- Kentucky

Issuers across the Southeast brought $71.7 billion of municipal bonds to market in 2016, a 3.3% year-over-year increase that was generated largely by refundings.

February 15 -

In oral arguments on Jefferson County, Ala.s bankruptcy plan last month, the 11th Circuit Court of Appeals expressed concern that ratepayers challenging the plan did not request a stay before bonds were sold.

January 25 - Alabama

A significant increase in Birmingham, Ala.s pension liabilities led Fitch Ratings to cut the citys issuer default and bond ratings by one notch to AA-minus, and to revise the rating outlook to negative.

January 17 -

Alabama state lawmakers in 2017 will weigh competing major bond programs to fund transportation and prison construction, as well as two controversial gambling proposals.

December 28 -

David Carrington, who was president of the commission that placed Jefferson County, Ala., into Chapter 9, said his experience presents an opportunity for him to consider running for governor.

December 1 - Alabama

Alabama plans to issue $652 million of bonds secured by settlement payments stemming from the Deepwater Horizon oil spill in the Gulf of Mexico.

November 28 -

At the request of Jefferson County, Ala.s bankruptcy attorneys, the 11th Circuit Court of Appeals set what appears to be a firm date to hear oral arguments on Dec. 16 in Atlanta.

November 17 -

The city of Mobile, Ala., has agreed to pay an undisclosed sum of money to the Internal Revenue Service to maintain the tax-exempt standing of $63.4 million of general obligation refunding and improvement warrants it issued in 2006.

November 17 -

After seven postponements in the appeal of Jefferson County, Ala's bankruptcy case, the county's attorney requested that the chief judge of the 11th Circuit Court of Appeals schedule oral arguments as soon as possible.

November 10 - Kentucky

In Tuesdays election, North Carolina and West Virginia got new governors while the region also saw the passage of bond-related measures, including big-ticket transportation initiatives.

November 9 -

A lawsuit that threatens to invalidate the sole security for bonds issued by the Chilton County Health Care Authority in Alabama prompted Fitch Ratings to place debts AA-minus rating on watch negative.

November 3 -

The tax supporting a $38 million bond deal for a rural Alabama hospital faces a legal challenge, though supporters say a state constitutional amendment on the Nov. 8 ballot should cure the problem for Chilton County and other localities, including Jefferson County.

October 26 -

For the sixth time this year, the 11th Circuit Court of Appeals has postponed oral arguments in Jefferson County, Ala.s bankruptcy appeal.

September 20 - Kentucky

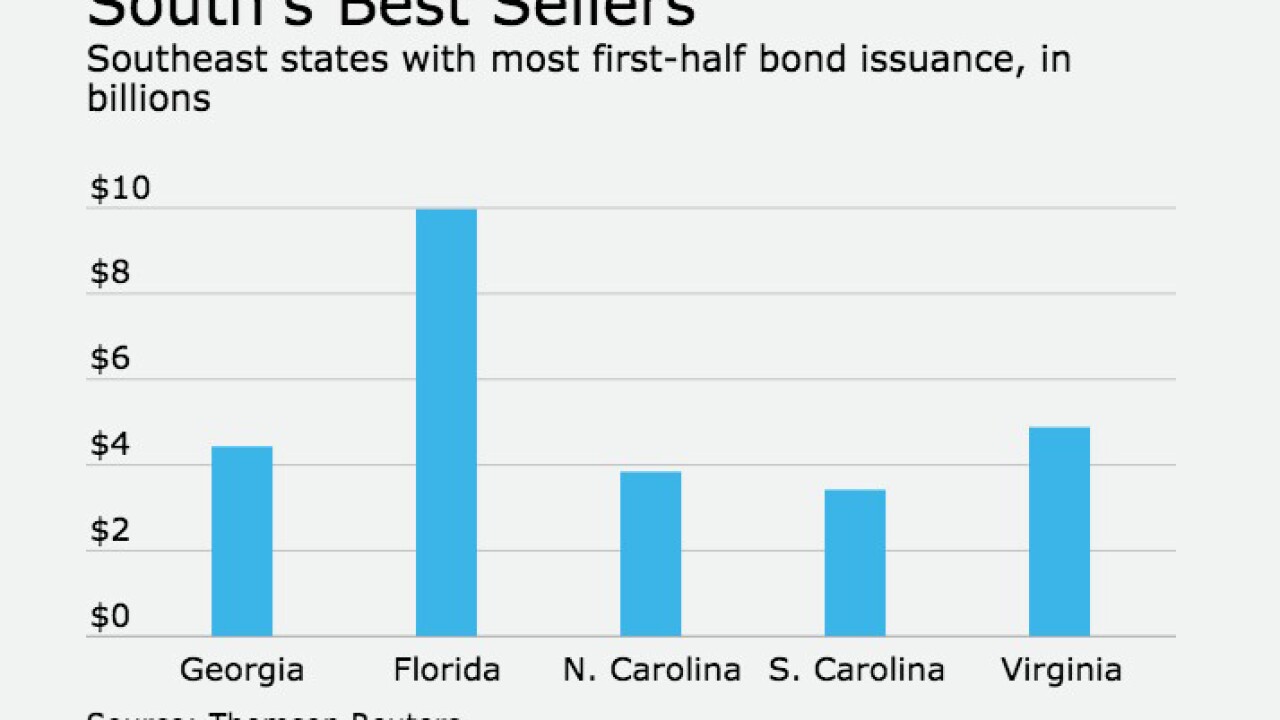

Southeast issuers sold $37.63 billion of municipal bonds in the first half of 2016, a decline of 10.9% from the same period last year, even as new money deals increased.

August 24 -

The 11th Circuit Court of Appeals delayed oral arguments in Jefferson County, Ala.'s bankruptcy appeal until November, and now plans to hear the case in Montgomery, instead of Atlanta.

August 18 -

Municipal bonds issued for Tennessee-based Global Ministries Foundation housing projects were placed on S&P Global Ratings' CreditWatch and could face rating downgrades because of uncertainty related to a federal investigation.

August 10 - Alabama

Alabama Gov. Robert Bentley has called lawmakers back to Montgomery Aug. 15 to consider allowing voters to decide on implementing a state lottery to pay for essential government services.

August 2 - Alabama

Alabama Gov. Robert Bentley released a video Wednesday appealing for voters to support a state lottery to pay for essential government services he said were not fully funded in the upcoming budget. He plans to ask lawmakers to put a lottery on the ballot in a special session he will call soon.

July 27 -

Former Alabama House of Representatives speaker Mike Hubbard was sentenced Friday to four years in prison on 12 felony corruption charges stemming from his role as a legislator

July 11 - Alabama

Wilmington Trust opened a new office in Birmingham, Ala., as part of an expansion of its corporate trust services in the Southeast; six new employees will offer trust and escrow services.

June 16