-

During its regular meeting Monday night, the Newton, Iowa, Community School Board of Education took another step forward in funding the new Berg Middle School.

March 30 - Michigan

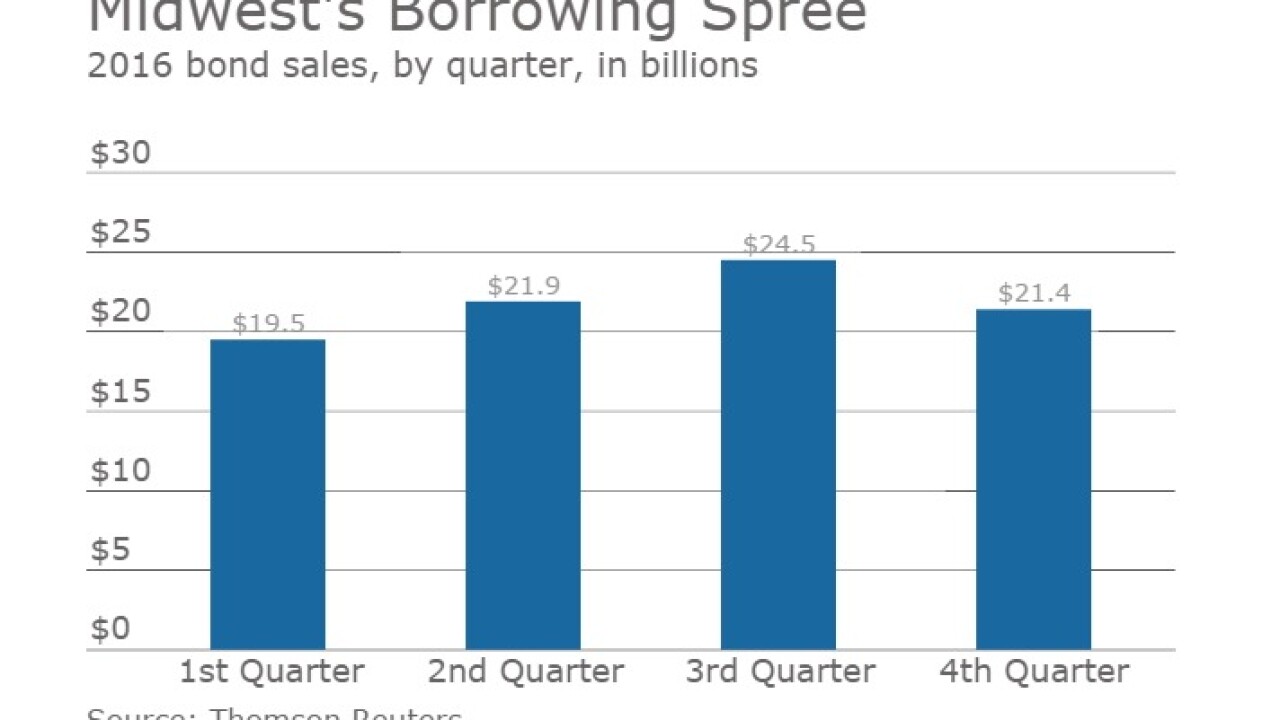

Issuers in the Midwest sold $87.2 billion of municipal bonds in 2016, a 23.4% year-over-year increase that was the biggest of any region.

February 14 - Iowa

Iowa s Xenia Rural Water District brought its long financial struggles to a happy ending as it formally shed remaining bonds from its troubled 2006 issue, ending a saga that began with an ambitious expansion that led to default and concerns over the districts solvency.

December 6 - Iowa

The Iowa Fertilizer Co. LLCs successful receipt of bondholder waivers and completion of a tender exchange for $150 million of the original nearly $1.2 billion deal eases pressures on the struggling project without eliminating them.

December 5 -

The Iowa Fertilizer Co. LLCs construction and cash flow troubles led Fitch Ratings to downgrade deeper into junk almost $1.2 billion of project bonds that are now under an Internal Revenue Service cloud.

November 21 - Missouri

The issuers of the Midwest sold $41 billion of municipal bonds in the first half of 2016, spurred by increased new money issuance, according to Thomson Reuters data.

August 23 -

An Iowa casino and racetrack is challenging the proposed loss of its tax-exempt status by the Internal Revenue Service, claiming it lessens the burdens of government and is a legitimate 501(c)(4) social welfare organization.

June 21 - Iowa

Iowa will return to the market twice this month after a six-year absence to snag refunding savings.

June 20 -

The Conroe Industrial Development Corporation in Texas has paid a penalty and agreed to redeem bonds under the Internal Revenue Services voluntary closing agreement program (VCAP) to settle a tax violation relating to bonds it issued in 2008 and refunded in 2012.

April 11 - Iowa

Coralville, Iowas general obligation bond rating moved closer to speculative grade amid balance sheet struggles due in part to its investment in recreational enterprises.

December 10 -

Standard & Poor's revised its outlook on the Iowa Board of Regents' University of Iowa Hospitals and Clinics to stable from negative after a decision to trim capital spending.

November 5 - Iowa

Fairfield, Iowas rating sank to the lowest investment grade at Moodys Investors Service, which warned it could drop further over operating deficits that have strained the towns balance sheet.

June 15 - Iowa

Moody's Investors Service has upgraded the rating of Winterset Community School District in Iowa to A1 from A2.

May 12 -

Moody's Investors Service revised its outlook for Cedar Rapids, Iowa-based Mercy Medical Center to stable from negative Feb. 24, when it affirmed the medical center's A2

February 26 -

Iowa Gov. Terry Branstad signed into law a transportation funding package that raises the state's tax on gasoline and diesel fuel by 10 cents a gallon and lifts permit fees on oversized vehicles.

February 25 - Illinois

Municipal bond borrowing by Midwestern issuers picked up steam last year, rising by 6.9% to $63.5 billion as issuers loosened the reins a bit on new money borrowing and refundings recorded double-digit gains thanks to favorable interest rates.

February 24 - Iowa

The Iowa Finance Authority hits the market Wednesday with $323 million of new-money and refunding state revolving bonds that will carry a green designation.

February 3 -

Legislation raising Iowa's gasoline tax by as much as 10 cents to bolster state transportation spending is being prepared with several key lawmakers saying the bill stands a good chance due to mounting bipartisan support for action.

January 29 -

Operating gains prompted Moody's Investors Service to revise Iowa's UnityPoint health system's outlook to stable from negative.

December 15 - Iowa

The Iowa Public Employees' Retirement Systems funded ratio rose to 82.7% in the last fiscal year up from 81% a year earlier.

December 8