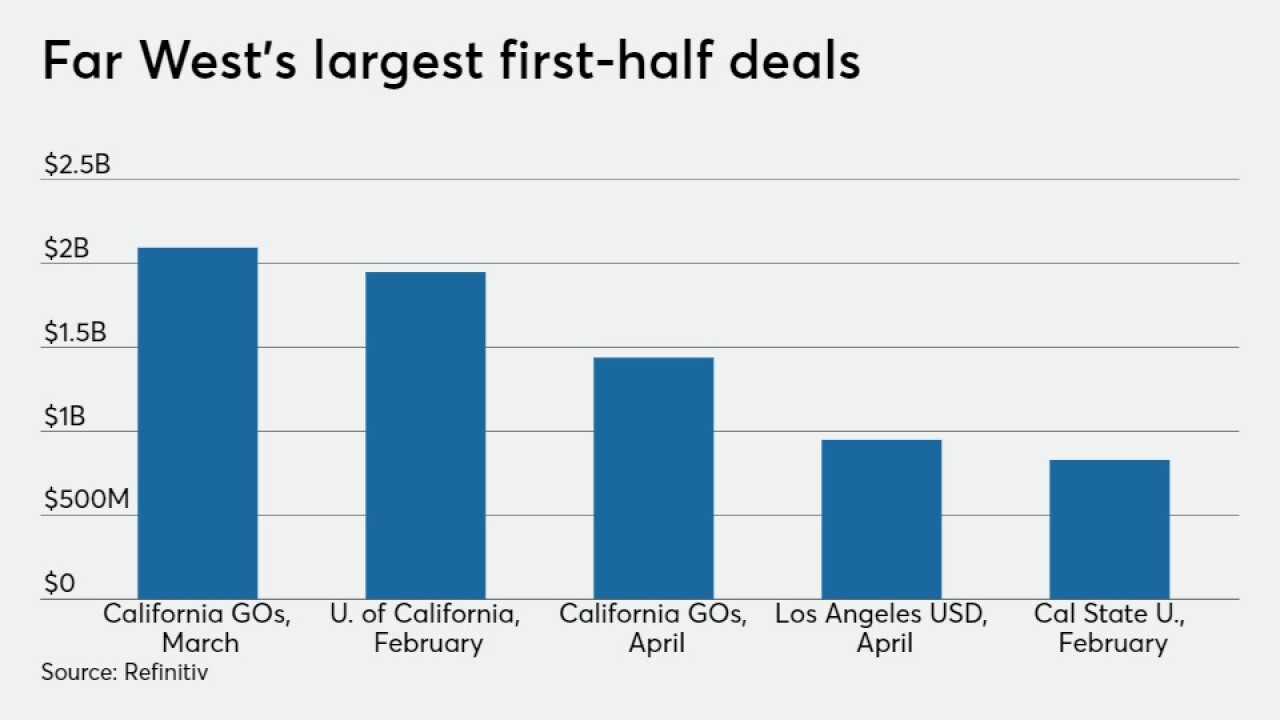

Municipal issuers in the Far West sold $38.7 billion in bonds during the first six months of 2020, 8.8% more than they did the year before.

August 27 -

Citing market turmoil from the pandemic, a California conduit issuer gave the Virgin Trains USA project a five-month extension to sell $3.25 billion of debt.

June 29 -

Moody's action on Aa1-rated Nevada follows a Fitch Ratings outlook cut to negative three weeks ago as the coronavirus hammers a tourism based state economy.

June 2 -

Fitch Ratings downgraded Las Vegas a notch to AA-minus

May 12 -

Nevada was one of the last states to recover from the Great Recession

April 24 -

AA-rated Las Vegas saw its outlook revised to negative by S&P Global Ratings with casinos shuttered and visitors absent.

March 30 -

Issuers in the Far West sold $85 billion of municipal bonds in 2019, a 23% increase from 2018.

February 27 -

Fitch Ratings raised the Las Vegas suburb to BBB-minus from BB, with a stable outlook.

January 31 -

The California Debt Limit Allocation Committee wants more information on the request for $600 million of private activity bond allocation.

January 16 -

S&P Global Ratings elevated Nevada's rating to AA-plus, two days after a Moody's upgrade.

November 11