-

Toni Harp says New Haven does not intend to apply to Connecticut's oversight board despite budget struggles and deficit borrowing.

September 10 -

City officials want to avoid more draconian state oversight by the new Municipal Accountability Review Board.

September 7 -

Such a move might allay fears in the capital markets while removing lawmakers from decision-making, according to consultant Jim Millstein.

August 29 -

Wilshire Consulting said the aggregate funded ratio for U.S. state pension plans remained unchanged between and first and second quarters of 2018 at 70.8%, up 0.7 percentage points from the previous 12 months.

August 27 -

The proposed Treasury rules would limit states' use of charitable deductions as workarounds for the $10,000 cap on the federal deduction for state and local taxes.

August 23 -

Two of three sales in Connecticut’s recent bond offering set record retail orders, said state Treasurer Denise Nappier, while spreads continued to drop.

August 21 -

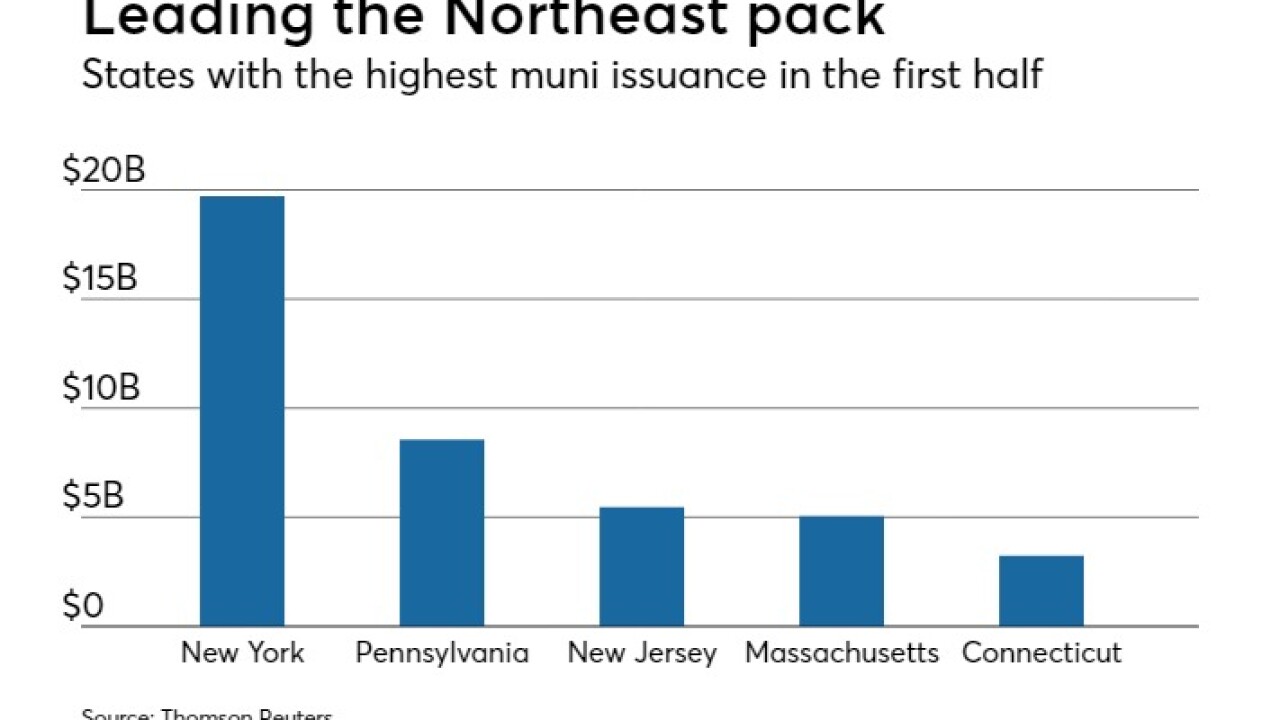

Northeast municipal bond issuance sank 11.7% in the first half of 2018 compared to a year earlier, reflecting a national trend driven by federal tax changes.

August 17 -

With the state's stagnant economy as a backdrop, Democrat Ned Lamont will face Republican Bob Stefanowski.

August 15 -

The state expects to come to market with an $889.1 million general obligation sale in three tranches.

August 13 -

The Trump administration’s effort to publish a proposed rule comes just over two months after the IRS announced May 23 it was working on the regulations to enforce the $10,000 cap on what previously was an unlimited personal deduction of state and local taxes, also known as SALT.

August 6