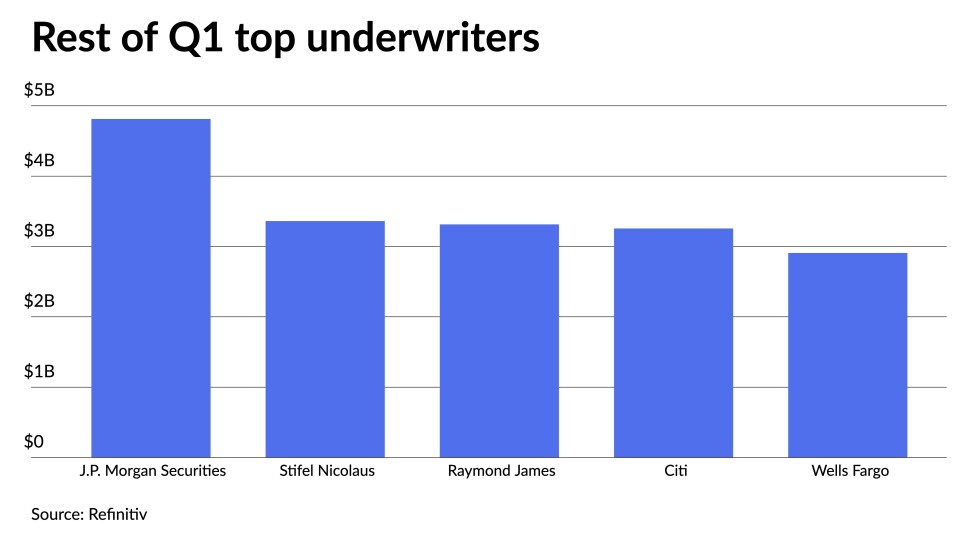

In the first quarter of 2023, the top municipal underwriters had $74.039 billion in 1,383 issues,, down from $97.270 billion in 2,301 transactions in 2022.

BofA Securities maintained its position as the leader despite fewer transactions than in Q1 2022.

The differences from year to year were minor shuffling among the top municipal underwriters, with only Jefferies breaking into the Top 10, demoting Barclays to 15th.