-

New Britain is reaping a rating reward from higher revenues and stronger budgetary practices, including full actuarial funding of its pensions.

April 28 -

Connecticut's governor proposed a new public finance tool as part of a broad plan to improve the state's resiliency against extreme weather and climate change.

February 5 -

The budgeting constraints transformed the state's finances and bond ratings. But critics say the policy's downsides include the stifling of needed investments.

December 23 -

Principal Street Partners will acquire the bankrupt firm that specialized in high-yield bonds issued for senior living facilities and charter schools.

December 9 -

Connecticut is poised to ramp up transportation borrowing, after years of consistently issuing less debt than it had the capacity and authority to sell.

December 9 -

Supply is slightly lower this week at nearly $10 billion but not by much, with the pace of supply suggesting $500 billion of issuance for the year could still happen, said Tripp Kaiser, a managing director at Municipal Market Analytics, Inc.

October 8 -

Speakers at the LGBTQ+ History Month mixer pushed back against attacks on diversity.

October 2 -

The group, which has grown to more than 100 individuals since its inception in 2019, will host an event featuring Connecticut Treasurer, Erick Russell.

September 9 -

Bettina Bronisz' colleagues say she'll leave a legacy of joy and laughter in the Connecticut Treasurer's office.

July 30 -

Connecticut's GO deal is expected to benefit from its improving fiscal reputation, embodied in two rating outlook revisions to positive ahead of the pricing.

June 3 -

Mr. Fish worked at Bankers Trust Co., Donaldson, Lufkin, & Jenrette and ABN Amro and had served as a chair of the Municipal Analysts Group of New York and been a president of the Society of Municipal Analysts.

March 4 -

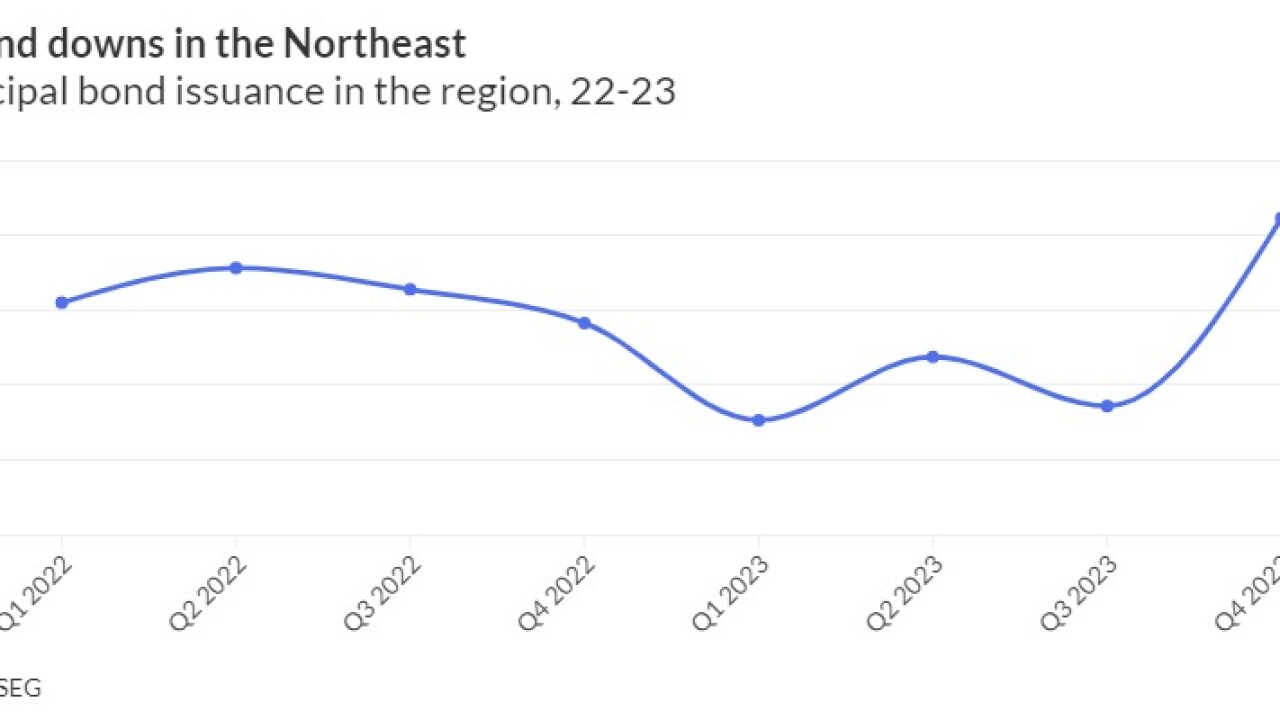

An off year from municipal bond issuers in the Northeast in 2023 pulled the national volume numbers into negative territory.

February 26 -

The top five bond financings have an average dollar volume of more than $917 million.

January 18 -

"The work done by our agency often focuses on the long-term," said Connecticut State Treasurer Erick Russell.

January 5 -

With fears of further Fed hikes subsided, Birch Creek strategists said with "loads of cash still sitting on the sidelines, and expectations that cash will no longer earn 5%+, we believe the muni market will benefit in 2024 from a return of investors looking to allocate to the asset class."

December 18 -

Triple-A yields fell up to five basis points Friday while USTs were mixed. Munis still underperformed taxables on the week, but the setup for the asset class going into yearend is decidedly positive.

December 15 -

The $250 million of new money social bonds will finance public school construction projects, with another $190 million refunding debt issued to build schools.

December 15 -

The top five bond financings have an average dollar volume of more than $1 billion.

December 11 -

The top five bond financings have an average dollar volume of more than $1 billion.

November 13 -

Municipal mutual fund losses continued last week as the Investment Company Institute reporting investors pulled $2.645 billion from the funds in the week ending Oct. 11. ETFs see more inflows, though.

October 18